Nike 2012 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2012 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

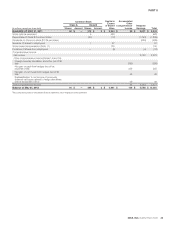

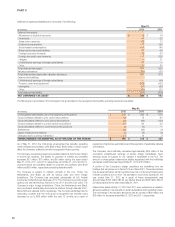

NOTE 3 — Property, Plant and Equipment

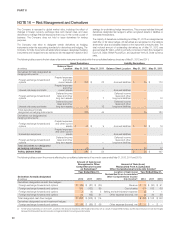

Property, plant and equipment included the following:

As of May 31,

(In millions) 2012 2011

Land $ 252 $ 237

Buildings 1,158 1,124

Machinery, equipment and internal-use software 2,755 2,487

Leasehold improvements 968 931

Construction in process 111 127

Total property, plant and equipment, gross 5,244 4,906

Less accumulated depreciation 2,965 2,791

TOTAL PROPERTY, PLANT AND EQUIPMENT, NET $ 2,279 $ 2,115

Capitalized interest was not material for the years ended May 31, 2012, 2011, and 2010.

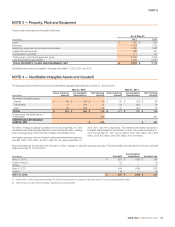

NOTE 4 — Identifiable Intangible Assets and Goodwill

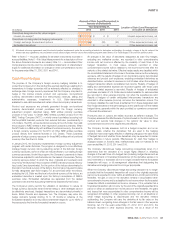

The following table summarizes the Company’s identifiable intangible asset balances as of May 31, 2012 and 2011:

May 31, 2012 May 31, 2011

(In millions)

Gross Carrying

Amount

Accumulated

Amortization

Net Carrying

Amount

Gross Carrying

Amount

Accumulated

Amortization

Net Carrying

Amount

Amortized intangible assets:

Patents $ 99 $ (29) $ 70 $ 80 $ (24) $ 56

Trademarks 41 (26) 15 44 (25) 19

Other 94 (30) 64 47 (22) 25

TOTAL $ 234 $ (85) $ 149 $ 171 $ (71) $ 100

Unamortized intangible assets —

Trademarks 386 387

IDENTIFIABLE INTANGIBLE

ASSETS, NET $ 535 $ 487

The effect of foreign exchange fluctuations for the year ended May 31, 2012

decreased unamortized intangible assets by approximately $2 million, resulting

from the strengthening of the U.S. Dollar in relation to the British Pound.

Amortization expense, which is included in selling and administrative expense,

was $22 million, $16 million, and $14 million for the years ended May 31,

2012, 2011, and 2010, respectively. The estimated amortization expense for

intangible assets subject to amortization for each of the years ending May 31,

2013 through May 31, 2017 are as follows: 2013: $21 million; 2014: $19

million; 2015: $15 million; 2016: $14 million; 2017: $13 million.

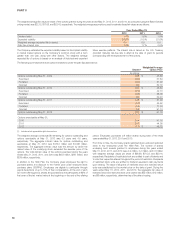

All goodwill balances are included in the Company’s “Other” category for segment reporting purposes. The following table summarizes the Company’s goodwill

balance as of May 31, 2012 and 2011:

(In millions) Goodwill

Accumulated

Impairment Goodwill, net

May 31, 2010 $ 387 $ (199) $ 188

Umbro France(1) 10 — 10

Other(2) 7— 7

May 31, 2011 404 (199) 205

Other(2) (4) — (4)

MAY 31, 2012 $ 400 $ (199) $ 201

(1) In March 2011, Umbro acquired the remaining 51% of the exclusive licensee and distributor of the Umbro brand in France for approximately $15 million.

(2) Other consists of foreign currency translation adjustments on Umbro goodwill.

NIKE, INC. Š2012 Form 10-K 51