Pfizer 2011 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2011 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

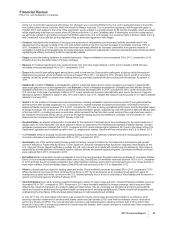

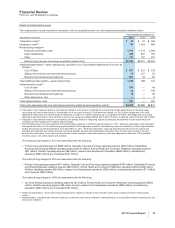

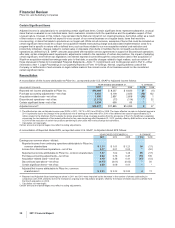

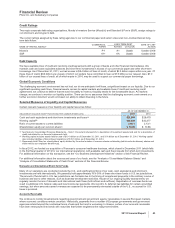

Details of Actual Costs Incurred

The components of costs incurred in connection with our acquisitions and our cost-reduction/productivity initiatives follow:

YEAR ENDED DECEMBER 31,

(MILLIONS OF DOLLARS) 2011 2010 2009

Transaction costs(a) $30 $ 22 $ 768

Integration costs(b) 730 1,004 569

Restructuring charges(c)

Employee termination costs 1,791 1,114 2,564

Asset impairments 256 870 159

Other 127 191 270

Restructuring charges and certain acquisition-related costs $2,934 $3,201 $4,330

Additional depreciation––asset restructuring, recorded in our Consolidated Statements of Income as

follows(d):

Cost of Sales $ 557 $ 527 $ 133

Selling, informational and administrative expenses 75 227 53

Research and development expenses 607 34 55

Total additional depreciation—asset restructuring 1,239 788 241

Implementation costs(e) :

Cost of sales 250 —46

Selling, informational and administrative expenses 25 — 159

Research and development expenses 72 —36

Other deductions—net ——9

Total implementation costs 347 — 250

Total costs associated with cost-reduction/productivity initiatives and acquisition activity $4,520 $3,989 $4,821

(a) Transaction costs represent external costs directly related to our business combinations and primarily include expenditures for banking, legal,

accounting and other similar services. Substantially all of the costs incurred in 2009 were fees related to a $22.5 billion bridge term loan credit

agreement entered into with certain financial institutions on March 12, 2009 to partially fund our acquisition of Wyeth. The bridge term loan credit

agreement was terminated in June 2009 as a result of our issuance of approximately $24.0 billion of senior unsecured notes in the first half of 2009.

(b) Integration costs represent external, incremental costs directly related to integrating acquired businesses and primarily include expenditures for

consulting and the integration of systems and processes.

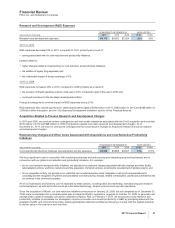

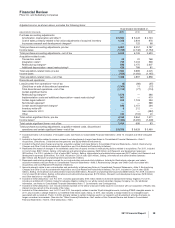

(c) From the beginning of our cost-reduction and transformation initiatives in 2005 through December 31, 2011, Employee termination costs represent

the expected reduction of the workforce by approximately 57,400 employees, mainly in manufacturing, sales and research, of which approximately

42,800 employees have been terminated as of December 31, 2011. Employee termination costs are generally recorded when the actions are

probable and estimable and include accrued severance benefits, pension and postretirement benefits, many of which may be paid out during

periods after termination. Asset impairments primarily include charges to write down property, plant and equipment to fair value. Other primarily

includes costs to exit certain assets and activities.

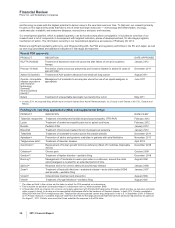

The restructuring charges in 2011 are associated with the following:

•Primary Care operating segment ($593 million), Specialty Care and Oncology operating segment ($220 million), Established

Products and Emerging Markets operating segment ($110 million), Animal Health and Consumer Healthcare operating segment

($51 million), Nutrition operating segment ($4 million), research and development operations ($489 million), manufacturing

operations ($280 million) and Corporate ($427 million).

The restructuring charges in 2010 are associated with the following:

•Primary Care operating segment ($71 million), Specialty Care and Oncology operating segment ($197 million), Established Products

and Emerging Markets operating segment ($43 million), Animal Health and Consumer Healthcare operating segment ($46 million),

Nutrition operating segment ($4 million), research and development operations ($292 million), manufacturing operations ($1.1 billion)

and Corporate ($455 million).

The restructuring charges in 2009 are associated with the following:

•Our three biopharmaceutical operating segments ($1.3 billion), Animal Health and Consumer Healthcare operating segment ($250

million), Nutrition operating segment ($4 million income), research and development operations ($339 million), manufacturing

operations ($292 million) and Corporate ($781 million).

(d) Additional depreciation––asset restructuring represents the impact of changes in the estimated useful lives of assets involved in restructuring

actions.

(e) Implementation costs generally represent external, incremental costs directly related to implementing our non-acquisition-related cost-reduction and

productivity initiatives.

2011 Financial Report 33