Pfizer 2009 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2009 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

third-highest investment grade rating. S&P indicated that the downgrade reflects the challenge to realize earnings and cash flow in

light of pending patent expirations offset by the addition of Wyeth products to our portfolio. Both Moody’s and S&P reaffirmed our

commercial paper ratings at their highest respective ratings. On October 16, 2009, upon completion of the acquisition of Wyeth, S&P

raised the rating of Wyeth’s outstanding bonds to AA from A+. On November 5, 2009, upon execution of an unconditional and

irrevocable guarantee by Pfizer of approximately $10.3 billion of legacy Wyeth debt, Moody’s upgraded the rating of Wyeth’s

outstanding bonds to A1 from A3.

Debt Capacity

We have available lines of credit and revolving-credit agreements with a group of banks and other financial intermediaries. We

maintain cash and cash equivalent balances and short-term investments in excess of our commercial paper and other short-term

borrowings. As of December 31, 2009, we had access to $8.6 billion of lines of credit, of which $6.4 billion expire within one year. Of

these lines of credit, $8.5 billion are unused, of which our lenders have committed to loan us $7.1 billion at our request. Also, $7.0

billion of our unused lines of credit, of which $5.0 billion expire in late 2010 and $2.0 billion expire in 2013, may be used to support

our commercial paper borrowings.

In March 2007, we filed a securities registration statement with the U.S. Securities and Exchange Commission (SEC). This

registration statement was filed under the automatic shelf registration process available to “well-known seasoned issuers” and

expires in March 2010. We can issue securities of various types under that registration statement at any time, subject to approval by

our Board of Directors in certain circumstances. On March 24, 2009, in order to partially finance our acquisition of Wyeth, we issued

$13.5 billion of senior unsecured notes under this registration statement. On June 3, 2009, also in order to partially finance the

Wyeth acquisition, we issued approximately $10.5 billion of senior unsecured notes in a private placement pursuant to Regulation S

under the Securities Act of 1933, as amended (Securities Act of 1933). The notes have not been and will not be registered under the

Securities Act of 1933 and, subject to certain exceptions, may not be sold, offered or delivered within the United States or to, or for,

the account or benefit of U.S. persons.

For additional information related to our long-term debt, see Notes to Consolidated Financial Statements––Note 9D. Financial

Instruments:Long-Term Debt, and for additional information on our acquisition of Wyeth, see Notes to Consolidated Financial

Statements––Note 2. Acquisition of Wyeth.

Global Economic Conditions

The global economic downturn in 2009 and the continuing economic weakness have not had, nor do we anticipate they will have, a

significant impact on our liquidity. Due to our significant operating cash flow, financial assets, access to capital markets and

available lines of credit and revolving credit agreements, we continue to believe that we have the ability to meet our liquidity needs

for the foreseeable future. As markets change, we continue to monitor our liquidity position. There can be no assurance that

continuing economic weakness or a further economic downturn would not impact our ability to obtain financing in the future.

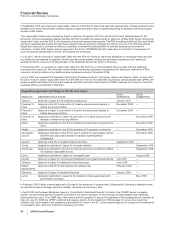

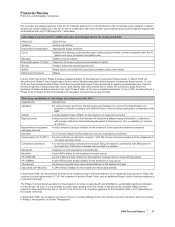

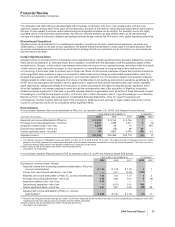

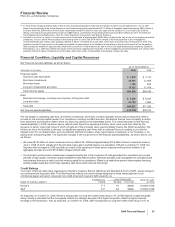

Selected Measures of Liquidity and Capital Resources

The following table sets forth certain relevant measures of our liquidity and capital resources:

AS OF DECEMBER 31,

(MILLIONS OF DOLLARS, EXCEPT RATIOS AND PER COMMON SHARE DATA) 2009 2008

Cash and cash equivalents and short-term investments and loans $27,164 $24,555

Working capital(a) $24,445 $16,067

Ratio of current assets to current liabilities 1.66:1 1.59:1

Shareholders’ equity per common share(b) $ 11.19 $ 8.56

(a) Working capital includes assets held for sale of $496 million as of December 31, 2009, and $148 million as of December 31, 2008.

(b) Represents total shareholders’ equity divided by the actual number of common shares outstanding (which excludes treasury shares and those held

by our employee benefit trust). The increase in shareholders’ equity per common share is due to the issuance of equity to partially finance the

Wyeth acquisition.

The increase in cash and cash equivalents and short-term investments and loans and working capital was primarily due to the timing

of accruals, cash receipts and payments in the ordinary course of business. Also contributing to the working capital increase was the

acquisition of Wyeth (see Notes to Consolidated Financial Statements—Note 2. Acquisition of Wyeth). The increase in accounts

receivable, less allowance for doubtful accounts, reflects the addition of accounts receivable acquired from Wyeth, as well as an

increase in alliance-related receivables, as a result of higher associated revenues, an increase in certain government receivables

and an increase due to foreign currency impacts. No significant collectability issues have been identified.

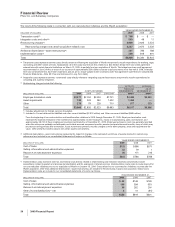

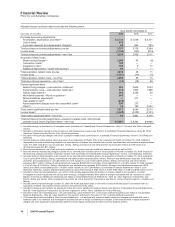

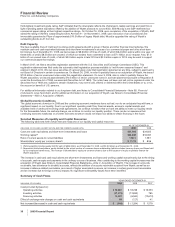

Summary of Cash Flows

YEAR ENDED DECEMBER 31,

(MILLIONS OF DOLLARS) 2009 2008 2007

Cash provided by/(used in):

Operating activities $ 16,587 $ 18,238 $ 13,353

Investing activities (31,272) (12,835) 795

Financing activities 14,481 (6,560) (12,610)

Effect of exchange-rate changes on cash and cash equivalents 60 (127) 41

Net increase/(decrease) in cash and cash equivalents $ (144) $ (1,284) $ 1,579

36 2009 Financial Report