Omron 2004 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2004 Omron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

OUR GROWTH STRATEGY: SOLIDIFYING PAST INITIATIVES

FOR THE FUTURE

1. The Essence and Inevitability of Strategy

Strengthening profitability, growth potential, and

stability to maximize corporate value

It is my conviction that a CEO’s primary responsibility is to respond

to stakeholders’ expectations by maximizing corporate value.

Accordingly, in 2001 the Omron Group formulated Grand Design

2010 (GD2010), a long-term management plan expressing the

desired direction for the Group over the coming decade, with the

priority goal of maximizing corporate value over the long term.

I believe that corporate value is composed of three major ele-

ments. The first of these is profitability. Only by producing profits

that exceed current investment costs can an enterprise begin to

achieve value, and high profitability demonstrates high-added-value

business development based on technology that distinguishes a

company from its competitors. In GD2010, we established 10% of

ROE as a profitability benchmark for our medium-term management

objectives. The second element is growth prospects. Needless to

say, the market places a premium, thus respects the bland value,

only on companies demonstrating growth potential. The third ele-

ment is stability. It is vital that a Company establish a solid earnings

base capable of withstanding volatility in the external environment. In

order to increase profitability and stability, it is necessary to reinforce

both financial and production systems. To raise growth potential,

meanwhile, technology and marketing must be organically integrat-

ed. These principles are the essence of GD2010.

2. Verification of the Past

Strengthening our earnings base

—turning the negative into the positive

Shortly after the launch of GD2010, the Omron Group was hit by a

major downturn in the economy, pushing us off the path of growth

that we had envisioned. In response, from fiscal 2002 we focused

on increasing profitability at an accelerated pace via structural

reforms stipulated in VIC21. Under VIC21, we carried out several

significant reforms. Specifically, an early retirement program led to a

reduction in domestic employment of about 1,460 people.

Furthermore, we closed three plants or partially transferred functions

overseas, and sold or absorbed eight businesses and 11 sub-

sidiaries. At the same time, we achieved cost reductions by under-

taking sweeping re-evaluations of our production processes and

materials procurement. As a result, we achieved all of VIC21’s

numerical targets, including overseas production ratios and busi-

ness portfolio revision as well as reductions in fixed and variable

expenses (¥32.4 billion actual vs. ¥30.0 billion target). This prepared

the ground for the dramatic earnings recovery we enjoyed during

the year under review.

3. Issues for the Future

Offensive-defensive strategic balance for progress in

the next stage of growth

By bringing our profitability targets (ROE) one year forward, I feel

that we are now at a stage where we can work on improving our

growth and stability. This does not mean, however, that our mission

to raise profitability has ended. Despite our gradual strengthening of

our earnings base, it is not yet solid enough to enable us to maintain

superior international competitiveness. Bearing this in mind, we have

divided the remaining seven years of GD2010 into two parts. During

the first four years, from fiscal 2004 to fiscal 2007, dubbed GD2010

New Phase 2, we will implement a strategy of offensive/defensive

balance with an eye to increasing the prospects for growth and sta-

bility, all the while paying keen attention to profitability.

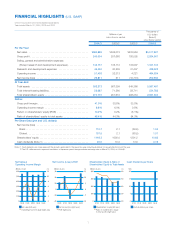

Results of VIC21 Structural Reforms

Period of implementation: April 2002 to September 2003

Reduction in groupwide

fixed and variable expenses . . . . . .

Expansion of overseas

production ratio

(compared with March 2001) . . . . .

Absorption or sale of low-profit

or unprofitable businesses . . . . . . .

ActualTargetItem

¥32.4 billion

52% increase in ratio

8 businesses, 11 subsidiaries

¥30.0 billion

50% increase in ratio

2 businesses, 5 subsidiaries

Review of GD2010 Phase 1

FY00 FY01 FY02 FY03

-5

5

0

10

15

(ROE: %) 10% ROE achieved

1 year ahead of schedule

-10 FY04

6.7

10.0

9.3

8.4

7.5

10.2

0.2

-5.1

Structural Reforms

(VIC21)

Initial ROE target

Actual ROE