National Grid 2015 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2015 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Corporate Governance

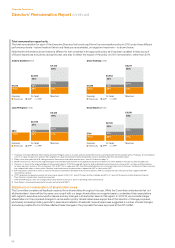

Directors’ Remuneration Report continued

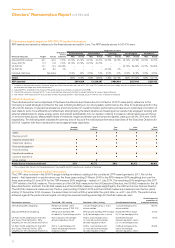

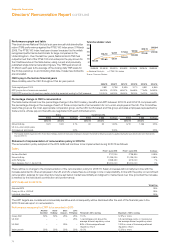

Performance against targets for APP 2014/15 (audited information)

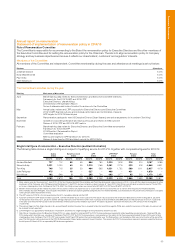

APP awards are earned by reference to the financial year and paid in June. The APP awards earned in 2014/15 were:

Financial measures Target Actual

Proportion

of max

achieved

Proportion of salary

Andrew Bonfield Steve Holliday Tom King John Pettigrew Nick Winser

Max Actual Max Actual Max Actual Max Actual Max Actual

Adjusted EPS (p/share) 54.7 60.6 100% 43.75% 43.75% 43.75% 43.75% 43.75% 43.75% 43.75% 43.75% 43.75% 43.75%

Group RoE (%) 11.2 11.8 100% 43.75% 43.75% 43.75% 43.75% – – – – – –

UK RoE (%) 13.7 14.3 83.33% – – – – – – 43.75% 36.46% 43.75% 36.46%

US RoE (%) 9.0 8.4 0% – – – – 43.75% 0% – – – –

Individual objectives See below 37. 5% 30% 37.5% 31% 37. 5% 21% 37.5% 30.8% 37. 5% 32.5%

Tot als 125% 117.5% 125% 118.5% 125% 64.75% 125% 111.0 4% 125% 112.71%

APP awarded £854,029 £1,209,687 £484,464 £527,4 40 £205,132

1. In relation to the financial measures, threshold, target and stretch performance pays out at 0%, 50% and 100% respectively and on a straight-line basis in between threshold and target

performance and target and stretch performance.

2. Adjusted EPS is amended for the impact of timing and actuarial assumptions on pensions and OPEBs.

3. The UK RoE comprises the reported 13.7% plus a discretionary adjustment of 60bps to include the benefit of a one-off legal settlement.

4. Nick Winser’s APP award for 2014/15 is prorated to reflect the period between 1 April and 28 July 2014 when he was a member of the Board.

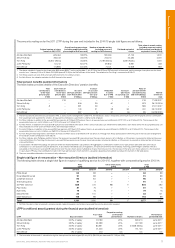

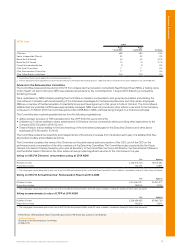

Individual objectives

The individual performance objectives of the Executive Directors and Executive Committee for 2014/15 were set by reference to the

Company’s overall strategic priorities for the year including building on our strong safety performance; the drive for business growth in the

UK and US; delivery of operational excellence and improvement in overall Company performance and service to customers; promotion of

new ideas to work more efficiently and effectively; strengthening the talent pipeline and keeping all our people fully engaged; working with

external stakeholders to shape energy policy and embed sustainability into our decision making to preserve natural resources and focus

on environmental issues. Measureable levels of threshold, target and stretch performance are agreed, paying out at 0%, 50% and 100%

respectively. The following table indicates the primary area of focus of the individual performance objectives of the Executive Directors for

2014/15, together with their overall performance against these objectives:

Andrew

Bonfield

Steve

Holliday

Tom

King

John

Pettigrew

Nick

Winser

Safety ••••

Business growth ••••

Capability development •••••

Stakeholder relations • • • •

Employee engagement •••••

Financial strategy •

Operational excellence •••••

Customer experience • •

Group strategy •

Proportion of maximum achieved: 80% 82.7% 56% 82.2% 86.6%

1. The scoring for Nick Winser is for the period between 1 April and 28 July 2014 when he was a member of the Board.

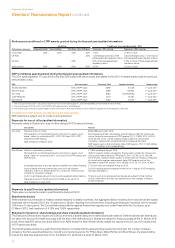

2014/15 LTPP performance (audited information)

The LTPP value included in the 2014/15 single total figure relates to vesting of the conditional LTPP award granted in 2011. Part of the

award – that dependent on performance over the three years ending 31 March 2014 for the EPS measure (50% weighting) and over the

three years ending 30 June 2014 for the TSR measure (25% weighting) – vested on 1 July 2014. The remaining 25% weighting of the 2011

LTPP relates to the RoE measure. This is made up of the UK RoE measure for the UK Executive Directors, the US RoE measure for the US

Executive Director and both the UK RoE measure and the US RoE measure in equal weightings for the CEO and Group Finance Director.

The UK RoE measure is measured over the four years ending 31 March 2015 and the US RoE measure is measured over the four years

ending 31 December 2014. However, the award does not vest until four years after the grant date, i.e. until 1 July 2015. The performance

achieved against the performance targets, including the expected vesting percentage for the RoE measures, was:

Performance measure Threshold – 25% vesting Maximum – 100% vesting Actual/expected vesting

Actual/expected

proportion of

maximum achieved

TSR ranking (25% weighting) Ranked at median of the

comparator group (FTSE 100)

7.5 percentage points or more

above median

7.33 percentage points

above median

98.3%

Adjusted EPS (50% weighting) EPS growth exceeds RPI

increase by 3 percentage points

EPS growth exceeds RPI increase

by 8 percentage points or more

Exceeded RPI increase

by 3.4 percentage points

31.0%

UK RoE (12.5% weighting for the CEO

andGroup Finance Director; 25%

weighting for the UK Executive Director)

RoE is equal to the average

allowed regulatory return

RoE is 2 percentage points

or more above the average

allowed regulatory return

Exceeded average

allowed regulatory return

by 3.1percentage points

100%

US RoE (12.5% weighting for the CEO

andGroup Finance Director; 25%

weighting for the US Executive Director)

RoE is 1 percentage point

below the average allowed

regulatory return

RoE is 1 percentage point

or more above the average

allowed regulatory return

0.98 percentage points

below the average

allowed regulatory return

25.9%

70