Pfizer 2011 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2011 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

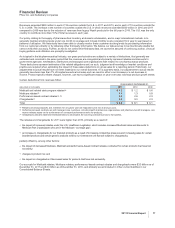

Our Business Development Initiatives

We are committed to capitalizing on growth opportunities by advancing our own pipeline and maximizing the value of our in-line

products, as well as through various forms of business development, which can include alliances, licenses, joint ventures,

dispositions and acquisitions. We view our business-development activity as an enabler of our strategies, and we seek to generate

profitable revenue growth and enhance shareholder value by pursuing a disciplined, strategic and financial approach to evaluating

business development opportunities. We are especially interested in opportunities in our five high-priority therapeutic areas—

immunology and inflammation; oncology; cardiovascular, metabolic and endocrine diseases; neuroscience and pain; and vaccines.

The most significant recent transactions are described below.

•In early 2011, we announced that we were conducting a strategic review of all of our businesses and assets. On July 7, 2011, we

announced our decisions to explore strategic alternatives for our Animal Health and Nutrition businesses that may include, among other

things, a full or partial separation of each of these businesses through a spin-off, sale, or other transaction. We believe these potential

actions may create greater shareholder value, enable us to become a more focused organization and optimize capital allocation. Given

the separate and distinct nature of Animal Health and Nutrition, we may pursue a different strategic alternative for each of these

businesses. Although the timeline for each evaluation may differ, we expect to announce our strategic decision for each of these

businesses in 2012 and to complete any separation of these businesses between July 2012 and July 2013.

We will continue to assess our businesses and assets as part of our regular, ongoing portfolio review process and also continue

to consider business development activities for our businesses.

•On February 26, 2012, we completed our acquisition of Alacer Corp., a privately owned company that manufactures, markets and

distributes vitamin supplements, including Emergen-C, primarily in the U.S.

•On December 1, 2011, we completed our acquisition of the consumer healthcare business of Ferrosan Holding A/S, a Danish company

engaged in the sale of science-based consumer healthcare products, including dietary supplements and lifestyle products, primarily in

the Nordic region and the emerging markets of Russia and Central and Eastern Europe. Our acquisition of Ferrosan’s consumer

healthcare business strengthens our presence in dietary supplements with a new set of brands and pipeline products. Also, we believe

that the acquisition allows us to expand the marketing of Ferrosan’s brands through Pfizer’s global footprint and provide greater

distribution and scale for certain Pfizer brands, such as Centrum and Caltrate, in Ferrosan’s key markets.

•On November 30, 2011, we completed our acquisition of Excaliard Pharmaceuticals, Inc. (Excaliard), a privately owned

biopharmaceutical company focused on developing novel drugs for the treatment of skin fibrosis, more commonly referred to as skin

scarring. Excaliard‘s lead compound, EXC-001, is an antisense oligonucleotide designed to interrupt the process of fibrosis by inhibiting

expression of connective tissue growth factor (CTGF) and has produced positive clinical results in reducing scar severity in certain

Phase 2 trials. For additional information, see Notes to Consolidated Financial Statements—Note 2C. Acquisitions, Divestitures,

Collaborative Arrangements and Equity-Method Investments: Other Acquisitions.

•In October 2011, we entered into an agreement with GlycoMimetics, Inc. for their investigational compound GMI-1070. GMI-1070 is a

pan-selectin antagonist currently in Phase 2 development for the treatment of vaso-occlusive crisis associated with sickle cell disease.

GMI-1070 has received Orphan Drug and Fast Track status from the FDA. Under the terms of the agreement, Pfizer will receive an

exclusive worldwide license to GMI-1070 for vaso-occlusive crisis associated with sickle cell disease and for other diseases for which

the drug candidate may be developed. GlycoMimetics will remain responsible for completion of the ongoing Phase 2 trial under Pfizer’s

oversight, and Pfizer will then assume all further development and commercialization responsibilities. GlycoMimetics would be entitled

to payments up to approximately $340 million, including an upfront payment as well as development, regulatory and commercial

milestones. GlycoMimetics is also eligible for royalties on any sales.

•On September 20, 2011, we completed our cash tender offer for the outstanding shares of Icagen, Inc. (Icagen), resulting in an

approximately 70% ownership of the outstanding shares of Icagen, a biopharmaceutical company focused on discovery, development

and commercialization of novel orally-administered small molecule drugs that modulate ion channel targets. On October 27, 2011, we

acquired all of the remaining shares of Icagen. For additional information, see Notes to Consolidated Financial Statements—Note 2C.

Acquisitions, Divestitures, Collaborative Arrangements and Equity-Method Investments: Other Acquisitions.

•On August 1, 2011, we sold our Capsugel business for approximately $2.4 billion in cash. For additional information, see Notes to

Consolidated Financial Statements—Note 2D. Acquisitions, Divestitures, Collaborative Arrangements and Equity-Method Investments:

Divestitures.

•On January 31, 2011 (the acquisition date), we completed a tender offer for the outstanding shares of common stock of King at a

purchase price of $14.25 per share in cash and acquired approximately 92.5% of the outstanding shares. On February 28, 2011, we

acquired all of the remaining shares of King for $14.25 per share in cash. As a result, the total fair value of consideration transferred for

King was approximately $3.6 billion in cash ($3.2 billion, net of cash acquired). Our acquisition of King complements our current

portfolio of pain treatments in our Primary Care business unit and provides potential growth opportunities in our Established Products

and Animal Health business units. For additional information, see Notes to Consolidated Financial Statements—Note 2B. Acquisitions,

Divestitures, Collaborative Arrangements and Equity-Method Investments: Acquisition of King Pharmaceuticals, Inc.

King’s principal businesses consist of a prescription pharmaceutical business focused on delivering new formulations of pain

treatments designed to discourage common methods of misuse and abuse; the Meridian auto-injector business for emergency

drug delivery, which develops and manufactures the EpiPen; an established products portfolio; and an animal health business

that offers a variety of feed-additive products for a wide range of species.

2011 Financial Report 9