National Grid 2015 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2015 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Statements

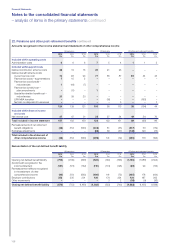

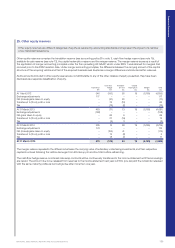

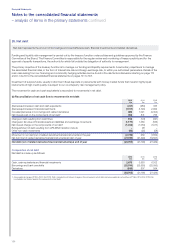

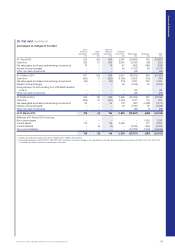

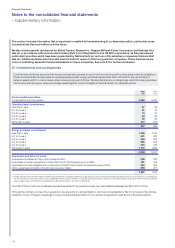

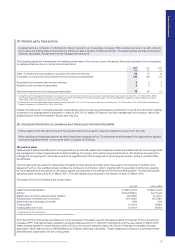

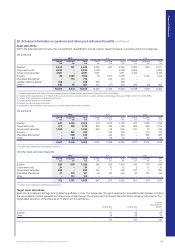

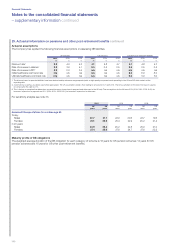

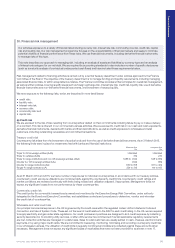

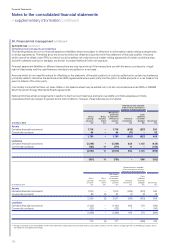

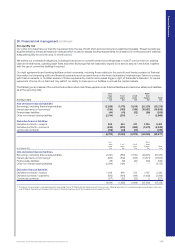

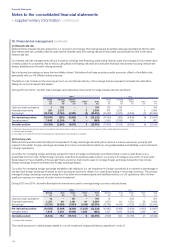

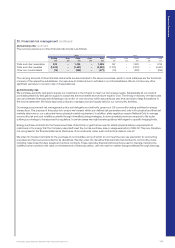

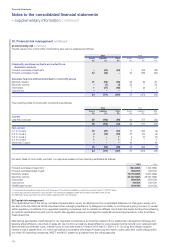

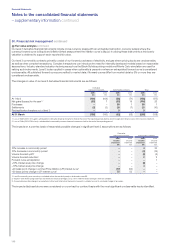

29. Actuarial information on pensions and other post-retirement benefits continued

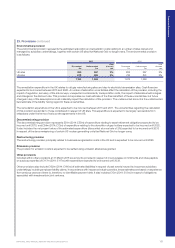

National Grid UK Pension Scheme

The 2013 actuarial funding valuation showed that, based on long-term financial assumptions, the contribution rate required to meet future

benefit accrual was 36% of pensionable earnings (currently 33% by employers and 3% by employees). In addition, National Grid makes

payments to the scheme to cover administration costs and the Pension Protection Fund levy.

Following the 2013 valuation, National Grid and the Trustees agreed a recovery plan which would see the funding deficit repaid by

31March 2027. Under the schedule of contributions, payments of £60m were made in 2013/14 and £99m in 2014/15 and will thereafter

rise in line with RPI until 2026/27. As part of the 2013 agreement, National Grid has established a security arrangement with a charge in

favour of the Trustees. At 31 March 2015 the value of this was required to be £397m. This was provided via £300m in letters ofcredit and

approximately £198m in UK Government bonds and cash. The assets held as security will be paid to the scheme in the event that National

Grid Gas plc (NGG) is subject to an insolvency event, is given notice of less than 12 months that Ofgem intends to revoke its licence under

the Gas Act 1986, or National Grid fails to make the required contributions in relation to the scheme. The assets held as security will be

released back to National Grid if the scheme moves into surplus. In addition, National Grid will make a payment of £200m (increased in

line with RPI) into the scheme if NGG’s credit rating by two out of three specified agencies falls below certain agreed levels for a period

of40 days.

This scheme ceased to allow new hires to join from 1 April 2002. A DC section of the scheme was offered for employees joining after this

date, which has since been replaced by The National Grid YouPlan (see below).

National Grid Electricity Group of the Electricity Supply Pension Scheme

The 2013 actuarial funding valuation showed that, based on long-term financial assumptions, the contribution rate required to meet future

benefit accrual was 33.4% of pensionable earnings (currently 27.5% by employers and an average of 5.9% by employees).

Following the 2013 valuation, National Grid and the Trustees agreed a recovery plan that would see the funding deficit repaid by 31 March

2027. Under the schedule of contributions, a payment of £80m was made in 2013/14 and £46m in 2014/15. Thereafter annual payments

are due of £47m in 2015/16 rising in line with RPI until 2026/27. As part of the 2013 agreement, National Grid has established security

arrangements with a charge in favour of the Trustees. At 31 March 2015 the value of this was required to be £150m. This was provided via

£150m in a letter of credit. In addition, approximately £36m in UK Government bonds and cash was held. The assets held as security will

be paid to the scheme in the event that National Grid Electricity Transmission plc (NGET) is subject to an insolvency event, or ceases to

hold a licence granted under the Electricity Act 1989. The assets held as security will be released back to National Grid if the scheme

moves into surplus. National Grid has also agreed to make a payment in respect of the deficit up to a maximum of £500m should certain

triggers be breached; namely if NGET ceases to hold the licence granted under the Electricity Act 1989 or NGET’s credit rating by two out

of three specified agencies falls below certain agreed levels for a period of 40 days.

The scheme closed to new members from 1 April 2006.

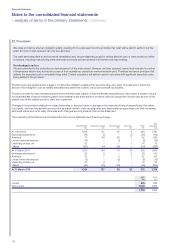

The National Grid YouPlan

The National Grid YouPlan (YouPlan) is a DC scheme that was launched in 2013 and under the rules of the plan, National Grid double

matches contributions to YouPlan up to a maximum of 6% of employee salary. YouPlan is the qualifying scheme used for automatic

enrolment and new hires are enrolled into YouPlan.

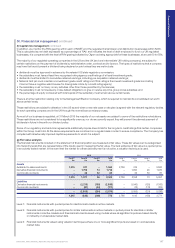

US pension plans

National Grid sponsors numerous non-contributory DB pension plans. The DB plans provide retirement benefits to vested union employees,

as well as vested non-union employees hired before 1 January 2011. Benefits under these plans generally reflect age, years of service and

compensation and are paid in the form of an annuity or lump sum. An independent actuary performs valuations annually. The Company

funds the defined benefit plans by contributing no less than the minimum amount required, but no more than the maximum tax deductible

amount allowed under US Internal Revenue Service regulations. The range of contributions based upon these regulations can vary

significantly based upon the funded status of the plans. At present, there is some flexibility in the amount that is contributed on an annual

basis. In general, the Company’s policy for funding the US pension plans is to contribute the amounts collected in rates and capitalised in

the rate base during the year, to the extent that the funding is no less than the minimum amount required. The assets of the plans are held

in trusts and administered by fiduciary committees comprised of appointed employees of the Company.

National Grid also has several DC pension plans, primarily comprised of employee savings and Company matching contributions.

Non-union employees hired after 1 January 2011 as well as new hires in 10 groups of represented union employees, receive a core

contribution into the DC plan, irrespective of the employee’s contribution into the plan.

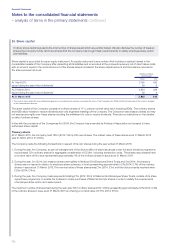

US retiree healthcare and life insurance plans

National Grid provides healthcare and life insurance benefits to eligible retired US employees. Eligibility is based on certain age and length

of service requirements and in most cases retirees contribute to the cost of their healthcare coverage. In the US, there is no governmental

requirement to pre-fund post-retirement health and welfare plans. However, in general, the Company’s policy for funding the US retiree

healthcare and life insurance plans is to contribute amounts collected in rates and capitalised in the rate base during the year.

– supplementary information continued

Notes to the consolidated financial statements

138