Nike 2012 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2012 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 7A. Quantitative and Qualitative Disclosures about

Market Risk

In the normal course of business and consistent with established policies and

procedures, we employ a variety of financial instruments to manage exposure

to fluctuations in the value of foreign currencies and interest rates. It is our

policy to utilize these financial instruments only where necessary to finance

our business and manage such exposures; we do not enter into these

transactions for speculative purposes.

We are exposed to foreign currency fluctuations, primarily as a result of our

international sales, product sourcing and funding activities. Our foreign

exchange risk management program is intended to lessen both the positive

and negative effects of currency fluctuations on our consolidated results of

operations, financial position and cash flows. We use forward exchange

contracts and options to hedge certain anticipated but not yet firmly

committed transactions as well as certain firm commitments and the related

receivables and payables, including third-party and intercompany

transactions. We also use forward contracts to hedge our investment in the

net assets of certain international subsidiaries to offset foreign currency

translation adjustments related to our net investment in those subsidiaries.

Where hedged, our program has the effect of delaying the impact of current

market rates on our consolidated financial statements dependent upon

hedge horizons.

When we begin hedging exposures, the type and duration of each hedge

depends on the nature of the exposure and market conditions. Generally, all

anticipated and firmly committed transactions that are hedged are to be

recognized within 12 to 18 months. The majority of the contracts expiring in

more than 12 months relate to the anticipated purchase of inventory. When

intercompany loans are hedged, it is typically for their expected duration.

Hedged transactions are principally denominated in Euros, British Pounds

and Japanese Yen. See section “Foreign Currency Exposures and Hedging

Practices” under Item 7 for additional detail.

Our earnings are also exposed to movements in short and long-term market

interest rates. Our objective in managing this interest rate exposure is to limit

the impact of interest rate changes on earnings and cash flows and to reduce

overall borrowing costs. To achieve these objectives, we maintain a mix of

commercial paper, bank loans and fixed rate debt of varying maturities and

have entered into receive-fixed, pay-variable interest rate swaps.

Market Risk Measurement

We monitor foreign exchange risk, interest rate risk and related derivatives

using a variety of techniques including a review of market value, sensitivity

analysis, and Value-at-Risk (“VaR”). Our market-sensitive derivative and other

financial instruments are foreign currency forward contracts, foreign currency

option contracts, interest rate swaps, intercompany loans denominated in

non-functional currencies, fixed interest rate U.S. Dollar denominated debt,

and fixed interest rate Japanese Yen denominated debt.

We use VaR to monitor the foreign exchange risk of our foreign currency

forward and foreign currency option derivative instruments only. The VaR

determines the maximum potential one-day loss in the fair value of these

foreign exchange rate-sensitive financial instruments. The VaR model

estimates assume normal market conditions and a 95% confidence level.

There are various modeling techniques that can be used in the VaR

computation. Our computations are based on interrelationships between

currencies and interest rates (a “variance/co-variance” technique). These

interrelationships are a function of foreign exchange currency market changes

and interest rate changes over the preceding one year period. The value of

foreign currency options does not change on a one-to-one basis with

changes in the underlying currency rate. We adjust the potential loss in option

value for the estimated sensitivity (the “delta” and “gamma”) to changes in the

underlying currency rate. This calculation reflects the impact of foreign

currency rate fluctuations on the derivative instruments only and does not

include the impact of such rate fluctuations on non-functional currency

transactions (such as anticipated transactions, firm commitments, cash

balances, and accounts and loans receivable and payable), including those

which are hedged by these instruments.

The VaR model is a risk analysis tool and does not purport to represent actual

losses in fair value that we will incur, nor does it consider the potential effect of

favorable changes in market rates. It also does not represent the full extent of

the possible loss that may occur. Actual future gains and losses will differ from

those estimated because of changes or differences in market rates and

interrelationships, hedging instruments and hedge percentages, timing and

other factors.

The estimated maximum one-day loss in fair value on our foreign currency

sensitive derivative financial instruments, derived using the VaR model, was

$21 million and $33 million at May 31, 2012 and 2011, respectively. The VaR

decreased year-over-year primarily as a result of decreased foreign currency

volatilities at May 31, 2012. Such a hypothetical loss in fair value of our

derivatives would be offset by increases in the value of the underlying

transactions being hedged. The average monthly change in the fair values of

foreign currency forward and foreign currency option derivative instruments

was $87 million and $79 million during fiscal 2012 and fiscal 2011,

respectively.

The instruments not included in the VaR are intercompany loans

denominated in non-functional currencies, fixed interest rate Japanese Yen

denominated debt, fixed interest rate U.S. Dollar denominated debt and

interest rate swaps. Intercompany loans and related interest amounts are

eliminated in consolidation. Furthermore, our non-functional currency

intercompany loans are substantially hedged against foreign exchange risk

through the use of forward contracts, which are included in the VaR

calculation above. Therefore, we consider the interest rate and foreign

currency market risks associated with our non-functional currency

intercompany loans to be immaterial to our consolidated financial position,

results from operations and cash flows.

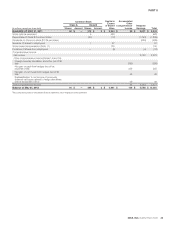

Details of third-party debt and interest rate swaps are provided in the table

below. The table presents principal cash flows and related weighted average

interest rates by expected maturity dates. Weighted average interest rates for

the fixed rate swapped to floating rate debt reflect the effective interest rates

as of May 31, 2012.

NIKE, INC. Š2012 Form 10-K 37