Nissan 2016 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2016 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

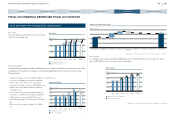

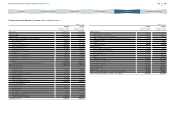

In our outlook for fiscal 2016, we expect our global sales to reach 5.60 million units, an increase of

3.3% compared to fiscal 2015.

With a total industry volume assumption of 89.40 million units, a 2.6% increase year on year, our

global market share is expected to grow from 6.2% to 6.3%.

In consequence of our plan, the financial forecast is as follows. We have used a foreign exchange

rate assumption of 105 yen to the dollar:

Nissan’s Fiscal 2016 Outlook

n Net sales 11.80 trillion yen

n Operating profit 710.0 billion yen

n Net income 525.0 billion yen

Fiscal 2016 Outlook (China JV Equity Basis)

600

450

300

150

0

2011 2015 201620142012 2013

406.4

468.7

536.3

463.1

540.0

479.0

4.3%

5.4%

5.1%

4.1%4.6%

3.9%

4.3%

5.4%

5.1%

4.1%4.6%

3.9%

600

450

300

150

0

2011

2016

201520142012 2013

531.9

560.0

428.0 457.8 500.6 506.1

4.4%

4.5%

5.2%4.8%4.4%4.7%

4.4%4.7%

4.5%

5.2%4.8%4.4%

(Forecast)

(Forecast)

(Billions of yen)

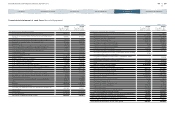

Dividend

Nissan’s strategic actions reflect not only its long-term vision as a global company to create sustainable

value but also the Company’s commitment to maximizing total shareholder returns.

We paid year-end cash dividends of 21 yen per share for fiscal 2015. As a result, the total

dividend payment for fiscal 2015, combined with the 21 yen dividend for the interim period, was 42 yen

per share.

The dividend payment

plan for fiscal 2016 is to be

48 yen per share,

considering the business

condition, risks and

opportunities for the year.

(FY)

Sales finance

Due to the increase in retail sales, total financial assets of the sales finance segment increased by

4.7% to 9,719.9 billion yen from 9,281.3 billion yen in fiscal 2014. The sales finance segment

generated 232.1 billion yen in operating profits in fiscal 2015 from 195.5 billion yen in fiscal 2014.

Investment policy

The company used capital expenditures in order to ensure Nissan’s future competitiveness. In fiscal

2015, capital expenditures totaled 479.0 billion yen, which was 3.9% of net sales.

R&D expenditures totaled 531.9 billion yen. These funds were used to develop new technologies

and products. One of the

Company’s strengths is its

extensive collaboration

and development

structure with Renault’s

R&D team, resulting from

the Alliance.

R&D Expenditures

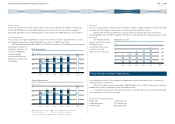

50

40

30

20

10

0

2015 2016201420132011 2012

48

42

20

25

30 33

(Outlook)

(FY)

Dividend per share

(Yen)

(Billions of yen)

Capital Expenditures

(FY)

■ Management pro forma basis*

■ China JV equity basis

● % of net sales (Management pro forma basis*)

● % of net sales (China JV equity basis)

* Based on continuation of proportionate consolidation of China JV

14

NISSAN MOTOR CORPORATION ANNUAL REPORT 2016

PERFORMANCE

CONTENTS

CORPORATE FACE TIME

TOP MESSAGE

NISSAN POWER 88

CORPORATE GOVERNANCE