Public Storage 2014 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2014 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7

Ancillary Businesses

We have four ancillary businesses: (1) merchandise (principally locks and boxes) sold at our U.S. self-storage

properties; (2) tenant reinsurance, in which we reinsure policies purchased by our self-storage customers from

a third-party insurance company; (3) property management, which we manage self-storage properties we don’t

own; and (4) European ancillary businesses run by Shurgard Europe, consisting of merchandise and insurance

commissions. These businesses complement our self-storage business, generate respectable revenue and cash

flow and require little capital.

While modest in relative size, each ancillary business meaningfully contributes to Public Storage’s overall

profitability. John Reyes and Capri Haga manage the tenant reinsurance business and Pete Panos manages

our merchandise business.

A breakdown of operating results follows:

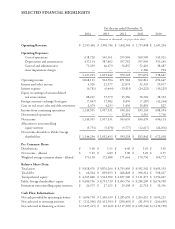

Net Operating Income

(Amounts in millions)

2014 2013 2012

Third party management $ 2 $ 2 $ 2

Merchandise 12 12 11

Tenant reinsurance 73 68 64

European ancillary businesses 25 23 23

Total $ 112 $ 105 $ 100

Public Storage’s share $ 99 $ 93 $ 88

Total assets $ 10 $ 10 $ 10

The true financial results of these ancillary businesses are somewhat obfuscated since much of the cost to

operate them are borne by our self-storage business with its in-place employee and customer base. We are looking

for additional businesses that complement our self-storage product and require nominal capital and can optimize

our employee and customer base.

Acquisitions and Developments

Last year we invested $530 million to acquire and develop 50 properties containing approximately 4.4 million

square feet of space. We have under development another 36 properties with 3.5 million square feet at an

estimated cost of $410 million. David Doll, President of the Real Estate Group, and his team did an excellent

job of adding to our intrinsic value, both deploying capital at attractive returns and increasing our presence in

key markets. This builds upon their tremendous achievements in 2013.

Going forward, we expect an increase in development activity and a possible reduction in acquisition activity, for

reasons noted below. As a result of our increased focus on development, we have greatly expanded David’s team,

adding 20 people over the last two years.

When to Invest

A few years back, Howard Marks, the Chairman and CEO of Oaktree Capital, a large, distressed bond investor,

wrote a book titled “The Most Important Thing.” He reviews a number of topics critical for successful investing.

Howard frequently cites Warren Buffett and the importance of understanding market conditions (he uses

cycles) and price. One of Public Storage senior management’s most important jobs is determining when, where