North Face 2000 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2000 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

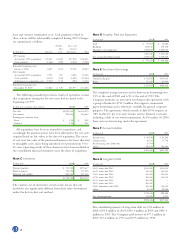

28

lease and contract termination costs. Cash payments related to

these actions will be substantially completed during 2001. Charges

are summarized as follows:

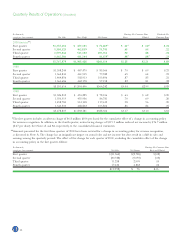

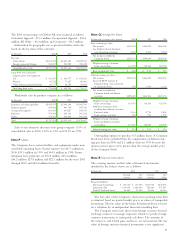

Facilities Lease and

Exit Contract

In thousands Severance Costs Termination Total

1999 Activity:

Accrual for 1999 acquisitions $ 5,061 $1,622 $17,948 $ 24,631

Cash payments (1,362) (208) (2,218) (3,788)

Estimated remaining costs,

January 1, 2000 3,699 1,414 15,730 20,843

2000 Activity:

Accrual for 2000 acquisitions 7,971 967 3,558 12,496

Cash payments (6,411) (831) (6,588) (13,830)

Adjustments to acquisition costs (2,037) (711) (723) (3,471)

Estimated remaining costs,

December 30, 2000 $ 3,222 $ 839 $11,977 $ 16,038

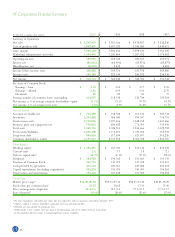

The following unaudited pro forma results of operations assume

that acquisitions during the last two years had occurred at the

beginning of 1999:

In thousands, except per share amounts 2000 1999

Net sales $5,927,634 $6,043,873

Net income 229,556 316,644

Earnings per common share:

Basic $ 1.98 $ 2.62

Diluted 1.95 2.58

All acquisitions have been accounted for as purchases, and

accordingly, the purchase prices have been allocated to the net assets

acquired based on fair values at the dates of acquisition. The excess

of cost over fair value of the purchased businesses has been allocated

to intangible assets and is being amortized over periods from 19 to

40 years. Operating results of these businesses have been included in

the consolidated financial statements since the dates of acquisition.

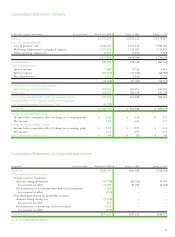

Note C Inventories

In thousands 2000 1999

Finished products $ 710,158 $575,617

Work in process 194,194 171,275

Materials and supplies 220,086 217,148

$1,124,438 $964,040

The current cost of inventories stated on the last-in, first-out

method is not significantly different from their value determined

under the first-in, first-out method.

Note D Property, Plant and Equipment

In thousands 2000 1999

Land $ 57,961 $ 46,626

Buildings 504,816 478,372

Machinery and equipment 1,302,549 1,289,064

1,865,326 1,814,062

Less accumulated depreciation 1,089,311 1,009,640

$ 776,015 $ 804,422

Note E Short-term Borrowings

In thousands 2000 1999

Commercial paper $ 56,855 $319,033

Banks 90,150 89,899

$147,005 $408,932

The weighted average interest rate for short-term borrowings was

9.0% at the end of 2000 and 6.5% at the end of 1999. The

Company maintains an unsecured revolving credit agreement with

a group of banks for $750.0 million that supports commercial

paper borrowings and is otherwise available for general corporate

purposes. The agreement, which extends to July 2004, requires an

.08% facility fee per year and contains various financial covenants,

including a debt to net worth requirement. At December 30, 2000,

there were no borrowings under the agreement.

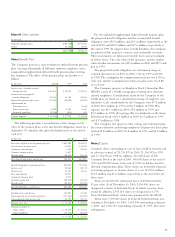

Note F Accrued Liabilities

In thousands 2000 1999

Income taxes $ 45,548 $ 59,242

Compensation 86,521 71,798

Restructuring costs (Note M) 37,393 –

Other 235,607 236,084

$405,069 $367,124

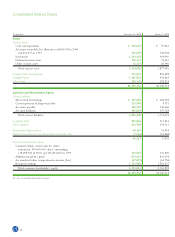

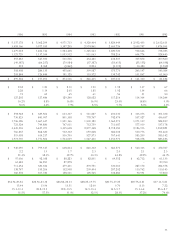

Note G Long-term Debt

In thousands 2000 1999

9.50% notes, due 2001 $100,000 $100,000

6.63% notes, due 2003 100,000 100,000

7.60% notes, due 2004 100,000 100,000

6.75% notes, due 2005 100,000 100,000

8.10% notes, due 2005 300,000 –

8.50% notes, due 2010 200,000 –

9.25% debentures, due 2022 100,000 100,000

Other 19,035 22,585

1,019,035 522,585

Less current portion 113,999 4,751

$905,036 $517,834

The scheduled payments of long-term debt are $1.8 million in

2002, $100.8 million in 2003, $100.3 million in 2004 and $400.3

million in 2005. The Company paid interest of $77.1 million in

2000, $73.4 million in 1999 and $59.5 million in 1998.