Nike 2012 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2012 Nike annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

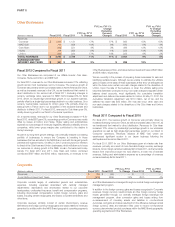

PART II

Fiscal 2011 Compared to Fiscal 2010

On a currency neutral basis, revenues for Western Europe increased 6% for

fiscal 2011, attributable to growth in most territories. Revenues for the U.K. &

Ireland, the largest market in Western Europe, grew 5% for fiscal 2011.

Western Europe’s Direct to Consumer revenues grew 10%, which

contributed approximately 1 percentage point to Western Europe’s revenue

increase. The growth in the Direct to Consumer business was fueled by 6%

growth in comparable store sales.

Excluding changes in currency exchange rates, footwear revenue in Western

Europe increased 8%, driven by double-digit percentage growth in Running,

Football (Soccer) and Action Sports, which more than offset a slight revenue

decline in Sportswear.

On a currency neutral basis, apparel revenue in Western Europe increased

4%, primarily driven by double-digit percentage growth in Football (Soccer)

and Running, which more than offset a mid-single-digit revenue decline in

Sportswear.

For fiscal 2011, the decrease in Western Europe’s EBIT was driven by

unfavorable foreign currency translation and a lower gross margin

percentage, all of which more than offset the increase in revenues and

improved leverage on selling and administrative expense. The decline in the

gross margin percentage was significantly impacted by the unfavorable year-

over-year standard currency rates. Also contributing to the decrease in the

gross margin percentage was higher product input and air freight costs,

higher royalty expenses related to sales of endorsed team products and

higher full price discounts. These factors more than offset the favorable

impact of fewer close-out sales.

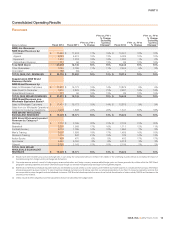

Central & Eastern Europe

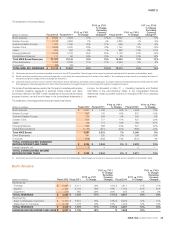

(Dollars in millions) Fiscal 2012 Fiscal 2011

FY12 vs. FY11

% Change

FY12 vs. FY11

% Change

Excluding

Currency

Changes Fiscal 2010

FY11 vs. FY10

% Change

FY11 vs. FY10

% Change

Excluding

Currency

Changes

Revenues by:

Footwear $ 671 $ 605 11% 13% $ 562 8% 10%

Apparel 441 359 23% 24% 357 1% 3%

Equipment 88 76 16% 17% 80 -5% -4%

TOTAL REVENUES $ 1,200 $ 1,040 15% 17% $ 999 4% 6%

EARNINGS BEFORE INTEREST

AND TAXES $ 234 $ 244 -4% $ 249 -2%

Fiscal 2012 Compared to Fiscal 2011

Excluding the changes in currency exchange rates, revenues for Central &

Eastern Europe increased 17% for fiscal 2012, driven by growth across most

territories, including double-digit growth in Russia and Turkey, which more

than offset lower revenues in Greece.

Excluding changes in currency exchange rates, Central & Eastern Europe’s

footwear revenue grew 13%, primarily driven by double-digit percentage

growth in unit sales and a low-single-digit percentage increase in average

selling price per pair. The increase in average selling price per pair was

reflective of product price increases which more than offset the negative

impact of higher discounts on in-line and close-out sales. The overall increase

in footwear sales was driven by growth across all key categories, most

notably Running, Sportswear and Football (Soccer).

Excluding changes in currency exchange rates, Central & Eastern Europe’s

apparel revenues grew 24%, mainly driven by double-digit percentage

growth in unit sales, offset by a slight decrease in average price per unit,

mainly due to less favorable product mix and higher discounts on in-line sales,

which more than offset the impact from product price increases. The overall

increase in apparel sales was primarily driven by growth in Football (Soccer),

Sportswear and Running.

On a reported basis, revenues for Central & Eastern Europe increased 15%

for fiscal 2012. However, EBIT fell 4%, primarily driven by a 420 basis point

decline in gross margin. The decline in gross margin was primarily due to

higher product input costs as well as higher discounts on in-line and close-out

products, which more than offset the favorable impact from product price

increases. Selling and administrative expense as a percentage of revenues

remained relatively flat compared to the prior period.

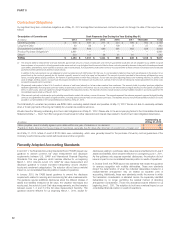

Fiscal 2011 Compared to Fiscal 2010

Led by Russia and Turkey, most territories within Central & Eastern Europe

reported revenue growth during fiscal 2011 as economic conditions in the

geography continued to show signs of recovery.

The growth in Central & Eastern Europe’s footwear revenues was mainly

driven by double-digit percentage growth in Football (Soccer), Running and

Action Sports, while the growth in apparel revenues was primarily driven by

double-digit percentage growth in Running.

For fiscal 2011, the decrease in Central & Eastern Europe’s EBIT was primarily

driven by unfavorable foreign currency translation and a lower gross margin

percentage, which more than offset the increase in revenues and improved

leverage on selling and administrative expense. The decline in the gross

margin percentage was primarily due to unfavorable year-over-year standard

currency rates, higher air freight costs and an increase in product input costs.

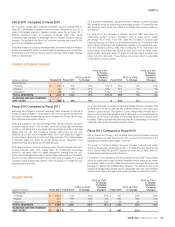

Greater China

(Dollars in millions) Fiscal 2012 Fiscal 2011

FY12 vs. FY11

% Change

FY12 vs. FY11

% Change

Excluding

Currency

Changes Fiscal 2010

FY11 vs. FY10

% Change

FY11 vs. FY10

% Change

Excluding

Currency

Changes

Revenues by:

Footwear $ 1,518 $ 1,164 30% 25% $ 953 22% 19%

Apparel 896 789 14% 9% 684 15% 13%

Equipment 125 107 17% 12% 105 2% 1%

TOTAL REVENUES $ 2,539 $ 2,060 23% 18% $ 1,742 18% 16%

EARNINGS BEFORE INTEREST

AND TAXES $ 911 $ 777 17% $ 637 22%

NIKE, INC. Š2012 Form 10-K 25