Public Storage 2014 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2014 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

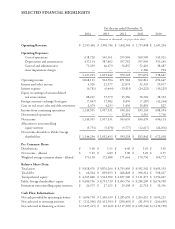

2

Net Operating Income

(Amounts in millions, except per share)

2014 2013 2012

U.S. self-storage $ 1,483 $ 1,326 $ 1,201

European self-storage 129 125 129

Commercial properties 262 250 241

Ancillary businesses 112 105 100

Total $ 1,986 $ 1,806 $ 1,671

Public Storage’s share $ 1,762 $ 1,590 $ 1,457

Free cash flow per share $ 7.73 $ 7.18 $ 6.41

Dividends per share $ 5.60 $ 5.15 $ 4.40

As noted in previous letters, our goal is to grow free cash flow per share on a long-term, sustainable basis. I

believe this is the best metric to calculate our intrinsic business value. It is also key to measuring long-term

managerial performance. It does not, however, capture other key attributes of our company such as brand, scale

and the quality of our properties and people that will, over time, enhance our intrinsic value.

In 2014, our 8% increase in free cash flow per share was lower than the ten year average of 11%. A couple of

reasons drove this decline, several of which we expect will persist in the near term.

First, Shurgard Europe repaid our 9% loan which had been generating a preferential return to us of about

$18 million per year.

Second, we have continued to deleverage the Company. Given our strong organic growth, we would need

to “leverage up” by about $1 billion per year to remain “leverage neutral.” In the current environment (as

discussed below) we are not able to invest $1 billion with adequate returns to justify additional borrowings.

Third, we have rapidly expanded our development program. Development of self-storage properties is dilutive

in the short term to free cash flow for a couple of reasons. First, a good portion of the cost of personnel and their

related activities involved in this program (about $3 million in 2014) are expensed instead of capitalized into

the cost of the new projects. Second, self-storage properties generally require eight to twelve months to

develop and once opened operate at a loss during the first six to twelve months. They do not achieve their

targeted level of cash flow for two to three years. In addition, development costs must be funded with capital for

which the funding costs are being expensed. We factor this dilution into our development return analysis and

believe our development program will add to our intrinsic value.

Our free cash flow, dividends, net income and core funds from operations

1

per share continue to grow nicely,

although at different rates in the short term. Long term, as demonstrated in our ten year growth rate, they tend

to converge.

Five-year Ten-year

2014 2009 2004 growth rate growth rate

Free cash flow $ 7.73 $ 4.75 $ 2.77 10% 11%

Dividends $ 5.60 $ 2.20 $ 1.80 21% 12%

Net income $ 5.25 $ 3.47 $ 1.38 9% 14%

Core funds from operations

$ 8.09 $ 5.03 $ 3.11 10% 10%

(1) See accompanying schedule “Supplemental Non-GAAP Disclosures.”