Omron 2004 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2004 Omron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

Hisao Sakuta

President and CEO

TO OUR SHAREHOLDERS, CUSTOMERS,

AND ALL OTHER STAKEHOLDERS

Our mission—to contribute meaningfully to the development of

society—is more than just an empty dream. That’s because we

have adopted a realistic approach to carrying out this mission,

effectively utilizing our accumulated managerial resources.

RETROSPECTIVE ON FISCAL 2003

1. Operating Environment

Momentum fueled by domestic private-sector capital

investment and continued growth in China

The subtle signs of recovery in the Japanese economy, which

began to emerge during the fiscal year ended March 31, 2003,

grew increasingly apparent over the course of fiscal 2003, ended

March 31, 2004. The biggest difference compared to past recov-

ery cycles is that the present upturn is not solely reliant on exports

but rather is grounded in solid domestic demand. In particular,

movement is being felt in the new growth industry of digital con-

sumer electronics, even as long-depressed private-sector capital

investment has shown impressive double-digit year-on-year growth

for the fiscal year under review.

At the same time, overseas expansion is picking up, centered on

China, where the Omron Group has prioritized business development

for some time. Currently making a transformation from the “world’s

factory” to the largest consumer market on earth, China achieved

strong real GDP growth of 9.1% during the year under review.

2. Operating Results of the Omron Group

High-value-added technology and marketing, com-

bined with aggressive overseas business development

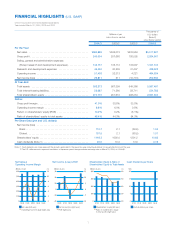

Overall sales for fiscal 2003 outpaced our initial target by 4.4%, ris-

ing to ¥584.889 billion, a 9.3% increase over the previous year.

Our Automotive Electronic Components Business (AEC) receded

because of production cutbacks by North American automakers.

Moreover, sales in the Other Businesses segment declined due to

exclusion of a number of previously consolidated subsidiaries from

the period’s consolidated results owing to structural reforms imple-

mented prior to September 2003. Nevertheless, we could achieve

the better-than-expected results, thanks largely to strong perform-

ances by our core business segments. In addition to positive con-

ditions in the macro business environment, I believe the expansion

in sales was driven by our solid grasp of customers’ diversifying

and increasingly sophisticated requirements, which in turn guided

our development and market launch of technology-driven products

and provision of solutions to help our customers attain greater pro-

ductivity and improved quality. Specifically, we actively undertook

proposal-based sales and marketing activities focusing on the

semiconductor and flat panel display (FPD) industries, and suc-

ceeded in substantially expanding sales of such products as base

inspection systems, displacement sensors, and high-precision

control devices. In addition, sales of backlights used in cellular

phones doubled by differentiating our products in respect of lower

energy consumption and increased brightness.

Geographically, sales rose 11.0% year-on-year in Japan and

6.8% overseas. Sales in China, in particular, showed strong growth

of approximately 30%, including direct exports from Japan, which is

clearly one of the most important factors of the year under review.

Structural improvements and increased net sales yield

record profits

Operating income jumped 59.1% year-on-year to ¥51.403 billion,

while net income soared by a factor of over 52.5 to ¥26.811 billion,

both record highs. These figures exceeded our initial targets by

19.5% and 41.1%, respectively.

Our proactive stance for strengthening our technological edge

and new market development resulted in increase in expense by

¥13.4 billion during the year. Nevertheless, this was more than off-

set by the positive effects of an increase in net sales (¥22.2 billion)

and productivity gains (¥10.2 billion). Productivity gains were the

fruits of our Value-added Innovation Committee 21 (VIC21) struc-

tural reforms, launched in fiscal 2001, which served to accelerate

reductions in variable costs and fixed manufacturing costs.

Return on shareholder’s equity (ROE) jumped from 0.2% to

10.2%, thus reaching a year ahead of schedule the 10% target set

out in VIC21. In short, I would summarize the year’s achievements

by noting that we succeeded in establishing a solid platform for the

next stage of growth.