Omron 2004 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2004 Omron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8

BUSINESS DOMAIN STRUCTURAL REFORMS

—ESTABLISHMENT OF NEW PLATFORMS FOR

GROWTH

1. Basic Recognition:

Essential to raise the level of potential growth in

each business domain

We define business value as the present value of future

cash flows anticipated from the Group’s various busi-

ness domains. In order to realize increased business

value it is essential to improve the profitability of existing

businesses (operational structure reforms) and to

increase our sales in growth domains.

2. Basic Strategy:

Further development of high growth regions and

of value-added fields utilizing our technological

edge

Two main focuses mark our approach to raising the top

line. The first focus is to prioritize the development of

geographic regions (markets) with high growth potential.

That means placing primary emphasis on the Chinese

market. The second focus is to fully leverage and then

further strengthen our technological edges in order to

advance into new, high value-added business domains.

Through the second focus, in particular, we are confi-

dent that we can achieve top line growth even in mature

markets such as those in Japan, Europe and North

America.

1) Further development in high growth regions

—Emphasis on China

The Omron Group places China at the top of the list of

regional markets to be developed. Although business

contraction is anticipated in the short term in China due

to government tightening to bring economic overheating

under control, growth potential remains strong in the

medium to long term as China continues to serve as the

“world’s factory” while also emerging as one of the

world’s great consumer market. The Group chalked up

¥38.8 billion in sales during fiscal 2003 in the Chinese

market, and has already achieved a correspondingly

well-recognized presence there. By fiscal 2007, the

Group aims to roughly quadruple its sales in China to

¥150.0 billion.

At the center of our strategy in China are our

Industrial Automation Business (IAB), Electronic

Components Business (ECB), and Healthcare Business

(HCB). Major manufacturers from Japan, Europe and

North America are expanding their output in China, and

more sophisticated automation is being required along-

side expanding demand for leading-edge devices such

as micro lens arrays (MLAs). In addition, as the living

standard in China continues to climb rapidly, the growth

potential is increasing for various healthcare products.

Factors such as the spread of private car ownership

and development of the transportation infrastructure,

moreover, are expected to result in expanded needs

that positively affect the demand felt by the Automotive

Electronic Components Business (AEC) and the Social

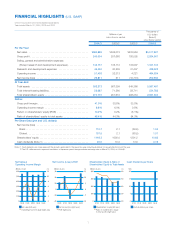

Full-Fledged Growth in China

¥150.0 billion

Fiscal 2001 Actual Fiscal 2004 Plan

Net sales: ¥25.0 billion ¥50.0 billion

Investment: ¥8.5 billion

(FY2001–2003)

Fiscal 2003 Actual Fiscal 2007 Plan

Net sales: ¥38.8 billion ¥150.0 billion

Investment: ¥30.0 billion

(FY2004–2007) FY01 FY02 FY03 FY04 FY07

30

90

60

120

150

Sales in the China Region

(Billions of yen)

0FY05 FY06

GD2010 New Phase 2

4 times in 4 years