North Face 2000 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2000 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

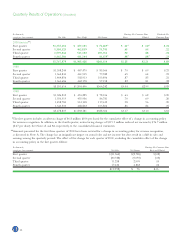

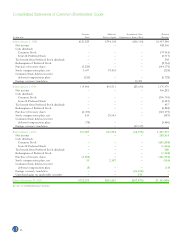

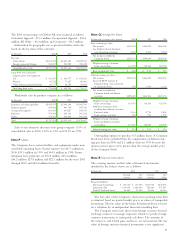

Note H Other Liabilities

In thousands 2000 1999

Deferred compensation $192,768 $179,321

Other 21,822 14,792

$214,590 $194,113

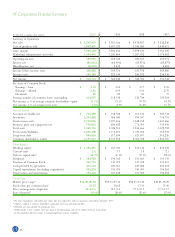

Note I Benefit Plans

The Company sponsors a noncontributory defined benefit pension

plan covering substantially all full-time domestic employees and a

nonqualified supplemental defined benefit pension plan covering

key employees. The effect of the pension plans on income is as

follows:

In thousands 2000 1999 1998

Service cost – benefits earned

during the year $ 20,863 $ 22,174 $ 20,391

Interest cost on projected

benefit obligation 47,630 41,166 38,584

Expected return on plan assets (57,945) (50,692) (45,270)

Amortization of:

Transition asset – – (3,068)

Prior service cost 6,352 5,359 5,667

Actuarial (gain) loss (2,156) (831) 610

Pension expense $ 14,744 $ 17,176 $ 16,914

The following provides a reconciliation of the changes in fair

value of the pension plans’ assets and benefit obligations, based on a

September 30 valuation date, plus the funded status at the end of

each year:

In thousands 2000 1999

Fair value of plan assets, beginning of year $ 667,295 $553,591

Actual return on plan assets 80,443 112,848

Company contributions 1,445 24,000

Acquired company plan 5,647 –

Benefits paid (26,441) (23,144)

Fair value of plan assets, end of year 728,389 667,295

Benefit obligations, beginning of year 585,850 591,726

Service cost 20,863 22,174

Interest cost 47,630 41,166

Plan amendments 19,277 –

Acquired company plan 4,917 –

Actuarial (gain) loss (28,274) (44,831)

Benefits paid (26,441) (24,385)

Benefit obligations, end of year 623,822 585,850

Funded status, end of year 104,567 81,445

Unrecognized net actuarial (gain) loss (137,164) (88,095)

Unrecognized prior service cost 43,729 29,911

Pension asset, net $ 11,132 $ 23,261

Amount included in:

Other Assets $ 42,516 $ 47,633

Other Liabilities (31,384) (24,372)

$ 11,132 $ 23,261

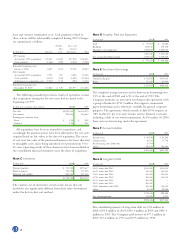

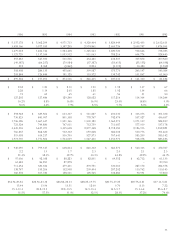

For the unfunded supplemental defined benefit pension plan,

the projected benefit obligation and the accumulated benefit

obligation were $50.5 million and $39.3 million, respectively, at the

end of 2000 and $50.2 million and $37.6 million, respectively, at

the end of 1999. To support these benefit liabilities, the Company

has purchased life insurance contracts and marketable securities.

These investments are held in irrevocable trusts and are included

in Other Assets. The cash value of life insurance and the market

value of other investments was $25.3 million in 2000 and $27.9 mil-

lion in 1999.

The projected benefit obligation was determined using an

assumed discount rate of 8.0% in 2000, 7.8% in 1999 and 6.8%

in 1998. The assumption for compensation increases was 4.0% in

each year, and the assumption for return on plan assets was 8.8%

in each year.

The Company sponsors an Employee Stock Ownership Plan

(ESOP) as part of a 401(k) savings plan covering most domestic

salaried employees. Contributions made by the Company to the

401(k) plan are based on a specified percentage of employee con-

tributions. Cash contributions by the Company were $7.2 million

in 2000, $6.9 million in 1999 and $6.5 million in 1998. Plan

expense was $4.7 million in 2000, $5.2 million in 1999 and

$5.5 million in 1998, after giving effect to dividends on the Series

B Preferred Stock of $3.3 million in 2000, $3.5 million in 1999

and $3.7 million in 1998.

The Company also sponsors other savings and retirement plans

for certain domestic and foreign employees. Expense for these plans

totaled $5.2 million in 2000, $6.2 million in 1999 and $6.5 million

in 1998.

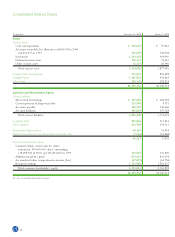

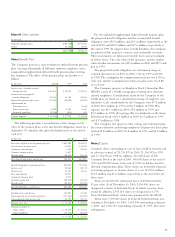

Note J Capital

Common shares outstanding are net of shares held in treasury, and

in substance retired, of 25,139,897 in 2000, 21,136,952 in 1999

and 17,134,370 in 1998. In addition, 311,608 shares of VF

Common Stock at the end of 2000, 306,698 shares at the end of

1999 and 232,899 shares at the end of 1998 are held in trust for

deferred compensation plans. These shares are treated for financial

accounting purposes as treasury shares at a cost of $10.6 million,

$10.5 million and $7.0 million, respectively at the end of the last

three years.

There are 25,000,000 authorized shares of Preferred Stock,

$1 par value. As of December 30, 2000, 2,000,000 shares are

designated as Series A Preferred Stock, of which none has been

issued. In addition, 2,105,263 shares are designated as 6.75%

Series B Preferred Stock, which were purchased by the ESOP.

There were 1,570,301 shares of Series B Preferred Stock out-

standing at December 30, 2000, 1,669,444 outstanding at January

1, 2000, and 1,760,119 outstanding at January 2, 1999, after share

redemptions.