Progressive 2013 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2013 Progressive annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Determining the fair value of the investment portfolio is the responsibility of management. As part of the responsibility, we

evaluate whether a market is distressed or inactive in determining the fair value for our portfolio. We review certain market

level inputs to evaluate whether sufficient activity, volume, and new issuances exist to create an active market. Based on

this evaluation, we concluded that there was sufficient activity related to the sectors and securities for which we obtained

valuations.

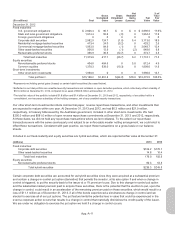

The composition of the investment portfolio by major security type was:

Fair Value

(millions) Level 1 Level 2 Level 3 Total Cost

December 31, 2013

Fixed maturities:

U.S. government obligations $3,662.2 $ 0 $ 0 $ 3,662.2 $ 3,630.4

State and local government obligations 0 2,256.0 0 2,256.0 2,247.3

Foreign government obligations 15.6 0 0 15.6 15.6

Corporate debt securities 0 2,926.6 0 2,926.6 2,885.0

Subtotal 3,677.8 5,182.6 0 8,860.4 8,778.3

Asset-backed securities:

Residential mortgage-backed 0 1,127.7 .2 1,127.9 1,110.1

Commercial mortgage-backed 0 2,131.5 29.0 2,160.5 2,154.4

Other asset-backed 0 1,077.7 0 1,077.7 1,073.0

Subtotal asset-backed securities 0 4,336.9 29.2 4,366.1 4,337.5

Redeemable preferred stocks:

Financials 0 102.8 0 102.8 84.2

Utilities 0 65.6 0 65.6 64.9

Industrials 0 145.5 0 145.5 150.4

Subtotal redeemable preferred stocks 0 313.9 0 313.9 299.5

Total fixed maturities 3,677.8 9,833.4 29.2 13,540.4 13,415.3

Equity securities:

Nonredeemable preferred stocks:

Financials 240.8 414.6 39.0 694.4 431.5

Utilities 0 16.8 0 16.8 14.2

Subtotal nonredeemable preferred stocks 240.8 431.4 39.0 711.2 445.7

Common equities:

Common stocks 2,530.0 0 0 2,530.0 1,450.6

Other risk investments 0 0 .5 .5 .5

Subtotal common equities 2,530.0 0 .5 2,530.5 1,451.1

Total fixed maturities and equity securities 6,448.6 10,264.8 68.7 16,782.1 15,312.1

Short-term investments:

Other short-term investments 987.8 284.8 0 1,272.6 1,272.6

Total portfolio $7,436.4 $10,549.6 $68.7 $18,054.7 $16,584.7

Debt $ 0 $ 2,073.7 $ 0 $ 2,073.7 $ 1,860.9

App.-A-20