Progressive 2010 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2010 Progressive annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OBJECTIVES

Profitability Progressive’s most important goal

is for our insurance subsidiaries to produce an

aggregate calendar-year underwriting profit of

at least 4%. Our business is a composite of many

product offerings defined in part by product

type, distribution channel, geography, customer

tenure, and underwriting grouping. Each of these

products has targeted operating parameters

based on level of maturity, underlying cost struc-

tures, customer mix, and policy life expectancy.

Our aggregate goal is the balanced blend

of these individual performance targets in any

calendar year.

Growth Our goal is to grow as fast as possible,

constrained only by our profitability objective

and our ability to provide high-quality customer

service. Progressive is a growth-oriented com-

pany and management incentives are tied to

profitable growth.

We report Personal Lines and Commercial

Auto results separately. We further break down

our Personal Lines’ results by channel (Agency

and Direct) to give shareholders a clearer picture

of the business dynamics of each distribution

method and their respective rates of growth. Ag-

gregate expense ratios and aggregate growth

rates disguise the true nature and performance

of each business.

FINANCIAL POLICIES

Progressive balances operating risk with risk

of investing and financing activities in order to

have sufficient capital to support all the insurance

we can profitably underwrite and service. Risks

arise in all operational and functional areas, and

therefore must be assessed holistically, account-

ing for the offsetting and compounding effects

of the separate sources of risk within Progressive.

We use risk management tools to quantify

the amount of capital needed, in addition to

surplus, to absorb consequences of events such

as unfavorable loss reserve development, liti-

ga tion, weather-related catastrophes, and

investment-market corrections. Our financial poli-

cies define our allocation of risk and we measure

our performance against them. If, in our view,

future opportunities meet our financial objectives

and policies, we will invest capital in expanding

business operations. Underleveraged capital will

be returned to investors. We expect to earn

a

return on equity greater than its cost. Presented is

an overview of Progressive’s Operating, Investing,

and Financing policies.

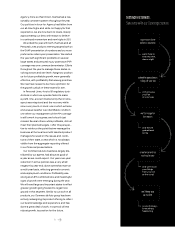

23

Operating Monitor pricing and reserving discipline

–

Manage profitability targets and operational perfor-

mance at our lowest level of product definition

–

Sustain premiums-to-surplus ratios at efficient

levels,

and at or below applicable state regulations,

for each insurance subsidiary

–

Ensure loss reserves are adequate and develop with

minimal variance

Investing Maintain a liquid, diversified, high-quality

investment portfolio

–

Manage on a total return basis

–

Manage interest rate, credit, prepayment, extension,

and con centra tion risk

–

Allocate portfolio between two groups:

Group I – target 0% to 25% (common equities, redeem

-

able and nonredeemable preferred stocks, and below

investment-grade fixed-maturity securities)

Group II–target 75% to 100% (other fixed-maturity

and short-term securities)

Financing Maintain sufficient capital to support

insurance operations

–

Maintain debt below 30% of total capital at book value

–

Neutralize dilution from equity-based compensation

in the year of issuance through share repurchases

–

Return underleveraged capital through share repur-

chases, extraordinary dividends, and a variable dividend

program based on annual underwriting results