Pfizer 2011 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2011 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

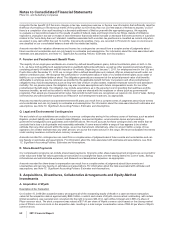

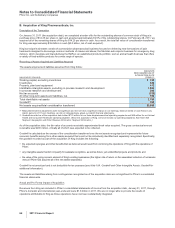

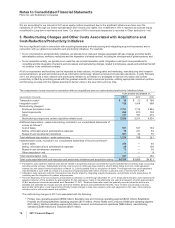

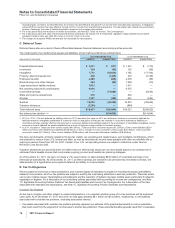

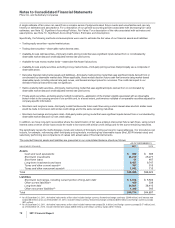

The amounts and classification of payments (income/(expense)) between us and our collaboration partners follow:

YEAR ENDED DECEMBER 31,

(MILLIONS OF DOLLARS) 2011 2010 2009

Revenues—Revenues(a) $1,029 $ 710 $ 676

Revenues—Alliance revenues(b) 3,630 4,084 2,925

Total revenues from collaborative arrangements 4,659 4,794 3,601

Cost of sales(c) (420) (124) (175)

Selling, informational and administrative expenses(d) (237) (131) 10

Research and development expenses(e) (299) (316) (361)

Other deductions—net 34 37 37

(a) Represents sales to our partners of products manufactured by us.

(b) Substantially all relate to amounts earned from our partners under co-promotion agreements.

(c) Primarily relates to royalties earned by our partners and cost of sales associated with inventory purchased from our partners.

(d) Represents net reimbursements from our partners/(to our partners) for selling, informational and administrative expenses incurred.

(e) Primarily related to net reimbursements, as well as upfront payments and milestone payments earned by our partners. The upfront and milestone

payments were as follows: $210 million in 2011, $147 million in 2010 and $150 million in 2009.

The amounts disclosed in the above table do not include transactions with third parties other than our collaboration partners, or

other costs associated with the products under the collaborative arrangements. In addition, during 2011 we paid $61 million in

milestones to a collaboration partner. These payments were recorded in Identifiable intangible assets-developed technology rights.

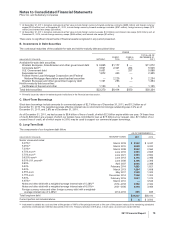

F. Equity-Method Investments

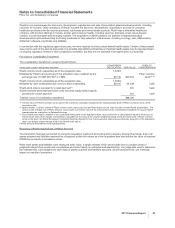

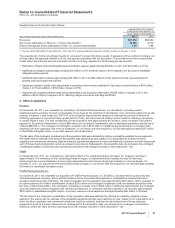

Investment in Laboratório Teuto Brasileiro

On November 8, 2010, we consummated our partnership to develop and commercialize generic medicines with Laboratório Teuto

Brasileiro S.A. (Teuto) a leading generics company in Brazil. As part of the transaction, we acquired a 40 percent equity stake in

Teuto, and entered into a series of commercial agreements. The partnership is enhancing our position in Brazil, a key emerging

market, by providing access to Teuto’s portfolio of products. Through this partnership, we have access to significant distribution

networks in rural and suburban areas in Brazil and the opportunity to register and commercialize Teuto’s products in various

markets outside of Brazil. Under the terms of our purchase agreement with Teuto, we made an upfront payment at the closing of

approximately $230 million. In addition, Teuto will be eligible to receive a performance-based milestone payment from us in 2012 of

up to approximately $200 million. We have an option to acquire the remaining 60 percent of Teuto’s shares beginning in 2014, and

Teuto’s shareholders have an option to sell their 60 percent stake to us beginning in 2015. The portion of the total arrangement

consideration that was allocated to the net call/put option, based on relative fair values of the 40% equity investment and net option

respectively, is being accounted for at cost and will be evaluated for impairment on an ongoing basis.

We are accounting for our interest in Teuto as an equity method investment due to the significant influence we have over the

operations of Teuto through our board representation, minority veto rights and 40% voting interest. Our investment in Teuto is

reported as a private equity investment in Long-term investments and loans. Our share of Teuto’s income and expenses is recorded

in Other deductions—net.

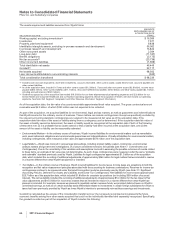

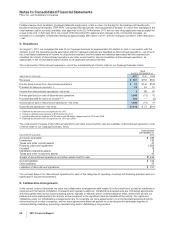

Formation of ViiV

On October 30, 2009, we and GlaxoSmithKline plc (GSK) created a new company, ViiV Healthcare Limited (ViiV), which is focused

solely on research, development and commercialization of human immunodeficiency virus (HIV) medicines. We and GSK have

contributed certain existing HIV-related products, pipeline assets and research assets to ViiV and will perform R&D and

manufacturing services. The R&D Services Agreement provides that we will perform R&D services for pipeline and marketed

products contributed by us and that such services be billed at our internal cost plus a profit margin. After two and a half years, either

party may terminate this agreement with six months’ notice. The Contract Manufacturing Agreement provides that we will

manufacture and supply products to ViiV for four years at a price that incorporates a profit margin. Prior to the agreed termination

date, ViiV may terminate this agreement at any time with approximately one-year’s notice. Further, Pfizer and GSK have entered

into a 3-year Research Alliance Agreement with ViiV under which each party, at its sole discretion, may conduct research programs

in order to achieve Proof of Concept for an HIV Therapy Compound. ViiV will have a right of first negotiation on compounds that

reach Proof of Concept.

We recognized a gain of approximately $482 million in connection with the formation, which was recorded in Other deductions—net

in the fourth quarter of 2009. Since we held a 15% equity interest in ViiV, we had an indirect retained interest in the contributed

assets; as such, 15% of the gain, or $72 million, is the portion of the gain associated with that indirect retained interest. In valuing

our investment in ViiV (which includes the indirect retained interest in the contributed assets), we used discounted cash flow

techniques, utilizing an 11% discount rate and a terminal year growth factor of 3%.

We currently hold a 15% equity interest and GSK holds an 85% equity interest in ViiV. The equity interests will be adjusted in the

event that specified sales and regulatory milestones are achieved. Our equity interest in ViiV could vary from 9% to 30.5%, and

GSK’s equity interest could vary from 69.5% to 91%, depending upon the milestones achieved with respect to the original assets

contributed to ViiV by us and by GSK. Each company also may be entitled to preferential dividend payments to the extent that

specific sales thresholds are met in respect of the marketed products and pipeline assets originally contributed.

2011 Financial Report 69