Nike 2012 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2012 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PART I

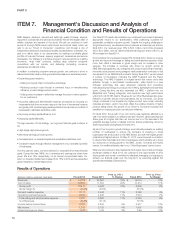

preferences, weather conditions, availability of import quotas and currency

exchange rate fluctuations, could adversely affect our business and cause our

results of operations to fluctuate. Our operating margins are also sensitive to a

number of factors that are beyond our control, including manufacturing and

transportation costs, shifts in product sales mix, geographic sales trends, and

currency exchange rate fluctuations, all of which we expect to continue.

Results of operations in any period should not be considered indicative of the

results to be expected for any future period.

“Futures” orders may not be an accurate indication of our

future revenues.

We make substantial use of our “futures” ordering program, which allows

retailers to order five to six months in advance of delivery with the commitment

that their orders will be delivered within a set period of time at a fixed price.

Our futures ordering program allows us to minimize the amount of products

we hold in inventory, purchasing costs, the time necessary to fill customer

orders, and the risk of non-delivery. We report changes in futures orders in our

periodic financial reports. Although we believe futures orders are an important

indicator of our future revenues, reported futures orders are not necessarily

indicative of our expectation of changes in revenues for any future period. This

is because the mix of orders can shift between futures and at-once orders. In

addition, foreign currency exchange rate fluctuations, order cancellations,

shipping timing, returns, and discounts can cause differences in the

comparisons between futures orders and actual revenues. Moreover, a

significant portion of our revenue is not derived from futures orders, including

at-once and close-out sales of NIKE Brand footwear and apparel, sales of

NIKE brand equipment, sales from our Direct to Consumer operations, and

sales from our Other Businesses.

Our “futures” ordering program does not prevent excess

inventories or inventory shortages, which could result in

decreased operating margins and harm to our business.

We purchase products from manufacturers outside of our futures ordering

program and in advance of customer orders, which we hold in inventory and

resell to customers. There is a risk we may be unable to sell excess products

ordered from manufacturers. Inventory levels in excess of customer demand

may result in inventory write-downs, and the sale of excess inventory at

discounted prices could significantly impair our brand image and have an

adverse effect on our operating results and financial condition. Conversely, if

we underestimate consumer demand for our products or if our manufacturers

fail to supply products we require at the time we need them, we may

experience inventory shortages. Inventory shortages might delay shipments

to customers, negatively impact retailer and distributor relationships, and

diminish brand loyalty.

The difficulty in forecasting demand also makes it difficult to estimate our

future results of operations and financial condition from period to period. A

failure to accurately predict the level of demand for our products could

adversely affect our net revenues and net income, and we are unlikely to

forecast such effects with any certainty in advance.

We may be adversely affected by the financial health of our

retailers.

We extend credit to our customers based on an assessment of a customer’s

financial condition, generally without requiring collateral. To assist in the

scheduling of production and the shipping of seasonal products, we offer

customers the ability to place orders five to six months ahead of delivery

under our “futures” ordering program. These advance orders may be

cancelled, and the risk of cancellation may increase when dealing with

financially ailing retailers or retailers struggling with economic uncertainty. In

the past, some customers have experienced financial difficulties, which have

had an adverse effect on our business. As a result, retailers may be more

cautious than usual with orders as a result of weakness in the retail economy.

A slowing economy in our key markets could have an adverse effect on the

financial health of our customers, which in turn could have an adverse effect

on our results of operations and financial condition. In addition, product sales

are dependent in part on high quality merchandising and an appealing store

environment to attract consumers, which requires continuing investments by

retailers. Retailers who experience financial difficulties may fail to make such

investments or delay them, resulting in lower sales and orders for our

products.

Consolidation of retailers or concentration of retail market

share among a few retailers may increase and concentrate

our credit risk, and impair our ability to sell our products.

The athletic footwear, apparel, and equipment retail markets in some

countries are dominated by a few large athletic footwear, apparel, and

equipment retailers with many stores. These retailers have in the past

increased their market share and may continue to do so in the future by

expanding through acquisitions and construction of additional stores. These

situations concentrate our credit risk with a relatively small number of retailers,

and, if any of these retailers were to experience a shortage of liquidity, it would

increase the risk that their outstanding payables to us may not be paid. In

addition, increasing market share concentration among one or a few retailers

in a particular country or region increases the risk that if any one of them

substantially reduces their purchases of our products, we may be unable to

find a sufficient number of other retail outlets for our products to sustain the

same level of sales and revenues.

Failure to adequately protect our intellectual property

rights could adversely affect our business.

We utilize trademarks on nearly all of our products and believe that having

distinctive marks that are readily identifiable is an important factor in creating a

market for our goods, in identifying us, and in distinguishing our goods from

the goods of others. We consider our NIKE®and Swoosh Design®

trademarks to be among our most valuable assets and we have registered

these trademarks in almost 150 jurisdictions. In addition, we own many other

trademarks that we utilize in marketing our products. We believe that our

trademarks, patents, and other intellectual property rights are important to our

brand, our success, and our competitive position. We periodically discover

products that are counterfeit reproductions of our products or that otherwise

infringe on our intellectual property rights. If we are unsuccessful in challenging

a party’s products on the basis of trademark or design or utility patent

infringement, continued sales of these products could adversely affect our

sales and our brand and result in the shift of consumer preference away from

our products.

The actions we take to establish and protect trademarks, patents, and other

intellectual property rights may not be adequate to prevent imitation of our

products by others or to prevent others from seeking to block sales of our

products as violations of proprietary rights. We may be subject to liability if

third parties successfully claim that we infringe their trademarks, patents, or

other intellectual property rights. Defending infringement claims could be

expensive and time-consuming and might result in our entering into costly

license agreements. We also may be subject to significant damages or

injunctions against development and sale of certain products.

In addition, the laws of certain foreign countries may not protect intellectual

property rights to the same extent as the laws of the United States. We may

face significant expenses and liability in connection with the protection of our

intellectual property rights outside the United States, and if we are unable to

successfully protect our rights or resolve intellectual property conflicts with

others, our business or financial condition may be adversely affected.

We are subject to periodic litigation and other regulatory

proceedings, which could result in unexpected expense of

time and resources.

From time to time we are called upon to defend ourselves against lawsuits

and regulatory actions relating to our business. Due to the inherent

uncertainties of litigation and regulatory proceedings, we cannot accurately

NIKE, INC. Š2012 Form 10-K 11