North Face 2000 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2000 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

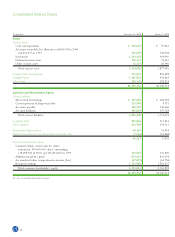

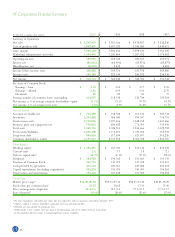

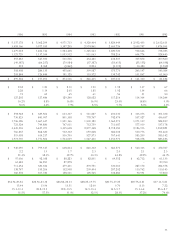

VF Corporation Financial Summary

In thousands, except per share amounts 200041999 1998 1997

Summary of Operations

Net sales $ 5,747,879 $ 5,551,616 $ 5,478,807 $ 5,222,246

Cost of products sold 3,842,451 3,657,120 3,586,686 3,440,611

Gross margin 1,905,428 1,894,496 1,892,121 1,781,635

Marketing, administrative and other 1,395,435 1,241,864 1,207,952 1,176,562

Operating income 509,993 652,632 684,169 605,073

Interest, net (81,032) (62,490) (55,871) (25,877)

Miscellaneous, net (8,279) 5,434 3,300 6,684

Income before income taxes 420,682 595,576 631,598 585,880

Income taxes 160,348 229,334 243,292 234,938

Net income $ 260,334 $ 366,242 $ 388,306 $ 350,942

Per share of Common Stock1

Earnings – basic $ 2.25 $ 3.04 $ 3.17 $ 2.76

Earnings – diluted 2.21 2.99 3.10 2.70

Dividends .89 .85 .81 .77

Average number of common shares outstanding 114,075 118,538 120,744 125,504

Net income as % of average common shareholders’ equity 11.7% 17.3% 19.7% 18.2%

Net income as % of average total assets 6.0% 8.9% 10.2% 10.1%

Financial Position

Accounts receivable, net $ 716,299 $ 732,502 $ 705,734 $ 587,934

Inventories 1,124,438 964,040 954,007 774,755

Total current assets 2,110,096 1,877,416 1,848,152 1,601,466

Property, plant and equipment, net 776,015 804,422 776,091 705,990

Total assets 4,358,156 4,026,514 3,836,666 3,322,782

Total current liabilities 1,006,200 1,113,473 1,033,006 765,908

Long-term debt 905,036 517,834 521,657 516,226

Common shareholders’ equity 2,191,813 2,163,818 2,066,308 1,866,769

Other Statistics

Working capital $ 1,103,896 $ 763,943 $ 815,146 $ 835,558

Current ratio 2.1 1.7 1.8 2.1

Debt to capital ratio234.7% 30.1% 27.1% 22.5%

Dividends $ 104,920 $ 104,302 $ 101,660 $ 100,141

Purchase of Common Stock 105,723 149,075 147,398 391,651

Cash provided by operations 443,314 423,361 429,282 460,652

Capital expenditures (excluding acquisitions) 125,224 150,076 189,059 154,262

Depreciation and amortization 173,422 167,432 161,385 156,252

Market Data

Market price range1$36.90-20.94 $55.00-27.44 $54.69-33.44 $48.25-32.25

Book value per common share119.52 18.62 17.30 15.40

Price earnings ratio – high-low 16.4-9.3 18.1-9.0 17.3-10.5 17.5-11.7

Rate of payout339.6% 28.0% 25.6% 27.9%

1Per share computations and market price ranges have been adjusted to reflect a two-for-one stock split in November 1997.

2Capital is defined as common shareholders’equity plus short-term and long-term debt.

3Dividends per share divided by earnings per share.

42000 includes a $76.7 million ($.67 per share) restructuring charge and a $6.8 million ($.06 per share) charge

for the cumulative effect of a change in accounting policy for revenue recognition.