Public Storage 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PUBLIC STORAGE

®

2014

ANNUAL

REPORT

Table of contents

-

Page 1

® PUBLIC STORAGE 2 0 1 4 ANNUAL R E P O RT -

Page 2

...29 3 53 Public Storage (cont.) 27 257 7 90 91 15 2,250 Shurgard Europe Belgium Denmark France Germany Netherlands Sweden United Kingdom Self-storage totals 21 10 55 16 40 30 21 193 2,443 PS Business Parks, Inc. Arizona California Florida Maryland Oregon Texas Virginia Washington Grand Totals 1 49... -

Page 3

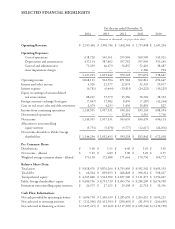

... For the year ended December 31, 2014 2013 2012 2011 2010 (Amounts in thousands, except per share data) Operating Revenue Operating Expenses: Cost of operations Depreciation and amortization General and administrative Asset impairment charges Operating income Interest and other income Interest... -

Page 4

... year-over-year increase in occupancy in seven years. Shurgard Europe's management team executed its ï¬rst unsecured term financing and, as a result, lowered its cost of capital and enabled it to fund several acquisitions and begin developing three new properties. • PS Business Parks, Inc. ("PSB... -

Page 5

Net Operating Income (Amounts in millions, except per share) 2014 2013 2012 U.S. self-storage European self-storage Commercial properties Ancillary businesses Total Public Storage's share Free cash ï¬,ow per share Dividends per share $ $ $ $ $ 1,483 129 262 112 1,986 1,762 7.73 5.60 $ $ $ $... -

Page 6

... job in 2014 managing and pricing the one million spaces and customers in this 125 million square feet group of properties. Same Store Properties (Amounts in millions, except sq. ft. occupancy and revenue per available foot) 2014 2013 2012 Revenues Costs of operations Net operating income... -

Page 7

... real estate company in the world and the third largest REIT. We are almost twice as large as our four public competitors (U-Haul, Extra Space, Cube Smart and Uncle Bob's) COMBINED. We own about 5% of the entire U.S. self-storage industry (about 49,000 properties containing 2.3 billion square feet... -

Page 8

... to drive operational excellence and avoid the ABCs, our company will continue to generate prodigious free cash ï¬,ow. European Self-Storage Shurgard Europe had an excellent 2014. Lead by Marc Oursin, Shurgard Europe's CEO, the company achieved the ï¬rst year-over-year increase in same store... -

Page 9

...breakdown of operating results follows: Net Operating Income (Amounts in millions) 2014 2013 2012 PSB's Same Park operations PSB's acquired/developed properties Public Storage's owned commercial properties Total Public Storage's share Total assets (before depreciation reserves) $ $ $ $ 226 26... -

Page 10

... another 36 properties with 3.5 million square feet at an estimated cost of $410 million. David Doll, President of the Real Estate Group, and his team did an excellent job of adding to our intrinsic value, both deploying capital at attractive returns and increasing our presence in key markets. This... -

Page 11

... well below replacement cost. In summary, 2010's investing environment was pessimistic, risk adverse and skeptical. Let's contrast 2010 to today. Capital is now plentiful, interest rates are at historic lows and many investors want to own real estate. In addition, operating results have been... -

Page 12

... and Europe, we may issue debt. Stay tuned. Conclusion We had a solid 2014 and are well positioned for 2015. The favorable operating environment and our exceptional teams should enable us to produce another year of positive results for all of our businesses. Ronald L. Havner, Jr. Chairman and CEO... -

Page 13

...Public Storage ...National Association of Real Estate Investment Trusts Equity Index ("NAREIT Equity Index") for the same period (total shareholder return equals price appreciation plus dividends). The stock price performance graph assumes that the value of the investment in the Company's Common Shares... -

Page 14

..., which is based upon historical cost and assumes the value of buildings diminish ratably over time, while we believe that real estate values ï¬,uctuate due to market conditions. We also present supplemental measures of our revenues and NOI including PSB and Shurgard Europe as if we owned them... -

Page 15

... Identification Number) 701 Western Avenue, Glendale, California 91201-2349 (Address of principal executive offices) (Zip Code) (818) 244-8080 (Registrant's telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each class Depositary Shares Each... -

Page 16

... Share, Series A $.01 par value ...Common Shares, $.10 par value ... New York Stock Exchange New York Stock Exchange New York Stock Exchange New York Stock Exchange New York Stock Exchange New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None (Title of class... -

Page 17

...Shares on the New York Stock Exchange (the "NYSE") on June 30, 2014). As of February 19, 2015, there were 172,808,464 outstanding Common Shares, $.10 par value per share. DOCUMENTS INCORPORATED BY REFERENCE Portions of the definitive proxy statement to be filed in connection with the Annual Meeting... -

Page 18

...real estate and zoning; risks associated with downturns in the national and local economies in the markets in which we operate, including risks related to current economic conditions and the economic health of our customers; the impact of competition from new and existing self-storage and commercial... -

Page 19

... Europe is the largest owner and operator of self-storage facilities in Western Europe. We also wholly own one self-storage facility in the United Kingdom which is managed by Shurgard Europe. (iii) Commercial: We have a 42% equity interest in PS Business Parks, Inc. ("PSB"), a publicly held REIT... -

Page 20

... after the reports and amendments are electronically filed with or furnished to the SEC. Competition We believe that storage customers generally store their goods within a five mile radius of their home or business. Most of our facilities compete with other nearby self-storage facilities that... -

Page 21

... our website and to our call center agents, and can inform the customer of storage alternatives at that site or our other nearby storage facilities. Property managers are extensively trained to maximize the conversion of such "walk in" shoppers into customers. Economies of scale: We are the largest... -

Page 22

... stock as of December 31, 2014). Participate in the growth of European self-storage through ownership in Shurgard Europe: We believe Shurgard Europe is the largest self-storage company in Western Europe. It owns and operates 192 facilities with approximately ten million net rentable square feet... -

Page 23

...preferred securities. See Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations - Liquidity and Capital Resources" for more information. Borrowing through mortgage loans or senior debt: Even though preferred securities have a higher coupon rate than long-term... -

Page 24

... limited partnerships that own an aggregate of 13 self-storage facilities. These entities are referred to collectively as the "Unconsolidated Real Estate Entities." PSB, which files financial statements with the SEC, and Shurgard Europe, have debt and other obligations that we do not consolidate... -

Page 25

...the winter months. We believe that these fluctuations result in part from increased moving activity during the summer months. Insurance We have historically carried customary property, earthquake, general liability, employee medical insurance and workers compensation coverage through internationally... -

Page 26

... real estate, we are subject to the risks related to the ownership and operation of real estate that can adversely impact our business and financial condition. These risks include the following: Natural disasters or terrorist attacks could cause damage to our facilities, resulting in increased costs... -

Page 27

...Shurgard Europe, as well as future repatriation of cash. Legislative, tax, and regulatory risks: We are subject to complex foreign laws and regulations related to permitting and land use, the environment, labor, and other areas, as well as income, property, sales, value added and employment tax laws... -

Page 28

... collateral by potential lenders to Public Storage due to the joint venture structure. Risks related to Shurgard Europe's Debt: Shurgard Europe has a total of â,¬407.5 million in debt outstanding at December 31, 2014, of which â,¬35.0 million is due annually in each of 2015, 2016 and 2017 and â,¬100... -

Page 29

... cases is paid by our customers, increases the cost of selfstorage rental to our customers and can negatively impact our revenues. Other local and state governments may impose a self-storage rent tax in the future. We are exposed to ongoing litigation and other legal and regulatory actions, which... -

Page 30

... "Public Storage" name in Canada with the Hughes Family, unless we are able to terminate the license agreement. Through our subsidiaries, we reinsure risks relating to loss of goods stored by customers in the Canadian Self-Storage Facilities. During the years ended December 31, 2014, 2013 and 2012... -

Page 31

..., increased costs of compliance, restatement of our financial statements and could also affect the marketability of our real estate facilities. In response to current economic conditions or the current political environment or otherwise, laws and regulations could be implemented or changed in ways... -

Page 32

... nations: At December 31, 2014 Number of Storage Net Rentable Square Facilities (a) Feet (in thousand) U.S.: California Southern Northern Florida Texas Illinois Washington Georgia North Carolina Virginia New York Colorado Maryland New Jersey Minnesota Michigan Arizona South Carolina Missouri Oregon... -

Page 33

...only the user has access. On-site operation is the responsibility of property managers who are supervised by district managers. Some self-storage facilities also include rentable uncovered parking areas for vehicle storage. Space is rented on a month-to-month basis and rental rates vary according to... -

Page 34

...Description of Commercial Properties: We have an interest in PSB, which, as of December 31, 2014, owns and operates approximately 28.6 million net rentable square feet of commercial space in eight states. At December 31, 2014, the $412.1 million book value and $1.2 billion market value, respectively... -

Page 35

... on our REIT taxable income (generally, net rents and gains from real property, dividends, and interest) that is fully distributed each year (for this purpose, certain distributions paid in a subsequent year may be considered), and if we meet certain organizational and operational rules. We believe... -

Page 36

... December 31, 2014 and 2013. d. Common Share Repurchases Our Board has authorized management to repurchase up to 35,000,000 of our common shares on the open market or in privately negotiated transactions. From the inception of the repurchase program through February 24, 2015, we have repurchased... -

Page 37

... year ended December 31, 2013 2012 2011 2014 Revenues Expenses: Cost of operations Depreciation and amortization General and administrative Asset impairment charges Operating income Interest and other income Interest expense Equity in earnings of unconsolidated real estate entities Foreign currency... -

Page 38

... Expense: We have elected to be treated as a real estate investment trust ("REIT"), as defined in the Internal Revenue Code. As a REIT, we do not incur federal income tax on our REIT taxable income (generally, net rents and gains from real property, dividends, and interest) that is fully distributed... -

Page 39

... and moving trends. We believe that our centralized information networks, national telephone and online reservation system, the brand name "Public Storage," and our economies of scale enable us to meet such challenges effectively. During 2014, 2013 and 2012, we acquired 44, 121 and 24 facilities... -

Page 40

...on our statements of cash flows. In addition, other REITs may compute these measures differently, so comparisons among REITs may not be helpful. For the year ended December 31, 2014, FFO was $7.98 per diluted common share, as compared to $7.53 for the same period in 2013, representing an increase of... -

Page 41

... (ii) certain other items such as legal settlements, recognition of deferred tax assets, costs associated with the acquisition of real estate facilities, and facility closure charges. We believe Core FFO per share is a helpful measure used by investors and REIT analysts to understand our performance... -

Page 42

...gain) Application of EITF D-42 Other items Core FFO per share Real Estate Operations $ 7.98 $ 7.53 6.0% $ Year Ended December 31, Percentage 2013 2012 Change 7.53 $ 6.31 19.3% $ 0.04 (0.10) 0.07 0.01 8.09 $ 7.44 (0.10) (0.05) 0.40 0.01 0.02 8.7% $ 7.44 $ 6.68 11.4% Self-Storage Operations: Our... -

Page 43

... (a) See "Net Operating Income" below for further information regarding this non-GAAP measure. Net income from our Self-Storage operations has increased 11.4% in 2014 as compared to 2013 and 11.2% in 2013 as compared to 2012. These increases are due to improvements in our Same Store Facilities, as... -

Page 44

Selected Operating Data for the Same Store Facilities (1,982 facilities) Year Ended December 31, Percentage 2014 2013 Change Revenues: Rental income Late charges and administrative fees Total revenues (a) Year Ended December 31, Percentage 2013 2012 Change (Dollar amounts in thousands, except ... -

Page 45

...rental income. (d) Annual contract rent represents the applicable annualized contractual monthly rent charged to our tenants, excluding the impact of promotional discounts, late charges and administrative fees. Analysis of Same Store Revenue Revenues generated by our Same Store Facilities increased... -

Page 46

... The decrease in 2013 was due primarily to reductions in incentive compensation, offset partially by higher employee health plan expenses. We expect on-site property manager payroll expense to increase modestly in 2015 due to inflationary wage increases. Supervisory payroll expense, which represents... -

Page 47

... property insurance, business license costs, bank charges related to processing the properties' cash receipts, credit card fees, and the cost of operating each proper ty's rental office including supplies and telephone data communication lines. These costs increased 2.0% in 2014 as compared to 2013... -

Page 48

... the Quarter Ended June 30 September 30 December 31 Entire Year (Amounts in thousands, except for per square foot amount) $ $ $ 452,571 429,958 408,636 $ $ $ 475,973 451,300 427,492 $ $ $ 467,728 442,830 419,885 $ $ $ 1,836,676 1,743,182 1,653,145 Total cost of operations: 2014 2013 2012 Property... -

Page 49

...,182 Net operating income: Los Angeles San Francisco New York Chicago Washington DC Seattle-Tacoma Miami Dallas-Ft. Worth Houston Atlanta Philadelphia Denver Minneapolis-St. Paul Portland Orlando-Daytona All other markets Total net operating income Year Ended December 31, 2013 2012 Change (Amounts... -

Page 50

Same Store Facilities Operating Trends by Market (Continued) Year Ended December 31, 2014 Weighted average square foot occupancy: Los Angeles San Francisco New York Chicago Washington DC Seattle-Tacoma Miami Dallas-Ft. Worth Houston Atlanta Philadelphia Denver Minneapolis-St. Paul Portland Orlando-... -

Page 51

Same Store Facilities Operating Trends by Market (Continued) Year Ended December 31, 2014 REVPAF: Los Angeles San Francisco New York Chicago Washington DC Seattle-Tacoma Miami Dallas-Ft. Worth Houston Atlanta Philadelphia Denver Minneapolis-St. Paul Portland Orlando-Daytona All other markets Total ... -

Page 52

... SAME STORE FACILITIES Rental income: 2014 third party acquisitions 2013 third party acquisitions 2012 third party acquisitions Other facilities Total rental income Cost of operations before depreciation and amortization expense: 2014 third party acquisitions 2013 third party acquisitions 2012 third... -

Page 53

... to December 31, 2014, we acquired four self-storage facilities (one each in Florida, North Carolina, Washington and Texas), with an aggregate of 265,000 net rentable square feet, for approximately $32 million in cash. We expect to increase the number of Non Same Store Facilities over at least... -

Page 54

... December 31, 2014, they acquired a building and ground lease on a self-storage property located in the United Kingdom for $11 million cash. The property, which is currently leased to a third party, is currently managed by Shurgard Europe and contains 83,000 square feet. The acquisition costs are to... -

Page 55

... rates for each period, is included in "equity in earnings of unconsolidated real estate entities" on our statements of income. In Note 4 to our December 31, 2014 financial statements, we disclose Shurgard Europe's consolidated operating results for the years ended December 31, 2014, 2013 and 2012... -

Page 56

..., or other related GAAP financial measures, in evaluating Shurgard Europe's operating results. (c) Realized annual rent per occupied square foot is computed by dividing annualized rental income, before late charges and administrative fees, by the weighted average occupied square feet for the period... -

Page 57

... impact of promotional discounts, late charges and administrative fees. NOI increased 2.9% in 2014 as compared to 2013, principally due to an increase of 2.9% in revenue, partially offset by an increase of 2.7% in cost of operations. NOI decreased 2.9% in 2013 as compared to 2012, principally due... -

Page 58

...insurance company against losses to goods stored by tenants in the domestic self-storage facilities we operate. The level of tenant reinsurance revenues is largely dependent upon the number of tenants that participate in the insurance program and the average premium rates charged. Cost of operations... -

Page 59

...well as the Company's stock price on the date of grant. We expect share-based compensation expense to increase in 2015 as compared to 2014. See Note 10 to our December 31, 2014 financial statements for further information on our share-based compensation. Costs of senior executives represent the cash... -

Page 60

... and issued additional preferred shares at lower coupon rates. Net income allocable to preferred shareholders in applying EITF D-42 totaled $61.7 million in 2012 (there were no redemptions of preferred securities and as a result, no EITF D-42 allocations in 2013 and 2014). Based upon our preferred... -

Page 61

... net income: Same Store Facilities Non Same Store Facilities Total net income from self-storage Ancillary operating revenue Ancillary cost of operations Commercial depreciation and amortization General and administrative expenses Operating income Year Ended December 31, 2013 (Amounts in thousands... -

Page 62

... attractive cost of capital relative to the issuance of our common shares and, as a result, issuances of common shares have been minimal over the past several years. During the early part of 2013, we issued preferred securities with coupon rates at 5.2%, but later in 2013, rates increased and market... -

Page 63

... facilities in good operating condition and maintain their visual appeal to the customer, which totaled $79.8 million in, 2014. Capital expenditures do not include costs relating to the development of new facilities or the expansion of net rentable square footage of existing facilities. For 2015, we... -

Page 64

... quarter of 2015. Shurgard Europe will use borrowings on its bank revolving credit facility combined with cash on hand to fund the purchase price. Redemption of Preferred Securities: We have two series of preferred securities redeemable, at our option, in 2015. Our 6.875% Series O Preferred Shares... -

Page 65

... which are fixed-rate) on our notes payable based on their contractual terms. See Note 6 to our December 31, 2014 financial statements for additional information on our notes payable. (2) We lease land, equipment and office space under various operating leases. Certain leases are cancelable; however... -

Page 66

...value. The table below summarizes the annual maturities of our fixed rate debt, which had a weighted average fixed rate of 4.0% at December 31, 2014. See Note 6 to our December 31, 2014 financial statements for further information regarding our fixed rate debt (amounts in thousands). 2015 Fixed rate... -

Page 67

...under the Securities Exchange Act of 1934, as amended (the "Exchange Act") is recorded, processed, summarized and reported within the time periods specified in accordance wit h SEC guidelines and that such information is communicated to our management, including our Chief Executive Officer and Chief... -

Page 68

...(United States), the consolidated balance sheets of Public Storage as of December 31, 2014 and 2013, and the related consolidated statements of income, comprehensive income, equity and cash flows for each of the three years in the period ended December 31, 2014 and our report dated February 24, 2015... -

Page 69

ITEM 9B. Other Information None. 55 -

Page 70

... for the real estate activities of Public Storage, including property acquisitions, developments, repackagings, and capital improvements. Lily Y. Hughes, age 52, became Senior Vice President, Chief Legal Officer and Corporate Secretary in January 2015. Prior to joining Public Storage, Ms. Hughes was... -

Page 71

... by reference to the material appearing in the Notice and Proxy Statement for the 2015 Annual Meeting of Shareholders, to be filed pursuant to Regulation 14A under the Exchange Act. ITEM 14. Principal Accountant Fees and Services The information required by this item is hereby incorporated by... -

Page 72

... financial statements schedules listed in the accompanying Index to Financial Statements and Schedules are filed as part of this report. 3. Exhibits See Index to Exhibits contained herein. b. Exhibits: See Index to Exhibits contained herein. c. Financial Statement Schedules Not applicable. 58 -

Page 73

... a Maryland real estate investment trust. Filed with the Registrant's Annual Report on Form 10 -K for the year ended December 31, 2009 and incorporated by reference herein. Bylaws of Public Storage, a Maryland real estate investment trust. Filed with the Registrant's Current Report on Form 8-K dated... -

Page 74

... 2013 and incorporated herein by reference. Shurgard Storage Centers, Inc. 2004 Long Term Incentive Compensation Plan. Filed as Appendix A of Definitive Proxy Statement dated June 7, 2004 filed by Shurgard (SEC File No. 001-11455) and incorporated herein by reference. Public Storage, Inc. 2001 Stock... -

Page 75

...by and among Public Storage, Wells Fargo Securities, LLC as Lead Arranger and Wells Fargo National Bank N.A. as Administrative Agent, dated as of December 2, 2013. Filed with Registrant's Current Report on Form 8-K dated December 2, 2013 and incorporated herein by reference. Employment Agreement and... -

Page 76

PUBLIC STORAGE INDEX TO FINANCIAL STATEMENTS (Item 15 (a)) Page References Report of Independent Registered Public Accounting Firm ...Balance sheets as of December 31, 2014 and 2013 ...For the years ended December 31, 2014, 2013 and 2012: Statements of income ...Statements of comprehensive income ... -

Page 77

... in all material respects the information set forth therein. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), Public Storage's internal control over financial reporting as of Dece mber 31, 2014, based on criteria established in... -

Page 78

...876,266 December 31, 2013 Investments in unconsolidated real estate entities Goodwill and other intangible assets, net Loan receivable from Shurgard Europe Other assets Total assets LIABILITIES AND EQUITY Borrowings on bank credit facility Term loan Notes payable Accrued and other liabilities Total... -

Page 79

... STATEMENTS OF INCOME (Amounts in thousands, except per share amounts) For the Years Ended December 31, 2014 2013 2012 Revenues: Self-storage facilities Ancillary operations $ 2,049,882 $ 145,522 2,195,404 1,849,883 $ 131,863 1,981,746 1,718,865 123,639 1,842,504 Expenses: Self-storage cost... -

Page 80

PUBLIC STORAGE STATEMENTS OF COMPREHENSIVE INCOME (Amounts in thousands) For the Years Ended December 31, 2014 2013 2012 Net income Other comprehensive income (loss): Aggregate foreign currency exchange (loss) gain Adjust for foreign currency exchange loss (gain) included in net income Other ... -

Page 81

...Common shares and restricted share units ($4.40 per share) Other comprehensive income (Note 2) Balances at December 31, 2012 Issuance of 29,000 preferred shares (Note 8) Issuance of common shares in connection with share-based compensation (388,005 shares) (Note 10) Share-based compensation expense... -

Page 82

... Common shares and restricted share units ($5.15 per share) Other comprehensive income (Note 2) Balances at December 31, 2013 Issuance of 30,500 preferred shares (Note 8) Issuance of common shares in connection with share-based compensation (669,263 shares) (Note 10) Share-based compensation expense... -

Page 83

PUBLIC STORAGE STATEMENTS OF CASH FLOWS (Amounts in thousands) For the Years Ended December 31, 2013 2012 2014 Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash provided by operating activities: Gain on real estate sales, including amounts in ... -

Page 84

PUBLIC STORAGE STATEMENTS OF CASH FLOWS (Amounts in thousands) For the Years Ended December 31, 2014 2013 2012 Supplemental schedule of non-cash investing and financing activities: Foreign currency translation adjustment: Real estate facilities, net of accumulated depreciation Investments in ... -

Page 85

... Public Storage (referred to herein as "the Company", "we", "us", or "our"), a Maryland real estate investment trust, was organized in 1980. Our principal business activities include the acquisition, development, ownership and operation of self-storage facilities which offer storage spaces for lease... -

Page 86

... as defined in the Internal Revenue Code. As a REIT, we do not incur federal income tax if we distribute 100% of our REIT taxable income (generally, net rents and gains from real property, dividends, and interest) each year, and if we meet certain organizational and operational rules. We believe we... -

Page 87

... the fair values of notes payable and receivable. In estimating fair values, we consider significant unobservable inputs such as market prices of land, market capitalization rates and earnings multiples for real estate facilities, projected levels of earnings, costs of construction, functional... -

Page 88

PUBLIC STORAGE NOTES TO FINANCIAL STATEMENTS December 31, 2014 Currency and Credit Risk Financial assets that are exposed to credit risk consist primarily of cash and cash equivalents, accounts receivable, loans receivable, and restricted cash. Cash equivalents and marketable securities we invest ... -

Page 89

... leases for storage space, as well as late charges and administrative fees, are recognized as earned. Promotional discounts reduce rental income over the promotional period. Ancillary revenues and interest and other income are recognized when earned. Equity in earnings of unconsolidated real estate... -

Page 90

...on our statements of comprehensive income are comprised primarily of foreign currency exchange gains and losses on our investment in, and loan receivable from, Shurgard Europe. Discontinued Operations Effective January 1, 2014, we present as discontinued operations only those facility disposals that... -

Page 91

..., adding 614,000 net rentable square feet of self-storage space, at an aggregate cost of $85.3 million. We disposed of real estate for an aggregate of $0.2 million in cash, recording a gain of approximately $0.1 million in connection with partial condemnations. During 2012, we acquired 24 operating... -

Page 92

...is a REIT traded on the New York Stock Exchange. We have an approximate 42% common equity interest in PSB as of December 31, 2014 and 2013, comprised of our ownership of 7,158,354 shares of PSB's common stock and 7,305,355 limited partnership units ("LP Units") in an operating partnership controlled... -

Page 93

PUBLIC STORAGE NOTES TO FINANCIAL STATEMENTS December 31, 2014 basis into PSB common stock. Based upon the closing price at December 31, 2014 ($79.54 per share of PSB common stock), the shares and units we owned had a market value of approximately $1.2 billion. During 2014, PSB recognized gains on ... -

Page 94

... and ancillary cost of operations Depreciation and amortization General and administrative Interest expense on third party debt Trademark license fee payable to Public Storage Interest expense on shareholder loan Lease termination (charge) benefit and other (a) Net income Average exchange rates Euro... -

Page 95

PUBLIC STORAGE NOTES TO FINANCIAL STATEMENTS December 31, 2014 2014 For the year ended December 31, Calculation of equity in earnings of Shurgard Europe: Our 49% share of Shurgard Europe's net income $ Adjustments: 49% of trademark license fees 49% of interest on shareholder loan Total equity in ... -

Page 96

... interest method. At December 31, 2014, the notes are secured by 34 real estate facilities with a net book value of approximately $161 million, have contractual interest rates between 2.9% and 7.1%, and mature between March 2015 and September 2028. During 2014 and 2013, we assumed mortgage debt with... -

Page 97

PUBLIC STORAGE NOTES TO FINANCIAL STATEMENTS December 31, 2014 respectively, to these interests; and we paid $6.5 million, $6.5 million and $5.9 million, respectively, in distributions to these interests. During 2014 and 2013...' Equity Preferred Shares At December 31, 2014 and 2013, we had the... -

Page 98

PUBLIC STORAGE NOTES TO FINANCIAL STATEMENTS December 31, 2014 At December 31, 2014 Earliest Redemption Date 4/15/2015 10/7/2015 4/14/2016 7/26/2016 1/12/2017 3/13/2017 6/15/2017 9/20/2017 1/16/2018 3/13/2018 3/17/2019 6/4/2019 12/2/2019 Dividend Rate 6.875% 6.500% 6.500% 6.350% 5.900% 5.750% 5.625... -

Page 99

... in connection with these redemptions. Common Shares During 2014, 2013 and 2012, activity with respect to the issuance or repurchase of our common shares was as follows (amounts in thousands): 2014 Shares Employee stock-based compensation and exercise of stock options (Note 10) Issuance of commons... -

Page 100

... common shares outstanding at December 31, 2014. The Hughes Family has ownership interests in, and operates, approximately 54 self-storage facilities in Canada ("PS Canada") using the "Public Storage" brand name pursuant to a non -exclusive, royalty-free trademark license agreement with the Company... -

Page 101

... $165 or less. The aggregate intrinsic value of exercisable stock options at December 31, 2014 amounted to approximately $135.3 million. Additional information with respect to stock options during 2014, 2013 and 2012 is as follows: 2014 Weighted Average Exercise Price per Share 85.49 176.74 66.39 63... -

Page 102

PUBLIC STORAGE NOTES TO FINANCIAL STATEMENTS December 31, 2014 2014 Stock option expense for the year (in 000's) 2013 2012 $ 3,216 $ 3,468 $ 3,036 Aggregate exercise date intrinsic value of options exercised during the year (in 000's) $ Average assumptions used in valuing options with the ... -

Page 103

PUBLIC STORAGE NOTES TO FINANCIAL STATEMENTS December 31, 2014 2014 Number of Grant Date Restricted Aggregate Share Units Fair Value Restricted share units outstanding January 1, Granted Vested Forfeited Restricted share units outstanding December 31, 636,329 $ 339,607 (166,905) (57,983) 751,048 $ ... -

Page 104

PUBLIC STORAGE NOTES TO FINANCIAL STATEMENTS December 31, 2014 European Self-Storage Segment The European Self-Storage segment comprises our interest in Shurgard Europe, which has a separate management team reporting directly to our CODM and our joint venture partner. The European Self-Storage ... -

Page 105

PUBLIC STORAGE NOTES TO FINANCIAL STATEMENTS December 31, 2014 Year ended December 31, 2014 Other Items Not Allocated to European Segments Self-Storage Commercial (Amounts in thousands) $ $ 15,720 15,720 $ 129,802 129,802 Domestic Self-Storage Revenues: Self-storage facilities Ancillary operations... -

Page 106

...4,233 $ 1,057,531 Expenses: Self-storage cost of operations Ancillary cost of operations Depreciation and amortization General and administrative Operating income Interest and other income Interest expense Equity in earnings of unconsolidated real estate entities Foreign currency exchange gain Gain... -

Page 107

... 12,874 943,035 Expenses: Self-storage cost of operations Ancillary cost of operations Depreciation and amortization General and administrative Operating income Interest and other income Interest expense Equity in earnings of unconsolidated real estate entities Foreign currency exchange gain Gain... -

Page 108

... to the Company, either individually or in the aggregate, is remote. Insurance and Loss Exposure We have historically carried customary property, earthquake, general liability, employee medical insurance and workers compensation coverage through internationally recognized insurance carriers, subject... -

Page 109

PUBLIC STORAGE NOTES TO FINANCIAL STATEMENTS December 31, 2014 March 31, 2013 Three Months Ended June 30, September 30, 2013 2013 (Amounts in thousands, except per share data) December 31, 2013 Self-storage and ancillary revenues Self-storage and ancillary cost of operations Depreciation and ... -

Page 110

PUBLIC STORAGE EXHIBIT 12 - STATEMENT RE: COMPUTATION OF RATIO OF EARNINGS TO FIXED CHARGES 2014 Year Ended December 31, 2013 2012 2011 2010 $ (5,432) (4,883) (3,505) 1,149,955 $ 1,057,531 $ 930,161 $ 833,143 (11,993) $ 688,354 (16,561) Income from continuing operations Less: Income ... -

Page 111

... Storage Centers, Inc. 2000 Long Term Incentive Plan, Shurgard Storage Centers, Inc. 1995 Long Term Incentive Compensation Plan; (4) (5) of our reports dated February 24, 2015, with respect to the consolidated financial statements and schedule of Public Storage and the effectiveness of internal... -

Page 112

... or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. /s/ Ronald L. Havner, Jr. Name: Ronald L. Havner, Jr. Title: Chairman, Chief Executive Officer & President Date: February 24, 2015 Exhibit 31.1 -

Page 113

... and report financial information; and b) any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. /s/ John Reyes Name: John Reyes Title: Chief Financial Officer Date: February 24, 2015... -

Page 114

... with the Annual Report on Form 10-K of Public Storage (the "Company") for the year ended December 31, 2014, as filed with the Securities and Exchange Commission on the date hereof (the "Report"), Ronald L. Havner, Jr., as Chairman, Chief Executive Officer and President of the Company and John... -

Page 115

.../investor Shareholder online inquiries: https://www-us.computershare.com/investor/contact Independent Registered Public Accounting Firm Ernst & Young LLP Los Angeles, CA PS Insurance Capri L. Haga President Shurgard Self Storage S.C.A. (Europe) Marc Oursin Chief Executive Ofï¬cer Annual Meeting... -

Page 116

® P UBLIC S TORAGE 701 Western Avenue, Glendale, California 91201-2349 ฀ ฀฀ ฀฀ (SKU 002CSN4AF0)