Progressive 2010 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2010 Progressive annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

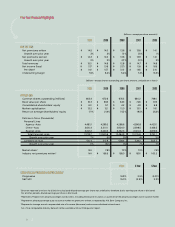

(billions

–

except per share amounts)

2010 2009 2008 2007 2006

FOR THE YEAR

Net premiums written $ 14.5 $ 14.0 $ 13.6 $ 13.8 $ 14.1

Growth over prior year 3% 3% (1)% (3)% 1%

Net premiums earned $ 14.3 $ 14.0 $ 13.6 $ 13.9 $ 14.1

Growth over prior year 2% 3% (2)% (2)% 3%

Total revenues $ 15.0 $ 14.6 $ 12.8 $ 14.7 $ 14.8

Net income (loss) $ 1.07 $ 1.06 $ (.07) $ 1.18 $ 1.65

Per share1 $ 1.61 $ 1.57 $ (.10) $ 1.65 $ 2.10

Underwriting margin 7.6% 8.4% 5.4% 7.4% 13.3%

2010 2009 2008 2007 2006

AT YEAR-END

Common shares outstanding (millions) 662.4 672.6 676.5 680.2 748.0

Book value per share $ 9.13 $ 8.55 $ 6.23 $ 7.26 $ 9.15

Consolidated shareholders’ equity $ 6.0 $ 5.7 $ 4.2 $ 4.9 $ 6.8

Market capitalization $ 13.2 $ 12.1 $ 10.0 $ 13.0 $ 18.1

Return on average shareholders’ equity 17.1% 21.4% (1.5)% 19.5% 25.3%

Policies in force (thousands)

Personal Lines

Agency–Auto 4,480.1 4,299.2 4,288.6 4,396.8 4,433.1

Direct–Auto 3,610.4 3,201.1 2,824.0 2,598.5 2,428.5

Special Lines 3,612.2 3,440.3 3,352.3 3,120.3 2,879.5

Total Personal Lines 11,702.7 10,940.6 10,464.9 10,115.6 9,741.1

Growth over prior year 7% 5% 3% 4% 3%

Commercial Auto 510.4 512.8 539.4 539.2 503.2

Growth over prior year 0% (5)% 0% 7% 7%

Market share2 NA 7.8% 7.3% 7.3% 7.4%

Industry net premiums written3 NA $ 156.5 $ 158.0 $ 159.1 $ 160.2

1-Year 3-Year 5-Year

STOCK PRICE APPRECIATION (DEPRECIATION)4

Progressive 16.9% 3.5% (4.3)%

S&P 500 15.0% (2.9)% 2.3%

1

Since we reported a net loss for 2008, the calculated diluted earnings per share was antidilutive; therefore, basic earnings per share is disclosed.

For all other periods, diluted earnings per share is disclosed.

2

Represents Progressive’s private passenger auto business, including motorcycle insurance, as a percent of the private passenger auto insurance market.

3Represents private passenger auto insurance market net premiums written as reported by A.M. Best Company, Inc.

4Represents average annual compounded rate of increase (decrease) and assumes dividend reinvestment.

NA = Final comparable industry data will not be available until our third quarter report.

Five-Year Financial Highlights

(billions

–

except shares outstanding, per share amounts, and policies in force)

3