Pfizer 2009 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2009 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

The integration and restructuring costs associated with a business combination may occur over several years, with the more

significant impacts ending within three years of the transaction. Because of the need for certain external approvals for some actions,

the span of time needed to achieve certain restructuring and integration activities can be lengthy. For example, due to the highly

regulated nature of the pharmaceutical business, the closure of excess facilities can take several years, as all manufacturing

changes are subject to extensive validation and testing and must be approved by the FDA and/or other global regulatory authorities.

Discontinued Operations

Adjusted income is calculated prior to considering the results of operations included in discontinued operations, as well as any

related gains or losses on the sale of such operations. We believe that this presentation is meaningful to investors because, while

we review our businesses and product lines periodically for strategic fit with our operations, we do not build or run our businesses

with the intent to sell them.

Certain Significant Items

Adjusted income is calculated prior to considering certain significant items. Certain significant items represent substantive, unusual

items that are evaluated on an individual basis. Such evaluation considers both the quantitative and the qualitative aspect of their

unusual nature. Unusual, in this context, may represent items that are not part of our ongoing business; items that, either as a result

of their nature or size, we would not expect to occur as part of our normal business on a regular basis; items that would be

non-recurring; or items that relate to products we no longer sell. While not all-inclusive, examples of items that could be included as

certain significant items would be a major non-acquisition-related restructuring charge and associated implementation costs for a

program that is specific in nature with a defined term, such as those related to our non-acquisition-related cost-reduction initiatives;

charges related to certain sales or disposals of products or facilities that do not qualify as discontinued operations as defined by U.S.

GAAP; amounts associated with transition service agreements in support of discontinued operations after sale; certain intangible

asset impairments; adjustments related to the resolution of certain tax positions; the impact of adopting certain significant, event-

driven tax legislation; net interest expense incurred through the consummation date of the acquisition of Wyeth on acquisition-

related borrowings made prior to that date; or possible charges related to legal matters, such as certain of those discussed in Legal

Proceedings in our 2009 Annual Report on Form 10-K and in Part II. Other Information; Item 1. Legal Proceedings, in our Quarterly

Reports on Form 10-Q filings. Also see Notes to Consolidated Financial Statements—Note 19. Legal Proceedings and

Contingencies. Normal, ongoing defense costs of the Company or settlements and accruals on legal matters made in the normal

course of our business would not be considered certain significant items.

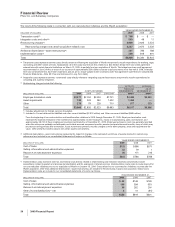

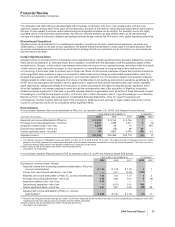

Reconciliation

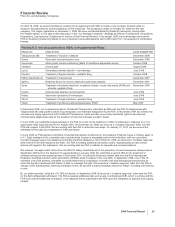

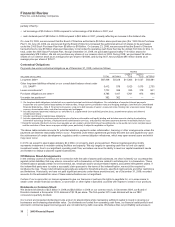

A reconciliation between Net income attributable to Pfizer Inc., as reported under U.S. GAAP, and Adjusted income follows:

YEAR ENDED DECEMBER 31, % CHANGE

(MILLIONS OF DOLLARS) 2009 2008 2007 09/08 08/07

Reported net income attributable to Pfizer Inc. $ 8,635 $ 8,104 $ 8,144 7—

Purchase accounting adjustments—net of tax 2,633 2,439 2,511 8(3)

Acquisition-related costs—net of tax 2,859 39 10 *290

Discontinued operations—net of tax (14) (78) 69 82 *

Certain significant items—net of tax 89 5,862 4,379 (98) 34

Adjusted income(a) $14,202 $16,366 $15,113 (13) 8

(a) The effective tax rate on Adjusted income was 29.5% in 2009, 22.0% in 2008 and 21.0% in 2007. The higher tax rate on Adjusted income in 2009 is

primarily due to the increased tax costs associated with certain business decisions executed to finance the Wyeth acquisition. The lower tax rate in

2008 also reflects $305 million in tax benefits related to the resolution of tax issues.

Certain amounts and percentages may reflect rounding adjustments.

* Calculation not meaningful.

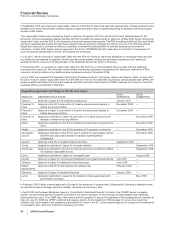

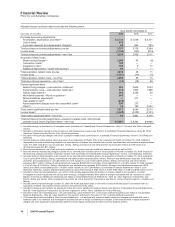

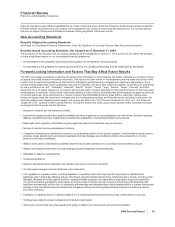

A reconciliation between Reported diluted EPS as reported under U.S. GAAP and Adjusted diluted EPS follows:

YEAR ENDED DECEMBER 31, % CHANGE

2009 2008 2007 09/08 08/07

Earnings per common share—diluted:

Reported income from continuing operations attributable to Pfizer Inc.

common shareholders(a) $ 1.23 $ 1.19 $ 1.18 31

Income from discontinued operations—net of tax —0.01 (0.01) (100) *

Reported net income attributable to Pfizer Inc. common shareholders 1.23 1.20 1.17 33

Purchase accounting adjustments—net of tax 0.38 0.36 0.37 6(3)

Acquisition-related costs—net of tax 0.40 —— *—

Discontinued operations—net of tax —(0.01) 0.01 100 *

Certain significant items—net of tax 0.01 0.87 0.63 (99) 38

Adjusted Net income attributable to Pfizer Inc. common

shareholders(a) $ 2.02 $ 2.42 $ 2.18 (17) 11

(a) Reported and Adjusted diluted earnings per share in 2009 were impacted by the increased number of shares outstanding in comparison with 2008

resulting primarily from shares issued to partially fund the Wyeth acquisition.

Certain amounts and percentages may reflect rounding adjustments.

* Calculation not meaningful.

2009 Financial Report 33