North Face 2000 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2000 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

Each outstanding share of Common Stock has one preferred

stock purchase right attached. The rights become exercisable ten

days after an outside party acquires, or makes an offer for, 15% or

more of the Common Stock. Once exercisable, each right will

entitle its holder to buy 1/100 share of Series A Preferred Stock

for $175. If the Company is involved in a merger or other business

combination or an outside party acquires 15% or more of the

Common Stock, each right will be modified to entitle its holder

(other than the acquirer) to purchase common stock of the acquir-

ing company or, in certain circumstances, VF Common Stock hav-

ing a market value of twice the exercise price of the right. In some

circumstances, rights other than those held by an acquirer may be

exchanged for one share of VF Common Stock. The rights, which

expire in January 2008, may be redeemed at $.01 per right prior to

their becoming exercisable.

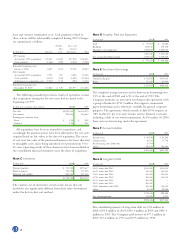

Note K Redeemable Preferred Stock

Each share of Series B Preferred Stock has a redemption value of

$30.88 plus cumulative accrued dividends, is convertible into 1.6

shares of Common Stock and is entitled to two votes per share

along with the Common Stock. The trustee for the ESOP may

convert the preferred shares to Common Stock at any time or may

cause the Company to redeem the preferred shares under certain

circumstances. The Series B Preferred Stock also has preference in

liquidation over all other stock issues.

The ESOP’s purchase of the preferred shares was funded by a

loan of $65.0 million from the Company that bears interest at

9.80% and is payable in increasing installments through 2002.

Interest income on this loan was $1.7 million in 2000, $2.6 million

in 1999 and $3.3 million in 1998. Principal and interest obligations

on the loan are satisfied as the Company makes contributions to

the savings plan and dividends are paid on the Preferred Stock. As

principal payments are made on the loan, shares of Preferred Stock

are allocated to participating employees’ accounts within the ESOP.

At the end of 2000, 1,312,345 shares of Preferred Stock had been

allocated to participating employees’ accounts.

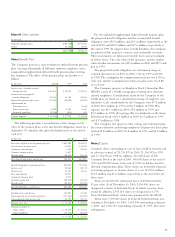

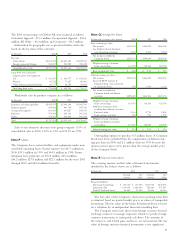

Note L Stock Option Plan

The Company has granted nonqualified stock options to officers,

directors and key employees under a stock compensation plan at

prices not less than fair market value on the date of grant. Options

become exercisable generally one year after the date of grant

and expire ten years after the date of grant. Activity in the stock

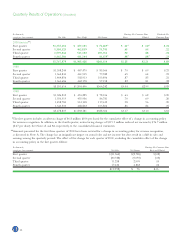

compensation plan is summarized as follows:

Weighted

Shares Average

Under Exercise

Options Price

Balance January 3, 1998 5,511,616 $28.21

Options granted 1,940,000 43.30

Options exercised (1,680,000) 27.26

Options canceled (69,310) 25.41

Balance January 2, 1999 5,702,306 33.65

Options granted 1,975,400 43.20

Options exercised (795,400) 31.87

Options canceled (250,810) 32.88

Balance January 1, 2000 6,631,496 36.74

Options granted 2,213,025 26.20

Options exercised (51,130) 21.60

Options canceled (294,500) 34.46

Balance December 30, 2000 8,498,891 $34.17

Stock options outstanding at December 30, 2000 are summa-

rized as follows:

Weighted

Average Weighted

Range of Remaining Average

Exercise Number Contractual Exercise

Prices Outstanding Life Price

$16– 20 41,220 .9 years $17.95

21– 25 599,586 3.7 years 23.48

26– 30 3,264,335 7.0 years 26.46

31– 35 1,081,100 5.9 years 34.49

40– 45 3,512,650 7.7 years 43.25

$16– 45 8,498,891 6.9 years $34.17

All above options are exercisable, except for those granted in

2000. There are 2,665,734 shares available for future grants of stock

options and stock awards, of which no more than 968,356 may be

grants of restricted stock awards.

Since all stock options are granted at market value, compensa-

tion expense is not required. However, had compensation expense

been determined based on the fair value of the options on the

grant dates, the Company’s net income would have been reduced

by $10.5 million ($.09 per share) in 2000, $11.9 million ($.10 per

share) in 1999 and $9.7 million ($.08 per share) in 1998.

The fair value of options granted during 2000 was $7.66 per

share, during 1999 was $9.97 per share and during 1998 was

$8.78 per share. Fair value is estimated based on the Black-Scholes

option-pricing model with the following assumptions: dividend

yield of 2.0%; expected volatility of 36% in 2000, 26% in 1999 and

20% in 1998; risk-free interest rates of 6.8% in 2000, 4.8% in 1999

and 5.4% in 1998; and expected lives of 4 years.

The Company has granted to key employees 69,706 shares of

restricted stock that vest in periods through 2005. Compensation

equal to the market value of shares at the date of grant is amortized

to expense over the vesting period. Expense for these shares was

$.6 million in 2000, $.3 million in 1999 and $.2 million in 1998.

In 2000 and 1999, the Company granted stock awards to certain

key employees under a stock award plan that replaced a portion of

the cash incentive compensation for those employees. The stock