Public Storage 2014 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2014 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3

U.S. Self-Storage

In 2014 our U.S. self-storage business, which generates 93% of revenues and 84% of net operating income,

continued to benefit from an improving economy and solid execution. In addition, new supply of

self-storage properties continues to be nominal relative to the estimated base of 2.3 billion square feet of

self-storage space nationally, producing ideal conditions for higher occupancies, better rental rates and lower

customer acquisition costs. When combined with our scale and low operating cost structure, we were able

to produce an almost 7% same store NOI growth. Our field and revenue management teams, led by Shawn

Weidmann and John Reyes, did an exceptional job in 2014 managing and pricing the one million spaces and

customers in this 125 million square feet group of properties.

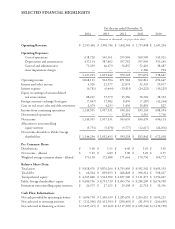

Same Store Properties

(Amounts in millions, except sq. ft. occupancy and revenue per available foot)

2014 2013 2012

Revenues $ 1,837 $ 1,743 $ 1,653

Costs of operations 499 489 496

Net operating income $ 1,338 $ 1,254 $ 1,157

Sq. ft. occupancy 93.9% 93.3% 91.9%

Revenue per available foot (“REVPAF”) $ 13.94 $ 13.21 $ 12.52

Our group of “Other” self-storage properties consist of recent acquisitions, newly developed and

redeveloped properties. This group of properties has more than tripled in the last two years and will

be a source of continued growth. Last year, this group generated nearly half of the $150 million growth

in NOI from our U.S. self-storage portfolio.

Other Self-Storage Properties

(Amounts in millions, except sq. ft. occupancy and REVPAF)

2014 2013 2012

Revenues $ 213 $ 107 $ 66

Costs of operations 68 35 22

Net operating income $ 145 $ 72 $ 44

Sq. ft. 19.4 14.9 6.2

Sq. ft. occupancy 88.2% 85.6% 85.1%

REVPAF $ 12.25 $ 12.12 $ 12.88

A key risk to our business, like most other businesses, is a significant increase in competition, i.e., new supply of

self-storage space. Although there are no reliable industry statistics on new self-storage construction, current

estimates indicate approximately 100 new properties were built in 2014 with an additional 300 to 500

projected for 2015. This compares to the estimated 49,000 current facilities, containing approximately

2.3 billion square feet or about seven square feet per person. Assuming the U.S. population grows at 1.1%

per year, annual increases of 25 million square feet of new self-storage space (about 500 properties) would be

needed to maintain the current per capita ratio. As you would expect, strong revenue and NOI growth and low

cap rates precipitate new competition (basic laws of economics apply to the self-storage business).