North Face 2000 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2000 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

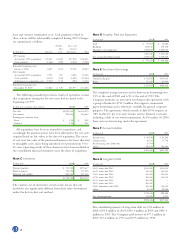

Stock-based Compensation: Compensation expense is recorded for

the excess, if any, of the market price of VF Common Stock at the

date of grant over the amount the employee must pay for the stock.

Other Comprehensive Income consists of certain changes in assets

and liabilities that are not included in Net Income but are instead

reported under generally accepted accounting principles within a

separate component of Common Shareholders’ Equity. The com-

ponents of Accumulated Other Comprehensive Income (Loss)

include the effects of foreign currency translation and unrealized

gains and losses on marketable securities.

New Accounting Pronouncement: The Company will adopt FASB

Statement No. 133, Accounting for Derivative Instruments and Hedging

Activities, and related amendments at the beginning of its 2001

fiscal year. This statement requires all derivatives to be recognized

as assets or liabilities on the balance sheet and measured at fair

value. Changes in the fair value of derivatives will be recognized in

either net income or other comprehensive income, depending on

the designated purpose of the derivative. The cumulative effect of

adopting this new statement will be an increase in reported net

income of $.4 million at the beginning of fiscal year 2001.

Use of Estimates: In preparing financial statements in accordance

with generally accepted accounting principles, management makes

estimates and assumptions that affect amounts reported in the

financial statements and accompanying notes. Actual results may

differ from those estimates.

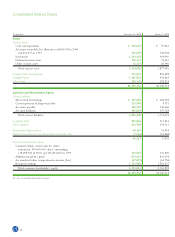

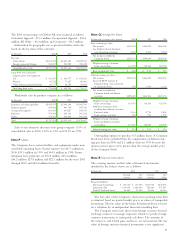

Note B Acquisitions

The Company acquired the common stock of The North Face,

Inc. and acquired the Eastpak backpack and daypack business in

May 2000. The Company also acquired the trademark rights to

the Chic and Gitano brands and, in October 2000, acquired 85%

of the common stock of H.I.S. Sportswear AG. The aggregate

cost for these businesses was $206.5 million, plus repayment of

$107.7 million of indebtedness. Intangible assets related to these

acquisitions totaled $171.2 million.

In 1999, the Company acquired three workwear and four

jeanswear businesses for an aggregate cost of $136.1 million, plus

repayment of $23.3 million in debt. Intangible assets related to

these acquisitions totaled $87.4 million. During 1998, the

Company acquired Bestform Group, Inc. for $184.3 million in

cash, plus repayment of $44.4 million in debt, and acquired three

other businesses for an aggregate cost of $76.1 million. Intangible

assets related to these acquisitions totaled $168.5 million.

The Company accrued various restructuring charges in connec-

tion with the 1999 and 2000 acquisitions. The charges relate to

severance, closure of manufacturing and distribution facilities, and

Notes to Consolidated Financial Statements

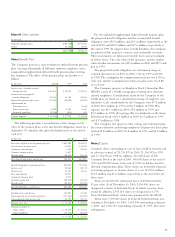

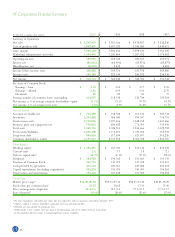

Note A Accounting Policies

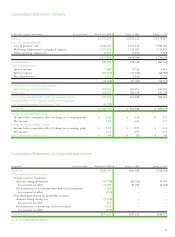

Principles of Consolidation: The consolidated financial statements

include the accounts of VF Corporation and all majority owned

subsidiaries after elimination of intercompany transactions and

profits.

Inventories are stated at the lower of cost or market. Inventories

stated on the last-in, first-out method represent 47% of total 2000

inventories and 42% in 1999. Remaining inventories are valued

using the first-in, first-out method.

Property and Depreciation: Property, plant and equipment are stated

at cost. Depreciation is computed by the straight-line method over

the estimated useful lives of the assets, ranging up to 40 years for

buildings and 10 years for machinery and equipment.

Intangible Assets represent the excess of costs over the fair value of

net tangible assets of businesses acquired, less accumulated amorti-

zation of $306.7 million and $270.5 million in 2000 and 1999.

These assets are amortized on the straight-line method over 10 to

40 years.

The Company’s policy is to evaluate intangible assets for

possible impairment whenever events or changes in circumstances

indicate that the carrying amount of such assets may not be recov-

erable. An impairment loss may be recorded if undiscounted future

cash flows, net of income tax payments, are not expected to be

adequate to recover the assets’ carrying value.

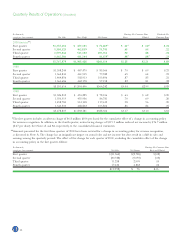

Revenue Recognition: During the fourth quarter of 2000, the

Company changed its accounting policy for recognizing sales in

accordance with the SEC’s Staff Accounting Bulletin No. 101,

Revenue Recognition in Financial Statements. Previously, sales were

recorded upon shipment of goods to the customer. The new policy

recognizes that the risks of ownership in some transactions do not

substantively transfer to customers until the product has been

received by them, without regard to when legal title has trans-

ferred. The cumulative effect of this change in policy for periods

prior to January 2000 of $6.8 million (net of income taxes of

$4.1 million), or $.06 per share, is shown in the Consolidated

Statements of Income. The accounting change has an insignificant

impact on annual sales and income (before cumulative effect).

However, due to seasonal shipping patterns, the change in account-

ing policy results in a shift of sales and earnings among the

Company’s quarterly periods. As a result, the Company has restated

its operating results for the first three quarters of 2000. (See

Quarterly Results of Operations on page 22 for more informa-

tion.) Pro forma results for prior fiscal years are not presented due

to immateriality.

Advertising Costs are expensed as incurred and were $251.7 million

in 2000, $257.6 million in 1999 and $287.5 million in 1998.

Shipping Costs to customers are included in Marketing, Administrative

and General Expenses and were $54.1 million in 2000, $51.0 mil-

lion in 1999 and $44.4 million in 1998.