Progressive 2013 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2013 Progressive annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

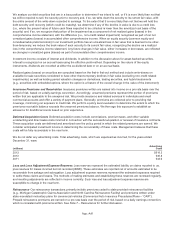

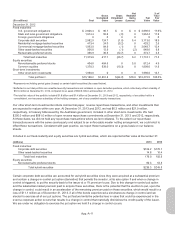

Other-Than-Temporary Impairment (OTTI) The following table shows the total non-credit portion of the OTTI recorded in

accumulated other comprehensive income, reflecting the original non-credit loss at the time the credit impairment was

determined:

December 31,

(millions) 2013 2012

Fixed maturities:

Residential mortgage-backed securities $(44.1) $(44.2)

Commercial mortgage-backed securities (.9) (.9)

Total fixed maturities $(45.0) $(45.1)

The following tables provide rollforwards of the amounts related to credit losses recognized in earnings for the periods

ended December 31, 2013, 2012, and 2011, for which a portion of the OTTI losses were also recognized in accumulated

other comprehensive income at the time the credit impairments were determined and recognized:

(millions)

Residential

Mortgage-

Backed

Commercial

Mortgage-

Backed

Corporate

Debt Total

Balance at December 31, 2012 $27.1 $ .6 $0 $27.7

Credit losses for which an OTTI was previously recognized .1 0 0 .1

Credit losses for which an OTTI was not previously recognized 0 0 0 0

Reductions for securities sold/matured 0 0 0 0

Change in recoveries of future cash flows expected to be collected1,2 (7.8) (.2) 0 (8.0)

Reductions for previously recognized credit impairments written-down to fair

value3(.2) 0 0 (.2)

Balance at December 31, 2013 $19.2 $ .4 $0 $19.6

(millions)

Residential

Mortgage-

Backed

Commercial

Mortgage-

Backed

Corporate

Debt Total

Balance at December 31, 2011 $34.5 $1.3 $0 $35.8

Credit losses for which an OTTI was previously recognized .1 0 0 .1

Credit losses for which an OTTI was not previously recognized .3 0 0 .3

Reductions for securities sold/matured 0 (.2) 0 (.2)

Change in recoveries of future cash flows expected to be collected1,2 (3.8) (.2) 0 (4.0)

Reductions for previously recognized credit impairments written-down to fair

value3(4.0) (.3) 0 (4.3)

Balance at December 31, 2012 $27.1 $ .6 $0 $27.7

(millions)

Residential

Mortgage-

Backed

Commercial

Mortgage-

Backed

Corporate

Debt Total

Balance at December 31, 2010 $32.3 $1.0 $ 6.5 $39.8

Credit losses for which an OTTI was previously recognized 1.4 0 0 1.4

Credit losses for which an OTTI was not previously recognized 1.1 .4 0 1.5

Reductions for securities sold/matured 0 0 0 0

Change in recoveries of future cash flows expected to be collected1,2 .8 .3 (6.5) (5.4)

Reductions for previously recognized credit impairments written-down to fair

value3(1.1) (.4) 0 (1.5)

Balance at December 31, 2011 $34.5 $1.3 $ 0 $35.8

1Reflects expected recovery of prior period impairments that will be accreted into income over the remaining life of the security.

2Includes $2.6 million, $1.4 million, and $2.0 million at December 31, 2013, 2012, and 2011, respectively, received in excess of the cash flows

expected to be collected at the time of the write-downs.

3Reflects reductions of prior credit impairments where the current credit impairment requires writing securities down to fair value (i.e., no remaining

non-credit loss).

App.-A-14