North Face 2000 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2000 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

To Our Shareholders

The elements are in place for improved

performance in 2001. By exiting unprofitable

businesses, reaping the benefits from acquisitions,

consolidating operations and strengthening our

leadership team, we have built a solid foundation

for renewed growth.

VF remains in a very strong financial posi-

tion. At year-end, our debt to capital ratio was

35%. Cash flow from operations of $443 million

gave us the flexibility to make acquisitions and

continue our share repurchase program. In 2000,

VF invested $106 million to repurchase four

million shares. We intend to continue to repurchase

our shares in 2001 as well. 2000 also marked

the 28th consecutive year of increased dividend

payments to our shareholders.

Recapping the Year’s Highlights

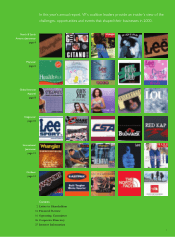

Strong brands. Backed by a steady flow of innova-

tive products, new marketing and great service,

VF’s brands generally performed solidly in 2000,

despite a lackluster retail environment. We are

particularly proud of the fact that our Wrangler

brand continued to expand its unit market share

and is now the number one jeans brand in the

U.S. Our Lee brand also had an excellent year,

with new products and retail service programs

driving strong gains. With our Wrangler, Lee,

Rustler, Riders, Brittania, Gitano and Chic

brands, VF holds a 27.5% share of the total jeans

market in the U.S., up from 24.7% in 1999. Our

European jeans brands also enjoyed a stronger

year in 2000, despite poor market conditions.

A continued emphasis on product innovation

also benefited our intimate apparel brands, as

evidenced by the success of new products such

as Vanity Fair’s Illumination®bras and the Lily of

France X-BraTM and Strappies bras. 2000 also

marked the successful launch of a new line of

intimate apparel under the licensed Tommy

Hilfiger brand. Our Playwear coalition, consisting

of our Healthtex, Lee and licensed Nike chil-

drenswear businesses, enjoyed an excellent year in

sales and profit growth. The knitwear industry

remains challenging, but we continue to make

strides in improving our competitive position

through lower cost manufacturing. Our JanSport

VF continues to strengthen its ability to take

advantage of changing economic and industry

conditions, giving us confidence in our outlook

for the future.

2000 was characterized by a volatile

stock market, a weak retail environment

and mixed financial results from many

industry participants. However, we made

solid progress on a number of important

fronts, including acquisitions, brand portfolio

development, cost reduction and systems. We also

were gratified by the increase in our stock price,

which rose 21% in 2000, compared with a 10%

decline for the S&P 500 index.

As we enter 2001, we believe we have the

right mix of brands, people and technology to

meet the needs of consumers and customers

around the world.

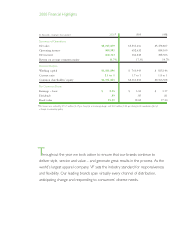

2000 Financial Performance

VF’s sales reached a record $5.7 billion in 2000,

reflecting strong jeans sales in the U.S. and the

addition of several new brands to our growing

portfolio. Excluding unusual items, earnings per

share were $2.98, compared with $3.04 in 1999.

In the fourth quarter of 2000, we took a

variety of actions to improve future profitability,

including exiting underperforming businesses and

product lines, closing higher cost manufacturing

facilities and consolidating distribution and

administrative operations. These actions, which

resulted in a charge to earnings in 2000 of

$120 million, or $.67 per share, should benefit

earnings by $45 million annually. Earnings were

also affected by a change in accounting policy

for revenue recognition in accordance with new

SEC guidelines. Reflecting both the restructuring

charge and the change in accounting policy, we

reported earnings per share of $2.25 in 2000.

Our core jeanswear, playwear, daypack,

knitwear and international businesses performed

well in 2000, but the dilutive effect of acquisitions

made during the year, difficulties in integrating

several workwear companies acquired in 1998

and 1999, and operating losses from our Wrangler

Japan business affected our bottom line.

Mackey J. McDonald

Chairman, President

and Chief Executive

Officer