Pfizer 2012 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2012 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

2012 Financial Report

23

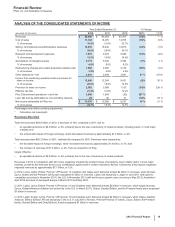

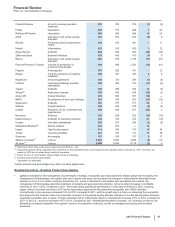

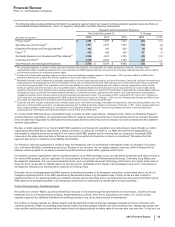

•Viagra is indicated for the treatment for erectile dysfunction. Viagra worldwide revenues increased 4% in 2012, compared to 2011,

primarily due to the increase in U.S. revenues, partially offset by branded and generic competitive pressure in developed Europe, other

developed markets and emerging markets. The increase in the U.S. more than offset the decrease in international markets due to

operational factors and the adverse impact of foreign exchange.

•Norvasc, for treating hypertension, lost exclusivity in the U.S. and other major markets in 2007 and in Canada in 2009. Norvasc

worldwide revenues decreased 7% in 2012, compared to 2011.

•Zyvox is the world’s best-selling branded agent among those used to treat serious Gram-positive pathogens, including methicillin-

resistant staphylococcus-aureus. Zyvox worldwide revenues increased 5% in 2012, compared to 2011, primarily due to growth in both

developed and emerging markets.

•Sutent is indicated for the treatment of advanced renal cell carcinoma, including metastatic renal cell carcinoma (mRCC); gastrointestinal

stromal tumors after disease progression on, or intolerance to, imatinib mesylate; and advanced pancreatic neuroendocrine tumor. Sutent

worldwide revenues increased 4% in 2012, compared to 2011, due to strong operational performance driven in the U.S. by price

increases and in other, non-European developed markets by volume growth due to targeted marketing efforts, and in emerging markets,

by increased market share, partially offset by the unfavorable impact of foreign exchange. We continue to seek to drive operational

revenue and prescription growth, supported by cost-effectiveness, efficacy and therapy management data. As of December 31, 2012,

Sutent was the most prescribed oral mRCC therapy in the U.S.

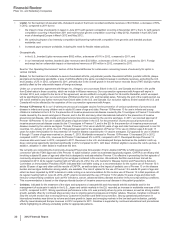

• Our Premarin family of products helps women address moderate-to-severe menopausal symptoms. It recorded an increase in worldwide

revenues of 6% in 2012, compared to 2011. U.S. revenues increased 7% in 2012, compared to 2011, primarily due to favorable

wholesaler inventory levels, price increases in January and July 2012, favorable rebates and the launch of multichannel marketing

support in 2012. Internationally, revenues decreased 2% compared to 2011. The decline was attributable to the unfavorable impact of

foreign exchange of 7% offset by the increase in operational revenues of 5%.

•Genotropin, one of the world’s leading human growth hormones, is used in children for the treatment of short stature with growth

hormone deficiency, Prader-Willi Syndrome, Turner Syndrome, Small for Gestational Age Syndrome, Idiopathic Short Stature (in the U.S.

only) and Chronic Renal Insufficiency (outside the U.S. only), as well as in adults with growth hormone deficiency. Genotropin is

supported by a broad platform of innovative injection-delivery devices and patient-support programs. Genotropin worldwide revenues

decreased 6% compared to 2011.

•Xalabrands consists of Xalatan, a prostaglandin, which is a branded agent used to reduce elevated eye pressure in patients with open-

angle glaucoma or ocular hypertension, and Xalacom, a fixed combination prostaglandin (Xalatan) and beta blocker (timolol) available

outside the U.S. Xalatan/Xalacom worldwide revenues decreased 36% in 2012, compared to 2011. Lower revenues were due primarily to

the loss of exclusivity in the U.S. in March 2011 and in the majority of European markets in January 2012.

• BeneFIX and ReFacto AF/Xyntha are hemophilia products using state-of-the-art manufacturing that assist patients with their lifelong

bleeding disorders. BeneFIX is the only available recombinant factor IX product for the treatment of hemophilia B, while ReFacto AF/

Xyntha is a recombinant factor VIII product for the treatment of hemophilia A. Both products are indicated for the control and prevention

of bleeding in patients with these disorders and in some countries are also indicated for prophylaxis in certain situations, such as surgery.

BeneFIX recorded an increase in worldwide revenues of 12% in 2012, compared to 2011, primarily as a result of increases in the U.S.

due to a launch of the new 3000 International Unit vial and price increases. ReFacto AF/Xyntha recorded an increase in worldwide

revenues of 15% in 2012, compared to 2011, driven by the successful transition of patients to Xyntha as a result of securing a

government contract in Australia, continued patient conversion to Xyntha in the U.S., as well as the successful launch of the ReFacto AF

dual chamber syringe in several European countries.

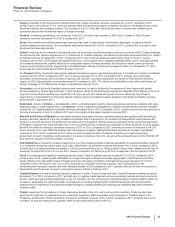

• Detrol/Detrol LA, a muscarinic receptor antagonist, is one of the leading branded medicines worldwide for overactive bladder. Detrol LA

is an extended-release formulation taken once a day. Detrol/Detrol LA worldwide revenues decreased 14% in 2012, compared to 2011,

primarily due to increased branded competition, a shift in promotional focus to our Toviaz product in most major markets and the loss of

exclusivity for Detrol IR in the U.S. in June 2012. Generic competition for Detrol LA in the U.S. is expected in the first quarter of 2014.

•Vfend is a broad-spectrum agent for treating yeast and molds. Vfend worldwide revenues increased 1% in 2012, compared to 2011

primarily due to U.S. market growth attributable to a fungal meningitis outbreak and double-digit growth in Latin America and China,

largely offset by the unfavorable impact of foreign exchange and supply constraints. International revenues increased 1% in 2012,

compared to 2011. Revenues in the U.S. in 2012 increased 3% compared to the same period in 2011, primarily due to the

aforementioned meningitis outbreak and lower Medicaid rebates in 2012 compared to 2011, partially offset by the loss of exclusivity of

Vfend tablets and the launch of generic voriconazole (generic Vfend) in February 2011.

•Chantix/Champix is an aid to smoking-cessation treatment in adults 18 years of age and older. Chantix/Champix worldwide revenues

decreased 7% in 2012, compared to 2011, primarily due to negative media exposure across several key markets and macro-economic

decline, which decreased patient willingness to pay out of pocket. We are continuing our educational and promotional efforts, which are

focused on addressing the significant health consequences of smoking highlighting the Chantix/Champix benefit-risk proposition,

emphasizing the importance of the physician-patient dialogue in helping patients quit smoking and identifying alternative treatment-

funding models.

•Pristiq is approved for the treatment of major depressive disorder in the U.S. and in various other countries. Pristiq has also been

approved for treatment of moderate-to-severe vasomotor symptoms (VMS) associated with menopause in Thailand, Mexico, the

Philippines and Ecuador. Pristiq recorded an increase in worldwide revenues of 9% in 2012, compared to 2011, primarily due to price

increases, as well as market growth, partially offset by lower prescription share in the U.S.