Omron 2007 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2007 Omron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

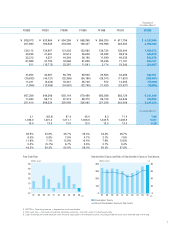

A.In fiscal 2007, we are expecting total operating

income of ¥97.4 billion (including inter-segment

income of ¥22.4 billion) for all business segments

and we anticipate that IAB will generate ¥64.6 billion of that

amount. Therefore, it is no exaggeration to say that the IAB will

be the leader in determining whether we will reach our con-

solidated operating income target of ¥75 billion for fiscal 2007.

During the 2nd Stage of GD2010, our long-term man-

agement plan, IAB, which is the core business of the

Omron Group, undertook decisive measures on a large

scale, implementing sweeping structural reforms in its

operations. Specifically, over the past three years we

have consolidated three of our plants in China (Shanghai)

into one plant. In Japan we also streamlined operations by

consolidating our development and production operations

in Mishima and Okayama into our plant at Kusatsu.

In addition, by transferring production of general-pur-

pose products to China, we also expect to achieve a 30%

improvement in productivity in that area in comparison with

the start of the 2nd Stage of GD2010. These initiatives in

streamlining and reform have significantly cut our manu-

facturing fixed costs. Furthermore, we were able to com-

plete spending to accommodate RoHS requirements (restric-

tions of hazardous substances in electric and electronic

devices) by the end of the previous fiscal year, and this will

result in cost reduction from fiscal 2007 onwards.

As a result of IAB’s efforts to increase sales since fiscal

2004, and the initiatives I just mentioned to control pro-

duction and selling, general and administrative (SG&A)

expenses, we expect to achieve for the most part (operating

margin will be 19%) our commitment of establishing an

earnings structure based on a ratio of 5:3:2, representing

gross profit, SG&A expenses (including R&D expenses),

and operating income respectively. This is, in fact, the most

important IAB company theme of the 2nd Stage of GD2010.

We plan to generate about half of the ¥16.1 billion

increase in operating income expected in fiscal 2007

through structural reforms in fixed expenses, and the

remaining half from an increase in volume. In sales for fis-

cal 2007, we expect a ¥34 billion increase year on year,

largely in Japan and Greater China. At home in Japan, we

will promote aggressive sales for resolving customer issues

in areas such as quality, safety and the environment, and in

those areas we will focus particular attention on the auto-

motive, semiconductor, flat panel display and liquid crys-

tal areas with a view to growing our applications business.

In Greater China, on the other hand, we will concentrate

on expanding our business operations in AOI (automated

optical inspection) and PLC (programmable logic controllers)

by reinforcing our sales framework, boosting productivity

and launching new products.

Q.5I understand that you are looking at a significant increase in operating

income (up 33.1% year on year) in IAB as the main force driving growth in

results for fiscal 2007, but can you give some specific details of the

possibilities for achieving that?

*Figures for the profit structure plan are based on management of IAB

itself. The share of operating expenses is approximately 1 percentage

point lower than figures released due to the way in which operating

expenses for headquarters are allocated.