Omron 2007 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2007 Omron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

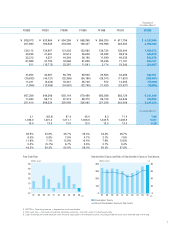

TEN-YEAR FINANCIAL HIGHLIGHTS

OMRON Corporation and Subsidiaries

¥736,651

284,199

168,135

52,028

64,036

97,959

38,280

40,539

(47,075)

(6,536)

(4,697)

630,337

21,813

382,822

165.0

1,660.7

34.0

38.6%

8.7%

13.3%

10.3%

60.7%

¥ 626,782

253,389

152,675

50,501

62,128

92,953

35,763

51,699

(43,020)

8,679

(38,320)

589,061

3,813

362,937

151.1

1,548.1

30.0

40.4%

9.9%

14.8%

10.7%

61.6%

¥ 608,588

249,771

144,219

49,441

56,111

84,753

30,176

61,076

(36,050)

25,026

(40,684)

585,429

24,759

305,810

126.5

1,284.8

24.0

41.0%

9.2%

13.9%

10.4%

52.2%

¥ 584,889

240,054

142,157

46,494

51,403

79,065

26,811

80,687

(34,484)

46,203

(28,119)

592,273

56,687

274,710

110.7

1,148.3

20.0

41.0%

8.8%

13.5%

10.2%

46.4%

Operating Results (for the year):

Net sales

Gross profit

Selling, general and administrative expenses

(excluding research and development expenses)

Research and development expenses

Operating income

EBITDA (note 3)

Net income (loss)

Cash Flows (for the year):

Net cash provided by operating activities

Net cash used in investing activities

Free cash flow (note 4)

Net cash used in financing activities

Financial Position (at year-end):

Total assets

Total interest-bearing liabilities

Total shareholders’ equity

Per Share Data:

Net income (basic)

Shareholders’ equity

Cash dividends (note 5)

Ratios:

Gross profit margin

Operating income margin

EBITDA margin

Return on shareholders’ equity (ROE)

Ratio of shareholders’ equity to total assets

FY2006 FY2005 FY2004 FY2003

Millions of yen

0

200

400

600

800

1,000

97 009998 02 0301 04 05 06 (FY)

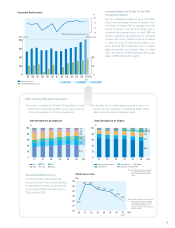

Net Sales and Operating Income Margin

Net sales (left axis) Operating income margin (right axis)

(Billions of yen) (%)

0

2

4

6

8

10

-20

-10

0

10

20

30

40

(FY)

97 009998 02 0301 04 05 06

Net Income (Loss) and ROE

(Billions of yen) (%)

Net income (loss) (left axis) ROE (right axis)

-10

-5

0

5

10

15

20

Yen

Notes: 1. The U.S. dollar amounts represent translations of Japanese yen at the approximate exchange rate on March 31, 2007, of ¥118=$1.

2. About the above-mentioned financial data, the profit or loss (excluding the balance of obligation settled) recognized on the transfer of employee pension

fund liabilities in March 31, 2006 is not included in any of “cost of sales”, “selling, general & administrative expenses” and “research and development

expenses”, to enable an easy comparison with previous fiscal years. It is assumed that this profit or loss is allocated in one lump sum.

6