Pfizer 2009 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2009 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

3. Other Significant Transactions and Events

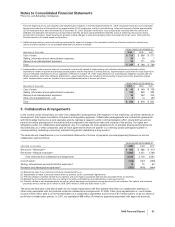

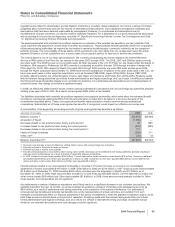

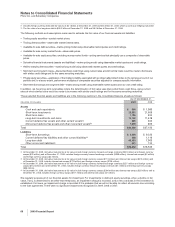

A. Formation of ViiV, an Equity-Method Investment

In the fourth quarter of 2009, we completed a previously announced transaction, where we and GlaxoSmithKline plc (GSK) created

a new company, ViiV Healthcare Limited (ViiV), which is focused solely on research, development and commercialization of human

immunodeficiency virus (HIV) medicines. We recognized a gain of approximately $482 million in connection with the formation,

which is recorded in Other (income)/deductions—net. Under the agreement, we and GSK have contributed certain existing HIV-

related products, pipeline assets and research assets to ViiV and will perform R&D and manufacturing services. We initially hold a

15% equity interest and GSK holds an 85% equity interest in ViiV. The equity interests will be adjusted in the event that specified

sales and regulatory milestones are achieved. Our equity interest in ViiV could vary from 9% to 30.5%, and GSK’s equity interest

could vary from 69.5% to 91%, depending upon the milestones achieved with respect to the original assets contributed by us and by

GSK to ViiV. Each company also may be entitled to preferential dividend payments to the extent that specific sales thresholds are

met in respect of the marketed products and pipeline assets originally contributed. We are accounting for our interest in ViiV as an

equity method investment due to the significant influence we have over the operations of ViiV through our board representation and

minority veto rights. Our investment in ViiV is reported as a private equity investment in Long-term investments and loans.

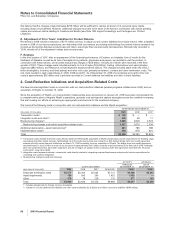

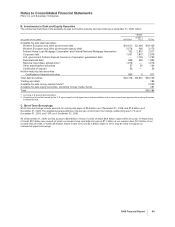

B. Prior-Period Acquisitions

During the years ended December 31, 2008 and 2007, we completed the following acquisitions in support of our commitment to

capitalizing on new growth opportunities:

•In the fourth quarter of 2008, we completed the acquisition of a number of animal health product lines from Schering-Plough

Corporation (Schering-Plough) for approximately $170 million.

•In the second quarter of 2008, we acquired Encysive Pharmaceuticals Inc. (Encysive), a biopharmaceutical company, through a tender

offer, for approximately $200 million, including transaction costs. In addition, in the second quarter of 2008, we acquired Serenex, Inc.

(Serenex), a privately held biotechnology company. In connection with these acquisitions, we recorded approximately $170 million in

Acquisition-related in-process research and development charges and approximately $450 million in intangible assets.

•In the first quarter of 2008, we acquired CovX, a privately held biotherapeutics company, and we acquired all the outstanding shares of

Coley Pharmaceutical Group, Inc. (Coley), a biopharmaceutical company. In connection with these and two smaller acquisitions related

to Animal Health, we recorded approximately $440 million in Acquisition-related in-process research and development charges in 2008.

In 2009, we resolved certain contingencies associated with CovX and recorded $68 million in Acquisition-related in-process research

and development charges.

•In the first quarter of 2007, we acquired BioRexis Pharmaceutical Corp., a privately held biopharmaceutical company, and Embrex, Inc.,

an animal health company. In connection with these and other smaller acquisitions, we recorded $283 million in Acquisition-related

in-process research and development charges.

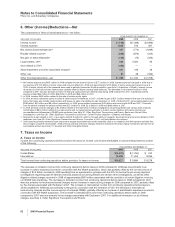

C. Bextra and Certain Other Investigations

In January 2009, we entered into an agreement-in-principle with the U.S. Department of Justice (DOJ) to resolve previously reported

investigations regarding past off-label promotional practices concerning Bextra, as well as certain other investigations. In connection

with these actions, in the fourth quarter of 2008, we recorded a charge of $2.3 billion, pre-tax and after-tax, in Other (income)/

deductions—net and such amount is included in Current deferred tax liabilities and other current liabilities in 2008. (see Note 19D.

Legal Proceedings and Contingencies: Government Investigations). In the third quarter of 2009, we reached final resolution of this

matter and no additional charge was recorded. The entire $2.3 billion was paid in 2009. We did record a tax benefit of $174 million in

the third quarter of 2009 as such resolution resulted in the receipt of information that raised our assessment of the likelihood of

prevailing on the technical merits of our tax position. In addition, in September 2009, we settled state civil consumer protection

allegations related to our past promotional practices concerning Geodon and recorded a charge of $33 million.

D. Certain Product Litigation––Celebrex and Bextra

In October 2008, we reached agreements-in-principle to resolve the pending U.S. consumer fraud purported class action cases and

more than 90% of the known U.S. personal injury claims involving Celebrex and Bextra, and we reached agreements to resolve

substantially all of the claims of state attorneys general primarily relating to alleged Bextra promotional practices. In connection with

these actions, in the third quarter of 2008, we recorded pre-tax charges of approximately:

•$745 million applicable to all known U.S. personal injury claims;

•$89 million applicable to the pending U.S. consumer fraud purported class action cases; and

•$60 million applicable to agreements to resolve civil claims brought by 33 states and the District of Columbia, primarily relating to

alleged Bextra promotional practices. Under these agreements, we made a payment of $60 million to the states and have adopted

compliance measures that complement policies and procedures previously established by us.

These litigation-related charges were recorded in 2008 in Other (income)/deductions—net. Virtually all of this amount was paid in

2009. During 2009, we recorded approximately $170 million in insurance recoveries in Selling, informational and administrative

expenses.

2009 Financial Report 59