Progressive 2010 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2010 Progressive annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Surveys don’t pay the bills, but often serve as a

valuable qualitative read on the company’s brand

and future potential. Our performance in 2010

will, however, pay the bills and more.

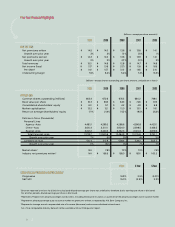

We ended the year with net premiums written

of around $14.5 billion, up some 3.4% from 2009,

and net income of $1 billion, comparable to 2009

performance. What distinguishes 2010 perfor-

mance for me is the addition of over 750,000 new

policyholders and by implication well over a

million new customers. Our 92.4 combined ratio

from underwriting operations, in tandem with a

7.8% total return on investments, contributed to

a very strong capital position. We were delighted

to share this performance with shareholders in

multiple ways not the least of which was a $1 ex-

traordinary dividend late in the year and a further

$0.40 variable dividend reflecting our internal

measure of annual per formance—Gainshare.

If the decade ending

2010

were a football

game, it would be a story of two distinct halves.

The first characterized by several years of

the industry regaining profitability through rate

increases, leading to significant industrywide

growth in written premium. Progressive posted

growth rates more often than not in the strong

double digits zone for this half. As well docu-

mented frequency declines emerged and industry

rate levels proved to be more than adequate, a

six-year period of industry profitability followed.

Best efforts interpreting history would suggest

that two consecutive profitable years was the

previous high water mark. Growth in written

premium inevitably slowed, producing a slightly

lagged, but matching, period of industrywide

written premium declines. Progressive frustrat-

ingly posted low single digit growth numbers

above and below zero for the same period. While

gas prices, driving behavior, Internet adoption,

media spending, and the economic crisis at a

minimum would be required to fully chronicle

the decade, there is little doubt the classic nature

of the insurance cycle, with unique wavelength

and amplitude to extend the analogy, has played

a significant role. The closing years of the decade

appear to be the approximate time frame during

which industrywide profitability will once again

be moderated and sustained industry premium

declines will turn positive.

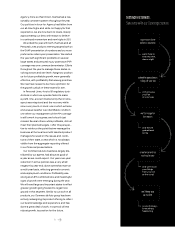

With that as a back drop, it is helpful to review

Progressive’s evolution as a company during the

same period and, more importantly, our position-

ing for whatever emerges over the next decade.

9