Omron 2007 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2007 Omron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

9795 96 009998 02 0301 04 05 06 07

(plan)

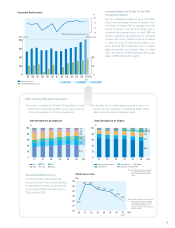

Corporate Performance

(%)

Net sales (left axis)

Operating income (right axis)

0

200

400

600

800

0

40

80

3rd Stage

(FY)

0

4

8

12

Operating income margin (right axis)

(Billions of yen)

(Billions of yen)

1st Stage 2nd Stage

Increased Sales and Profits for the Fifth

Consecutive Period

We have established sales of more than ¥750

billion and operating income of greater than

¥75 billion for fiscal 2007 as management indi-

cators to achieve the last 2nd Stage goal of

doubling total business value. In fiscal 2006 we

actively invested in strengthening our profitabili-

ty base. As a result, despite one-time increases

in costs the fruits of restructuring began to be

seen, and the fifth consecutive term of higher

sales and profits was realized. Also, for fiscal

2007, the effects of M&A activities has brought

sales of ¥800 billion within sight.

Restructuring of Business Segments

Operational Restructuring

In order to build a robust earnings

structure, we are continuously working

on business efficiency, and are aiming

to achieve an SG&A expense ratio of

22% by fiscal 2007.

Note: Excluding extraordinary factors in the ATM

business and the response to hazardous

chemical substance regulations in FY04.

Also excluding extraordinary factors in

response to hazardous chemical substance

regulations in FY05

(FY)

22.0

22.8

22.8

25.3 25.3

24.3 24.1 23.8

SG&A Expense Ratio

20

21

22

23

24

25

26

02 0300 01 04 05 07

(Target)

06

(%)

0

20

40

60

80

100

02 03

3.8

8.9

18.8

12.6

14.4

41.5

01 04 05 06

Sales Breakdown by Segment

(%)

(FY)

IAB

SSB

ECB

HCB

AEC

Others

(FY)

Sales Breakdown by Region

5.5

15.8

13.3

55.9

0

20

40

60

80

100

02 0301 04 05 06

(%)

Japan (including exports)

Greater China

North America

Southeast Asia and Others

Europe

9.5

Note: Until FY03, Greater China was included

in Southeast Asia and Others. Greater

China includes China, Hong Kong and

Taiwan.

2) In Greater China—which stands out as a major con-

sumer—we are focusing on expanding sales where

major manufacturers are building plants.

1) In order to establish ECB and AEC as pillars of busi-

ness of the same scale as IAB, we are, above all, pro-

moting the expansion of the two segments.