Progressive 2013 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2013 Progressive annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Gross realized gains and losses were the result of sales transactions in our fixed-income portfolio, related to movements in

credit spreads and interest rates, rebalancing of our equity-indexed portfolio, and tax management strategies. In addition,

gains and losses reflect recoveries from litigation settlements and holding period valuation changes on hybrids and

derivatives. Also included are write-downs for securities determined to be other-than-temporarily impaired in our fixed-

maturity and/or equity portfolios.

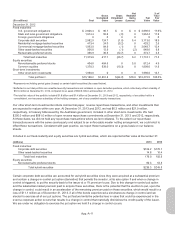

Net Investment Income The components of net investment income for the years ended December 31, were:

(millions) 2013 2012 2011

Fixed maturities:

U.S. government obligations $ 50.2 $ 49.8 $ 58.0

State and local government obligations 48.0 51.1 60.0

Foreign government obligations .2 0 0

Corporate debt securities 98.8 107.5 106.7

Residential mortgage-backed securities 28.1 16.1 18.6

Commercial mortgage-backed securities 74.8 82.2 83.4

Other asset-backed securities 16.7 20.3 24.5

Redeemable preferred stocks 21.2 24.2 33.0

Total fixed maturities 338.0 351.2 384.2

Equity securities:

Nonredeemable preferred stocks 36.2 43.8 57.7

Common equities 45.8 44.9 35.7

Short-term investments:

Other short-term investments 2.0 3.1 2.4

Investment income 422.0 443.0 480.0

Investment expenses (18.8) (15.4) (13.5)

Net investment income $403.2 $427.6 $466.5

Trading Securities At December 31, 2013 and 2012, we did not hold any trading securities and we did not have any net

realized gains (losses) on trading securities for the years ended December 31, 2013, 2012, and 2011.

Derivative Instruments For all derivative positions discussed below, realized holding period gains and losses are netted

with any upfront cash that may be exchanged under the contract to determine if the net position should be classified either

as an asset or liability. To be reported as a net derivative asset and a component of the available-for-sale portfolio, the

inception-to-date realized gain on the derivative position at period end would have to exceed any upfront cash received. On

the other hand, a net derivative liability would include any inception-to-date realized loss plus the amount of upfront cash

received (or netted, if upfront cash was paid) and would be reported as a component of other liabilities. These net derivative

assets/liabilities are not separately disclosed on the balance sheet due to their immaterial effect on our financial condition,

cash flows, and results of operations.

App.-A-17