Pfizer 2012 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2012 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

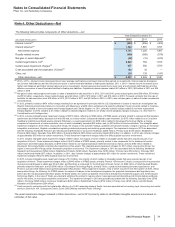

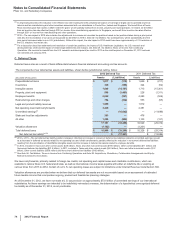

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

2012 Financial Report

73

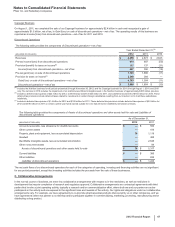

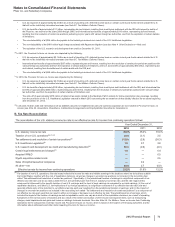

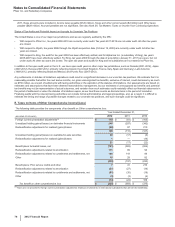

• U.S. tax expense of approximately $2.2 billion as a result of providing U.S. deferred income taxes on certain current-year funds earned outside the U.S.

that will not be indefinitely reinvested overseas (see Note 5C. Tax Matters: Deferred Taxes);

• U.S. tax benefits of approximately $1.1 billion, representing tax and interest, resulting from a multi-year settlement with the IRS with respect to audits of

the Pfizer Inc. tax returns for the years 2006 through 2008, and international tax benefits of approximately $310 million, representing tax and interest,

resulting from the resolution of certain tax positions pertaining to prior years with various foreign tax authorities, and from the expiration of certain statutes

of limitations;

• The non-deductibility of a $336 million fee payable to the federal government as a result of the U.S. Healthcare Legislation;

• The non-deductibility of the $491 million legal charge associated with Rapamune litigation (see also Note 4. Other Deductions––Net); and

• The expiration of the U.S. research and development tax credit on December 31, 2011.

(b) In 2011, the Provision for taxes on income was impacted by the following:

• U.S. tax expense of approximately $2.1 billion as a result of providing U.S. deferred income taxes on certain current-year funds earned outside the U.S.

that will not be indefinitely reinvested overseas (see Note 5C. Tax Matters: Deferred Taxes);

• International tax benefits of approximately $267 million, representing tax and interest, resulting from the resolution of certain prior-period tax positions with

various foreign tax authorities and from the expiration of certain statutes of limitations, and U.S. tax benefits of approximately $80 million, representing tax

and interest, resulting from the settlement of certain audits with the IRS; and

• The non-deductibility of a $248 million fee payable to the federal government as a result of the U.S. Healthcare Legislation.

(c) In 2010, the Provision for taxes on income was impacted by the following:

• U.S. tax expense of approximately $2.5 billion as a result of providing U.S. deferred income taxes on certain current-year funds earned outside the U.S.

that will not be indefinitely reinvested overseas (see Note 5C. Tax Matters: Deferred Taxes);

• U.S. tax benefits of approximately $2.0 billion, representing tax and interest, resulting from a multi-year audit settlement with the IRS, and international tax

benefits of approximately $460 million, representing tax and interest, resulting from the resolution of certain prior-period tax positions with various foreign

tax authorities, and from the expiration of certain statutes of limitations; and

• The write-off of approximately $270 million of deferred tax assets related to the Medicare Part D subsidy for retiree prescription drug coverage, resulting

from the provisions of the U.S. Healthcare Legislation enacted in March 2010 concerning the tax treatment of that subsidy effective for tax years beginning

after December 31, 2012.

(d) In all years, federal, state and international net tax liabilities assumed or established as part of a business acquisition are not included in Provision for taxes on

income (see Note 2A. Acquisitions, Divestitures, Collaborative Arrangements and Equity-Method Investments: Acquisitions).

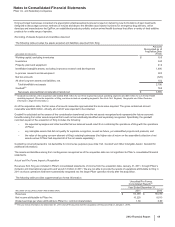

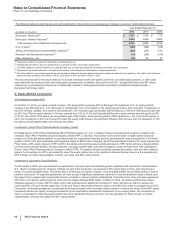

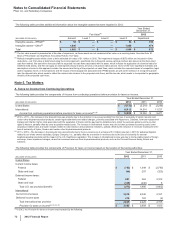

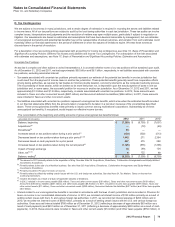

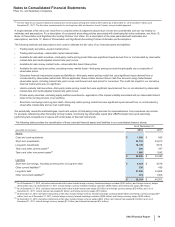

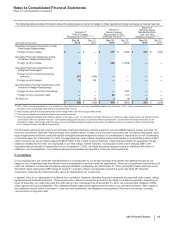

B. Tax Rate Reconciliation

The reconciliation of the U.S. statutory income tax rate to our effective tax rate for Income from continuing operations follows:

Year Ended December 31,

2012 2011 2010

U.S. statutory income tax rate 35.0%35.0%35.0%

Taxation of non-U.S. operations(a), (b), (c) (3.0)(3.1)2.5

Tax settlements and resolution of certain tax positions(d) (12.0) (2.8)(26.3)

U.S. Healthcare Legislation(d) 1.0 0.7 2.8

U.S. research and development tax credit and manufacturing deduction(d) (0.3)(0.9)(2.3)

Certain legal settlements and charges(d) 1.4 —0.4

Acquired IPR&D ——0.5

Wyeth acquisition-related costs ——0.5

Sales of biopharmaceutical companies —0.2 —

All other––net (0.9)2.7 (0.9)

Effective tax rate for income from continuing operations 21.2%31.8%12.2%

(a) For taxation of non-U.S. operations, this rate impact reflects the income tax rates and relative earnings in the locations where we do business outside

the United States, together with the cost of repatriation decisions, as well as changes in uncertain tax positions not included in the reconciling item

called “Tax settlements and resolution of certain tax positions”. Specifically: (i) the jurisdictional location of earnings is a significant component of our

effective tax rate each year as tax rates outside the U.S. are generally lower than the U.S. statutory income tax rate, and the rate impact of this

component is influenced by the specific location of non-U.S. earnings and the level of such earnings as compared to our total earnings; (ii) the cost of

repatriation decisions, and other U.S. tax implications of our foreign operations, is a significant component of our effective tax rate each year and

generally offsets some of the reduction to our effective tax rate each year resulting from the jurisdictional location of earnings; and (iii) the impact of

changes in uncertain tax positions not included in the reconciling item called “Tax settlements and resolution of certain tax positions” is a component of

our effective tax rate each year that can result in either an increase or decrease to our effective tax rate. The jurisdictional mix of earnings, which

includes the impact of the location of earnings as well as repatriation costs, can vary as a result of the repatriation decisions, as a result of operating

fluctuations in the normal course of business and as a result of the extent and location of other income and expense items, such as restructuring

charges, asset impairments and gains and losses on strategic business decisions. See also Note 5A. Tax Matters: Taxes on Income from Continuing

Operations for the components of pre-tax income and Provision for taxes on income, which is based on the location of the taxing authorities, and for

information about settlements and other items impacting Provision for taxes on income.