North Face 2000 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2000 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

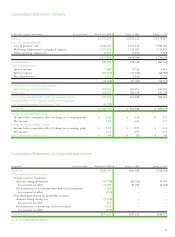

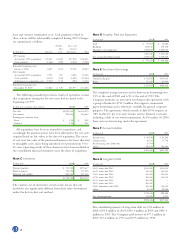

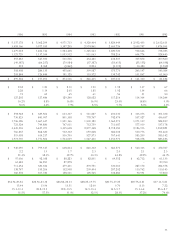

Note Q Earnings Per Share

In thousands, except per share amounts 2000 1999 1998

Basic earnings per share:

Net income $260,334 $366,242 $388,306

Less Preferred Stock dividends

and redemption premium 4,158 6,394 5,912

Net income available for

Common Stock $256,176 $359,848 $382,394

Weighted average Common

Stock outstanding 114,075 118,538 120,744

Basic earnings per share $ 2.25 $ 3.04 $ 3.17

Diluted earnings per share:

Net income $260,334 $366,242 $388,306

Increased ESOP expense if

Preferred Stock were converted

to Common Stock 925 1,036 1,136

Net income available for

Common Stock and dilutive

securities $259,409 $365,206 $387,170

Weighted average Common

Stock outstanding 114,075 118,538 120,744

Additional Common Stock

resulting from dilutive securities:

Preferred Stock 2,561 2,724 2,854

Stock options and other 582 996 1,397

Weighted average Common

Stock and dilutive securities

outstanding 117,218 122,258 124,995

Diluted earnings per share $ 2.21 $ 2.99 $ 3.10

Outstanding options to purchase 6.5 million shares of Common

Stock have been excluded from the computation of diluted earn-

ings per share in 2000 and 2.1 million shares in 1999 because the

option exercise prices were greater than the average market price

of the Common Stock.

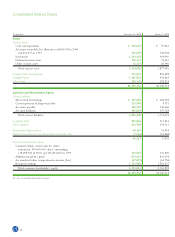

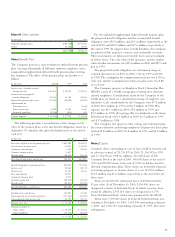

Note R Financial Instruments

The carrying amount and fair value of financial instruments

included in the balance sheets are as follows:

In thousands 2000 1999

Carrying Fair Carrying Fair

Amount Value Amount Value

Financial liabilities:

Short-term borrowings $ 147,005 $ 147,005 $408,932 $408,932

Long-term debt 1,019,035 1,028,460 522,585 507,297

Series B Preferred Stock 48,483 91,052 51,544 80,133

The fair value of the Company’s short-term and long-term debt

is estimated based on quoted market prices or values of comparable

borrowings. The fair value of the Series B Preferred Stock is based

on a valuation by an independent financial consulting firm.

The Company enters into short-term foreign currency forward

exchange contracts to manage exposures related to specific foreign

currency transactions or anticipated cash flows. The amounts of

the contracts, and related gains and losses, are not material. The fair

value of foreign currency financial instruments is not significant.

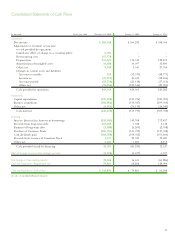

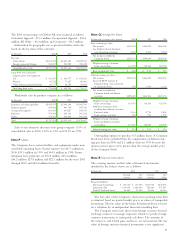

The 2000 restructuring costs (Note M) were incurred as follows:

Consumer Apparel – $71.0 million; Occupational Apparel – $34.6

million; All Other – $6.0 million; and Corporate – $8.3 million.

Information by geographic area is presented below, with sales

based on the location of the customer:

In thousands 2000 1999 1998

Net sales:

United States $4,803,872 $4,605,624 $4,552,785

Foreign, primarily Europe 944,007 945,992 926,022

Consolidated net sales $5,747,879 $5,551,616 $5,478,807

Long-lived assets, primarily

property, plant and equipment:

U.S. $ 610,287 $ 650,577 $ 634,231

Mexico 85,762 71,627 60,400

Other foreign, primarily Europe 80,777 83,029 83,842

Total long-lived assets $ 776,826 $ 805,233 $ 778,473

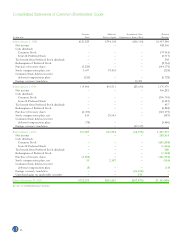

Worldwide sales by product category are as follows:

In thousands 2000 1999 1998

Jeanswear and related products $2,985,975 $2,936,196 $2,962,790

Intimate apparel 894,580 981,798 965,782

Occupational apparel 661,635 640,227 482,931

Knitwear 472,298 453,103 506,365

Other 733,391 540,292 560,939

Total $5,747,879 $5,551,616 $5,478,807

Sales to one domestic discount store group comprise 13.9% of

consolidated sales in 2000, 13.0% in 1999 and 12.3% in 1998.

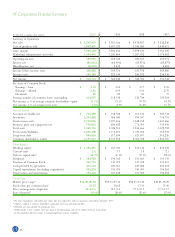

Note P Leases

The Company leases certain facilities and equipment under non-

cancelable operating leases. Rental expense was $67.1 million in

2000, $59.3 million in 1999 and $64.3 million in 1998. Future

minimum lease payments are $55.8 million, $45.4 million,

$36.2 million, $27.8 million and $22.1 million for the years 2001

through 2005 and $62.4 million thereafter.

33