Omron 2007 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2007 Omron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

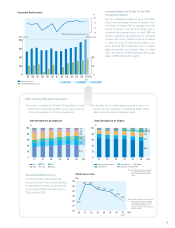

A.In the automobile industry the development of

new vehicles has been centered on the themes

of safety and the environment, and the number of

electronic devices used in vehicles is increasing. Following

this trend, the introduction of AEC products in new vehi-

cles is also increasing. As a result, net sales for AEC in fiscal

2006 rose significantly to ¥93.3 billion (up 20.3% over the

previous year). Despite a rapid recovery in operating income

during the second half of the fiscal year, operating income

for the full year finished in the red with a deficit of ¥1.2 bil-

lion (the first half was ¥2 billion in the red, the second half

was ¥0.8 billion in the black).

There were two main factors inhibiting performance at

AEC. One was the squeeze on profits caused by surges in

raw material prices such as silver and copper, and the other

was the delay in improvement in production efficiency at

production bases in North America in both the previous year

and the first half of fiscal 2006. In North America, orders

have been increasing over the past year, but production

plants were unable to cope with increases in production

volume and were unable to fulfill their supply quotas in fis-

cal 2006. Consequently, production plants in Japan had to

cover their shortfall, and the products then had to be air

freighted. This abnormal situation not only resulted in unnec-

essary transport costs and production costs but also result-

ed in productivity at North American plants falling below

projections and a significant rise in fixed production expens-

es. Added to these was the negative effect of the appreci-

ation of the Canadian dollar on results.

To address this situation, AEC put in place emergency

measures to improve earnings. Specifically, we reviewed

product values and the possibilities of changing over to

alternative materials, based on value analysis (VA) and value

engineering (VE), and we undertook efforts to revise prices

of relays where profitability had been seriously impaired by

the surges in silver and copper prices. Furthermore, as for

the production framework, we also transferred production of

some of our products from North America to Japan and

China. In addition, we revised our logistics network infra-

structure and shifted operations from local production to

production in what we deemed to be optimal locations. As

a result of these measures, the operating income of AEC

improved dramatically in the second half of fiscal 2006 and

returned to the black.

Furthermore, to broaden the application of relays to other

areas, such as general consumer electronics and commu-

nications equipment, we launched the Relay Business

Improvement Project: a company-wide initiative under my

direct control that involved IAB as well as ECB. We have

also been promoting improvement in productivity not only in

North America but in other areas as well.

As a result, AEC’s operating income is gradually head-

ing in the direction of improvement in fiscal 2007, and we are

expecting a profit of ¥1.4 billion for the full year. However, in

contrast to AEC’s sales target of ¥100 billion, the level of

operating income is still far too low. I am determined to do

everything within my power, in cooperation with the entire

Omron Group and AEC, in order to improve income in a way

that will result in lifting the operating income margin in

excess of capital cost (about 6%).

Q.2For the past three years, AEC has remained in the red. Could you please

comment on conditions at AEC at present and what you are planning for

future measures to rebuild the segment?