Pfizer 2012 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2012 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

2012 Financial Report

13

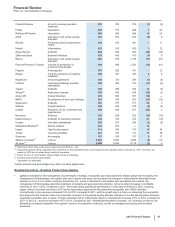

• The market approach is a historical approach to estimating fair value and relies primarily on external information. Within the market

approach are two methods that we may use:

Guideline public company method—this method employs market multiples derived from market prices of stocks of companies that

are engaged in the same or similar lines of business and that are actively traded on a free and open market and the application of

the identified multiples to the corresponding measure of our reporting unit’s financial performance.

Guideline transaction method—this method relies on pricing multiples derived from transactions of significant interests in companies

engaged in the same or similar lines of business and the application of the identified multiples to the corresponding measure of our

reporting unit’s financial performance.

The market approach is only appropriate when the available external information is robust and deemed to be a reliable proxy for the

specific reporting unit being valued; however, these assessments may prove to be incomplete or inaccurate. Some of the more significant

estimates and assumptions inherent in this approach include: the selection of appropriate guideline companies and transactions and the

determination of applicable premiums and discounts based on any differences in ownership percentages, ownership rights, business

ownership forms or marketability between the reporting unit and the guideline companies and transactions.

• The income approach is a forward-looking approach to estimating fair value and relies primarily on internal forecasts. Within the income

approach, the method that we use is the discounted cash flow method. We start with a forecast of all the expected net cash flows

associated with the reporting unit, which includes the application of a terminal value, and then we apply a reporting unit-specific discount

rate to arrive at a net present value amount. Some of the more significant estimates and assumptions inherent in this approach include:

the amount and timing of the projected net cash flows, which includes the expected impact of technological risk and competitive, legal

and/or regulatory forces on the projections, as well as the selection of a long-term growth rate; the discount rate, which seeks to reflect

the various risks inherent in the projected cash flows; and the tax rate, which seeks to incorporate the geographic diversity of the

projected cash flows.

Specifically:

• When we estimate the fair value of our five biopharmaceutical reporting units, we rely solely on the income approach. We use the income

approach exclusively as many of our products are sold in multiple reporting units and as one reporting unit is geographic-based while the

others are product and/or customer-based. Further, the projected cash flows from a single product may reside in up to three reporting

units at different points in future years and the discounted cash flow method would reflect the movement of products among reporting

units. As such, the use of the comparable guideline company method was not practical or reliable. However, on a limited basis and as

deemed reasonable, we attempt to corroborate our outcomes with the market approach. For the income approach, we use the

discounted cash flow method.

• When we estimate the fair value of our Consumer Healthcare reporting unit, we use a combination of approaches and methods. We use

the income approach and the market approach, which we weight equally in our analysis. We weight them equally as we have equal

confidence in the appropriateness of the approaches for this reporting unit. For the income approach, we use the discounted cash flow

method and for the market approach, we use both the guideline public company method and the guideline transaction method, which we

weight equally to arrive at our market approach value.

• When we estimate the fair value of our Animal Health reporting unit, we use the income approach, relying exclusively on the discounted

cash flow method. We rely exclusively on the income approach as the discounted cash flow method provides a more reliable outlook of

the business. However, on a limited basis and as deemed reasonable, we attempt to corroborate our outcomes with the market

approach. (See also Notes to Consolidated Financial Statements––Note 19A. Subsequent Events: Zoetis Debt Offering and Initial Public

Offering.)

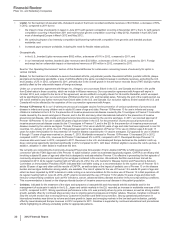

While all reporting units can confront events and circumstances that can lead to impairment, we do not believe that the risk of goodwill

impairment for any of our reporting units is significant at this time.

Our Consumer Healthcare reporting unit has the narrowest difference between fair value and book value. However, we estimate that it would

take a significant negative change in the undiscounted cash flows, the discount rate and/or the market multiples in the consumer industry for

the Consumer Healthcare reporting unit goodwill to be impaired. Our Consumer Healthcare reporting unit performance and consumer

healthcare industry market multiples are highly correlated with the overall economy and our specific performance is also dependent on our and

our competitors’ innovation and marketing effectiveness, and on regulatory developments affecting claims, formulations and ingredients of our

products.

For all of our reporting units, there are a number of future events and factors that may impact future results and that could potentially have an

impact on the outcome of subsequent goodwill impairment testing. For a list of these factors, see the “Forward-Looking Information and

Factors That May Affect Future Results” section of this Financial Review.

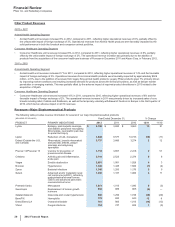

Benefit Plans

The majority of our employees worldwide are covered by defined benefit pension plans, defined contribution plans or both. In the U.S., we

have both qualified and supplemental (non-qualified) defined benefit plans, as well as other postretirement benefit plans, consisting primarily

of healthcare and life insurance for retirees (see Notes to Consolidated Financial Statements—Note 1P. Basis of Presentation and Significant

Accounting Policies: Pension and Postretirement Benefit Plans and Note 11. Pension and Postretirement Benefit Plans and Defined

Contribution Plans). Beginning on January 1, 2011, for employees hired in the U.S. and Puerto Rico after December 31, 2010, we no longer

offer a defined benefit plan and, instead, offer an enhanced benefit under our defined contribution plan. In addition to the standard matching

contribution by the Company, the enhanced benefit provides an automatic Company contribution for such eligible employees based on age