Public Storage 2014 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2014 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.4

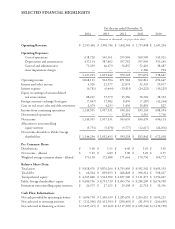

There are a couple of key operating metrics that reflect the overall strength of the self-storage business.

One is customer acquisition costs, which is the sum of all expenditures and promotional discounts used

to attract customers. When measured against revenues, it is fairly indicative of customer demand. In 2014,

our customer acquisition costs as a percent of revenues decreased to 5.9% from 9.2% in 2011.

Another key metric is the percentage of customers who have stored with us longer than one year. This metric

indicates the “stickiness” of our customer base, how well we are servicing it and managing our churn through

annual rate increases. Managing customer duration is critical to achieve and sustain high occupancies and

revenue growth. Over the last three years, the percentage of customers storing with us for longer than one year

(in our same store group of properties) increased by 5.3% to a record 56.7%.

Public Storage and the Self-Storage Industry

We sometimes meet with investors who don’t know much about Public Storage or the industry. John Reyes,

our CFO, has put together a great presentation explaining our company and the self-storage business, which is

summarized as follows:

Size

On an equity basis (shares outstanding multiplied by the year-end market price) we are the third largest

public real estate company in the world and the third largest REIT.

We are almost twice as large as our four public competitors (U-Haul, Extra Space, Cube Smart and Uncle

Bob’s) COMBINED.

We own about 5% of the entire U.S. self-storage industry (about 49,000 properties containing

2.3 billion square feet) and dominate the largest and fastest growing MSAs.

Financing

Unlike most real estate companies, which are generally 40% leveraged with debt, we don’t use much debt or

leverage. This hurts our results, i.e., we would grow cash flow faster with more leverage. Our businesses

generate fairly stable and predictable cash flows which can be easily leveraged or monetized, providing us

an important source of liquidity. In addition, we have no significant short term cash requirements. The

mood on Wall Street periodically changes and it is usually fast and dramatic. Accordingly, we have sought

to immunize our company from the vicissitudes in the capital markets.

Product Demand and Customers

Demand for our product comes primarily from recurring life events we call the four D’s: death, divorce,

downsizing and dislocation (job change, marriage, college or natural disaster), along with business expansions

and contractions. Most customers initially think they will rent a storage space for a short time, but those

life events frequently dictate a much longer stay. Approximately 56.7% of our total customers have been

with us longer than a year, and on average, our tenant base averages about 36 months.

Our customers want convenience and easy access to their possessions and view their storage space as an

extension of their residence. As a result, most of our customers reside within a three-to-five mile radius to

the property where they are renting.