Nike 2012 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2012 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

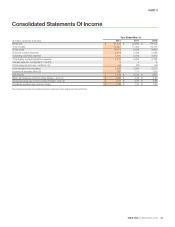

PART II

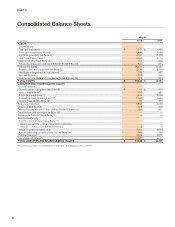

Consolidated Balance Sheets

May 31,

(In millions) 2012 2011

ASSETS

Current assets:

Cash and equivalents $ 2,317 $ 1,955

Short-term investments (Note 6) 1,440 2,583

Accounts receivable, net (Note 1) 3,280 3,138

Inventories (Notes 1 and 2) 3,350 2,715

Deferred income taxes (Note 9) 274 312

Prepaid expenses and other current assets (Notes 6 and 16) 870 594

Total current assets 11,531 11,297

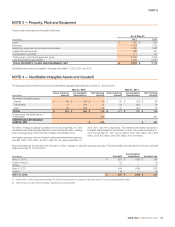

Property, plant and equipment, net (Note 3) 2,279 2,115

Identifiable intangible assets, net (Note 4) 535 487

Goodwill (Note 4) 201 205

Deferred income taxes and other assets (Notes 6, 9 and 16) 919 894

TOTAL ASSETS $ 15,465 $ 14,998

LIABILITIES AND SHAREHOLDERS’ EQUITY

Current liabilities:

Current portion of long-term debt (Note 8) $ 49 $ 200

Notes payable (Note 7) 108 187

Accounts payable (Note 7) 1,588 1,469

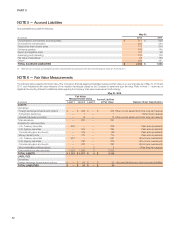

Accrued liabilities (Notes 5, 6 and 16) 2,053 1,985

Income taxes payable (Note 9) 67 117

Total current liabilities 3,865 3,958

Long-term debt (Note 8) 228 276

Deferred income taxes and other liabilities (Notes 6, 9 and 16) 991 921

Commitments and contingencies (Note 15) ——

Redeemable Preferred Stock (Note 10) ——

Shareholders’ equity:

Common stock at stated value (Note 11):

Class A convertible — 90 and 90 shares outstanding — —

Class B — 368 and 378 shares outstanding 33

Capital in excess of stated value 4,641 3,944

Accumulated other comprehensive income (Note 14) 149 95

Retained earnings 5,588 5,801

Total shareholders’ equity 10,381 9,843

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY $ 15,465 $ 14,998

The accompanying notes to consolidated financial statements are an integral part of this statement.

42