Pfizer 2012 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2012 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

2012 Financial Report

103

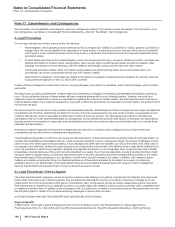

A2. Legal Proceedings––Product Litigation

Like other pharmaceutical companies, we are defendants in numerous cases, including but not limited to those discussed below, related to our

pharmaceutical and other products. Plaintiffs in these cases seek damages and other relief on various grounds for alleged personal injury and

economic loss.

Asbestos

•Quigley

Quigley Company, Inc. (Quigley), a wholly owned subsidiary, was acquired by Pfizer in 1968 and sold products containing small amounts of

asbestos until the early 1970s. In September 2004, Pfizer and Quigley took steps that were intended to resolve all pending and future claims

against Pfizer and Quigley in which the claimants allege personal injury from exposure to Quigley products containing asbestos, silica or

mixed dust. We recorded a charge of $369 million pre-tax ($229 million after-tax) in the third quarter of 2004 in connection with these matters.

In September 2004, Quigley filed a petition in the U.S. Bankruptcy Court for the Southern District of New York seeking reorganization under

Chapter 11 of the U.S. Bankruptcy Code. In March 2005, Quigley filed a reorganization plan in the Bankruptcy Court that needed the approval

of 75% of the voting claimants, as well as the Bankruptcy Court and the U.S. District Court for the Southern District of New York. In connection

with that filing, Pfizer entered into settlement agreements with lawyers representing more than 80% of the individuals with claims related to

Quigley products against Quigley and Pfizer. The agreements provide for a total of $430 million in payments, of which $215 million became

due in December 2005 and has been and is being paid to claimants upon receipt by Pfizer of certain required documentation from each of the

claimants. The reorganization plan provided for the establishment of a trust (the Trust) for the evaluation and, as appropriate, payment of all

unsettled pending claims, as well as any future claims alleging injury from exposure to Quigley products.

In February 2008, the Bankruptcy Court authorized Quigley to solicit an amended reorganization plan for acceptance by claimants. According

to the official report filed with the court by the balloting agent in July 2008, the requisite votes were cast in favor of the amended plan of

reorganization.

The Bankruptcy Court held a confirmation hearing with respect to Quigley’s amended plan of reorganization that concluded in December

2009. In September 2010, the Bankruptcy Court declined to confirm the amended reorganization plan. As a result of the foregoing, Pfizer

recorded additional charges for this matter of approximately $1.3 billion pre-tax (approximately $800 million after-tax) in 2010. Further, in order

to preserve its right to address certain legal issues raised in the court’s opinion, in October 2010, Pfizer filed a notice of appeal and motion for

leave to appeal the Bankruptcy Court’s decision denying confirmation.

In March 2011, Pfizer entered into a settlement agreement with a committee (the Ad Hoc Committee) representing approximately 40,000

claimants in the Quigley bankruptcy proceeding (the Ad Hoc Committee claimants). Consistent with the additional charges recorded in 2010

referred to above, the principal provisions of the settlement agreement provide for a settlement payment in two installments and other

consideration, as follows:

• the payment to the Ad Hoc Committee, for the benefit of the Ad Hoc Committee claimants, of a first installment of $500 million upon receipt

by Pfizer of releases of asbestos-related claims against Pfizer Inc. from Ad Hoc Committee claimants holding $500 million in the aggregate

of claims (Pfizer began paying this first installment in June 2011);

• the payment to the Ad Hoc Committee, for the benefit of the Ad Hoc Committee claimants, of a second installment of $300 million upon

Pfizer’s receipt of releases of asbestos-related claims against Pfizer Inc. from Ad Hoc Committee claimants holding an additional $300

million in the aggregate of claims following the earlier of the effective date of a revised plan of reorganization and April 6, 2013;

• the payment of the Ad Hoc Committee’s legal fees and expenses incurred in this matter up to a maximum of $19 million (Pfizer began

paying these legal fees and expenses in May 2011); and

• the procurement by Pfizer of insurance for the benefit of certain Ad Hoc Committee claimants to the extent such claimants with non-

malignant diseases have a future disease progression to a malignant disease (Pfizer procured this insurance in August 2011).

Following the execution of the settlement agreement with the Ad Hoc Committee, Quigley filed a revised plan of reorganization and

accompanying disclosure statement with the Bankruptcy Court in April 2011, which it amended in June 2012. In August 2012, the Bankruptcy

Court authorized Quigley to solicit the revised plan of reorganization for acceptance by claimants. The balloting agent's preliminary tabulation

report filed with the court reflects that the requisite number of asbestos-related claimants cast votes in favor of the revised plan. A class of

claimants holding non-asbestos-related, unsecured claims voted against the revised plan. However, we believe that, under applicable

bankruptcy law, the revised plan may be confirmed notwithstanding the vote of the non-asbestos-related claimants.

Under the revised plan, and consistent with the additional charges recorded in 2010 referred to above, we expect to contribute an additional

amount to the Trust, if and when the Bankruptcy Court confirms the plan, of cash and non-cash assets (including insurance proceeds) with a

value in excess of $550 million. The Bankruptcy Court must find that the revised plan meets the standards of the U.S. Bankruptcy Code before

it confirms the plan. We expect that, if approved by claimants, confirmed by the Bankruptcy Court and the District Court and upheld on any

subsequent appeal, the revised reorganization plan will result in the District Court entering a permanent injunction directing pending claims, as

well as future claims, alleging asbestos-related personal injury from exposure to Quigley products to the Trust, subject to the recent decision of

the Second Circuit discussed below. There is no assurance that the plan will be approved by claimants or confirmed by the courts.

In April 2012, the U.S. Court of Appeals for the Second Circuit affirmed a ruling by the U.S. District Court for the Southern District of New York

that the Bankruptcy Court’s preliminary injunction in the Quigley bankruptcy proceeding does not prohibit actions directly against Pfizer Inc. for