Pfizer 2011 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2011 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

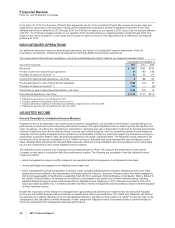

Cost-Reduction Goals

With respect to the January 26, 2009 announcements, and our acquisition of Wyeth on October 15, 2009, in the aggregate, we set a

goal to generate cost reductions, net of investments in the business, of approximately $4 billion to $5 billion, by the end of 2012, at

2008 average foreign exchange rates, in comparison with the 2008 pro forma combined adjusted total costs of the legacy Pfizer and

legacy Wyeth operations. (For an understanding of adjusted total costs, see the “Adjusted Income” section of this Financial Review.)

We achieved this goal by the end of 2011, a year earlier than expected.

With respect to the new R&D productivity initiative announced on February 1, 2011, we set a goal to achieve significant reductions in

our annual research and development expenses by the end of 2012. Adjusted R&D expenses were $8.4 billion in 2011, and we

expect adjusted R&D expenses to be approximately $6.5 billion to $7.0 billion in 2012. (For an understanding of adjusted research

and development expenses, see the “Adjusted Income” section of this Financial Review.) We are on track to meet this 2012 goal.

In addition to these major initiatives, we continuously monitor our organizations for cost reduction and/or productivity opportunities.

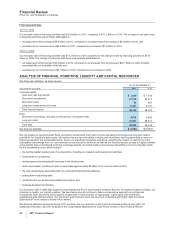

Expected Total Costs

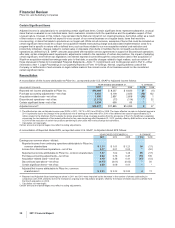

We have incurred and will continue to incur costs in connection with these announced actions. We estimate that the total costs of

both of the aforementioned initiatives could range up to $16.4 billion through 2012, of which we have incurred approximately $12.7

billion in cost-reduction and acquisition-related costs (excluding transaction costs) through December 31, 2011.

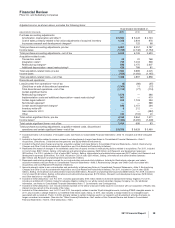

Key Activities

The targeted cost reductions have been and are being achieved through the following actions:

•The closing of duplicative facilities and other site rationalization actions Company-wide, including research and development facilities,

manufacturing plants, sales offices and other corporate facilities. Among the more significant actions are the following:

•Manufacturing: After the acquisition of Wyeth, our operational manufacturing sites totaled 81 and in mid-2010, we announced our

plant network strategy for our Global Supply division, excluding Capsugel. Excluding the 14 plants acquired as part of our acquisition

activity in 2011, as of December 31, 2011, we operated plants in 74 locations around the world that manufacture products for our

businesses. Locations with major manufacturing facilities include Belgium, China, Germany, Ireland, Italy, Japan, Philippines, Puerto

Rico, Singapore and the United States. Our Global Supply division’s plant network strategy has targeted the exiting of ten additional

sites over the next several years.

•Research and Development: After the acquisition of Wyeth, we operated in 20 R&D sites and announced that we would close a

number of sites. We have completed a number of site closures. In addition, in 2011, we closed our Sandwich, U.K. research and

development facility, except for a small presence, and rationalized several other sites to reduce and optimize the overall R&D

footprint. We disposed of our toxicology site in Catania, Italy; exited our R&D sites in Aberdeen and Gosport, U.K.; and disposed of a

vacant site in St. Louis, MO. We are presently marketing for sale, lease or sale/lease-back, either a portion of or all of certain of our

R&D campuses. Locations with R&D operations are in the U.S., Europe, Canada and China, with five major research sites in

addition to a number of specialized units. We also re-prioritized our commitments to disease areas and have reduced efforts in areas

where we do not currently have or expect to have a competitive advantage.

•Workforce reductions across all areas of our business and other organizational changes. We identified areas for a reduction in

workforce across all of our businesses. After the closing of the Wyeth acquisition, the combined workforce was approximately 120,700.

As of December 31, 2011, the workforce totaled approximately 103,700, a decrease of 17,000, primarily in the U.S. field force,

manufacturing, R&D and corporate operations. We have exceeded our original target for reducing the combined Pfizer/Wyeth

workforce.

•The increased use of shared services.

•Procurement savings.

32 2011 Financial Report