Pfizer 2012 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2012 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

24

2012 Financial Report

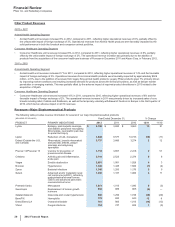

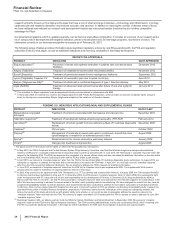

•Revatio is for the treatment of pulmonary arterial hypertension (PAH). Worldwide revenues remained relatively flat in 2012, compared to

2011. 2012 revenues were impacted by the unfavorable impact of foreign exchange, partially offset by an increased PAH awareness

driving earlier diagnosis in the U.S. and EU. In the U.S., Revatio tablet lost exclusivity in September 2012, and Revatio intravenous

injection will lose exclusivity in May 2013.

•Zosyn/Tazocin, our broad-spectrum intravenous antibiotic, faces generic global competition. U.S. exclusivity was lost in September

2009. Zosyn/Tazocin recorded a decrease in worldwide revenues of 24% in 2012, compared to 2011.

•Effexor, an antidepressant for treating adult patients with major depressive disorder, generalized anxiety disorder, social anxiety disorder

and panic disorder, faces generic competition in most markets. It recorded a decrease in worldwide revenues of 37% in 2012, compared

to 2011.

•Prevnar/Prevenar (7-valent), our 7-valent pneumococcal conjugate vaccine for preventing invasive, and, in certain international

markets, non-invasive pneumococcal disease in infants and young children, recorded a decrease in worldwide revenues of 18% in 2012,

compared to 2011. Many markets have transitioned from the use of Prevnar/Prevenar (7-valent) to Prevnar 13/Prevenar 13, resulting in

lower revenues for Prevnar/Prevenar (7-valent). We expect this trend to continue.

•Caduet is a single-pill therapy combining Lipitor and Norvasc for the prevention of cardiovascular events. Caduet worldwide revenues

decreased 52% in 2012, compared to 2011, primarily due to the loss of U.S. exclusivity in November 2011.

•Xalkori, for the treatment of patients with locally advanced or metastatic non-small cell lung cancer (NSCLC) that is anaplastic lymphoma

kinase (ALK)-positive as detected by an FDA-approved test, was approved by the FDA in August 2011. In developed markets, Xalkori has

also been approved in Japan, South Korea, Canada and Switzerland, and it received conditional marketing authorization in the EU in

October 2012. In addition, it has been filed or approved in more than 25 emerging markets, including China. Xalkori recorded worldwide

revenues of $123 million in 2012, with 66% of those revenues generated in the U.S. market.

• Inlyta, for the treatment of patients with advanced renal cell carcinoma after failure of a prior systemic treatment, has been approved in

the U.S., Switzerland, Japan, Canada, Australia, South Korea and the EU (exact indications vary by region). Inlyta recorded worldwide

revenues of $100 million in 2012.

•Xeljanz (in the U.S.) was approved by the FDA in November 2012 for the treatment of adult patients with moderately to severely active

rheumatoid arthritis who have had an inadequate response or intolerance to methotrexate, to be used as monotherapy or in combination

with methotrexate or other nonbiologic disease-modifying antirheumatic drugs.

•Alliance revenues worldwide decreased 4% in 2012, compared to 2011, mainly due to the loss of exclusivity for Aricept 5mg and 10mg

tablets in the U.S. in November 2010 and the entry of multi-source generic competition in the U.S. in May 2011, as well as the loss of

exclusivity in many major European markets in February 2012, and lower revenues for Spiriva in certain European countries, Canada

and Australia due to the expiration of our collaboration with BI in those countries, partially offset by the strong performance of Enbrel and

Rebif in the U.S. We expect that the Aricept 23mg tablet will have exclusivity in the U.S. until July 2013. See the “The Loss or Expiration

of Intellectual Property Rights” section of this Financial Review for a discussion regarding the expiration of various contract rights relating

to Aricept, Spiriva, Enbrel and Rebif. Eliquis (apixaban) has been jointly developed and commercialized by Pfizer and Bristol-Myers

Squibb (BMS). In 2012, Eliquis (apixaban) was approved to reduce the risk of stroke and systemic embolism in patients with nonvalvular

atrial fibrillation in the 27 countries of the EU, plus Iceland and Norway, Canada, Japan and the U.S., and it was launched for that

indication in the U.S. in January 2013. The two companies share commercialization expenses and profit/losses equally on a global basis.

• Embeda—We met with the FDA in May 2012 to discuss our proposal for reintroduction of Embeda to the market. The required stability

programs are underway, and we are working toward a submission with the FDA in the first half of 2013.

See Notes to Consolidated Financial Statements—Note 17. Commitments and Contingencies for a discussion of recent developments

concerning patent and product litigation relating to certain of the products discussed above.

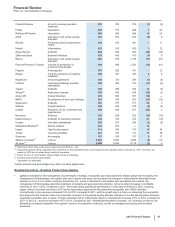

Research and Development

Research and Development Operations

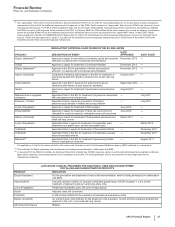

Innovation is critical to the success of our company and drug discovery and development is time-consuming, expensive and unpredictable,

particularly for human health products. As a result, and also because we are predominately a human health company, the vast majority of our

R&D spending is associated with human health products, compounds and activities.