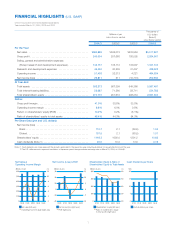

Omron 2004 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2004 Omron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7

SPECIAL FEATURE:

FY2004 - 2007 MEDIUM-TERM MANAGEMENT PLAN “GD2010 NEW PHASE 2”

—Strategy of Balancing Growth and Earnings—

PROLOGUE

—AIMING AT DOUBLING TOTAL BUSINESS VALUE

Due principally to a substantial worsening of the eco-

nomic climate immediately following launch of our long-

term growth vision, Grand Design 2010 (GD2010), the

performance of the Omron Group deviated considerably

from the growth path initially laid out. With subsequent

steady implementation of the productivity improvement

structural reforms, Value-added Innovation Committee

21 (VIC 21), however, we were finally able during fiscal

2003 to improve our profitability to where it surpassed

the goals we set in GD2010. With that as a turning

point, we will now move forward steadily toward maxi-

mizing the Omron Group’s corporate value, the original

aim of GD2010.

Maximizing corporate value, however, is not a goal

that can be accomplished overnight. During the first half

of the remaining seven years of GD2010, therefore, we

will be seeking a balance between growth and earnings,

with the aim of doubling the total present value of the

future cash flows anticipated from our various business

segments.

OPERATING STRUCTURE REFORM

—FURTHER REINFORCEMENT OF PLATFORM FOR

PROFITABILITY

1. Basic Recognition:

We are far from satisfied with the current situation

Although ROE and other indicators of profitability

exceeded initial projections following implementation of

VIC21, we are fully aware that the current situation does

not allow us to rest on our laurels. All we have accom-

plished thus far is to improve slightly the structural

weaknesses we identified. It is important, in particular,

to promote still further our ability to cope with changes

in the external environment and our international com-

petitiveness.

2. Concrete Strategies and Objectives:

Further reductions in SG&A and fixed manufactur-

ing cost ratios

As a goal for further reinforcing our earnings structure,

we are aiming to increase our operating income from

the current 8.8% to more than 10% by fiscal 2007. The

specific ways in which we will accomplish that goal are

to accelerate shifting production to China to reduce our

fixed manufacturing cost ratio while promoting efficien-

cy in our sales and related support structures and fur-

ther reductions in SG&A expenses for a lower SG&A

ratio. The combination of lower fixed manufacturing

costs and SG&A ratio is expected to result in a 2-3 per-

centage points drop making it possible to realize oper-

ating income margins of over 10%.

Maximizing Long-Term Corporate Value

Establish a profit

structure

Build a growth

structure

Achieve a growth

structure

Phase 1 New Phase 2 Phase 3

ROE 10%

Target Double total business value

FY2001 FY2004 FY2007 FY2010