National Grid 2015 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2015 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

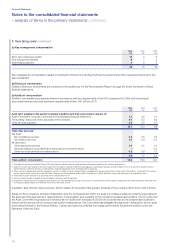

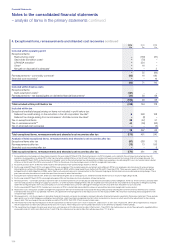

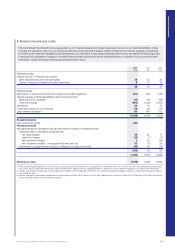

Financial Statements

– analysis of items in the primary statements continued

Notes to the consolidated financial statements

Unaudited commentary on the results of our principal operations by segment continued

Commentary on UK regulated financial performance

The regulated financial performance calculation provides a

measure of the performance of the regulated operations before

the impacts of interest and taxation. It adjusts reported operating

profit under IFRS to reflect the impact of the businesses’

regulatory arrangements when presenting financial performance.

Adjustments in calculating regulatory financial performance

The principal adjustments from reported operating profit to UK

regulated financial performance are:

Movement in UK regulatory ‘IOUs’: Revenue related to

performance in one year may be recovered in later years. Revenue

may be recovered in one year but be required to be returned to

customers in future years. IFRS recognises these revenues when

they flow through invoices to customers and not in the period to

which they relate.

Performance RAV: UK performance efficiencies are in part

remunerated by the creation of additional RAV which is expected

to result in future earnings under regulatory arrangements.

Pension adjustment: Cash payments against pension deficits

inthe UK are recoverable under regulatory contracts.

3% RAV indexation: Future UK revenues expected to be set

using an asset base adjusted for inflation. This will be billed in

future periods and recognised under IFRS at that time.

UK deferred taxation adjustment: Future UK revenues are

expected to recover cash taxation cost including the unwinding

ofdeferred taxation balances created in the current year.

Regulatory depreciation: US and UK regulated revenues include

allowance for a return of regulatory capital in accordance with

regulatory assumed asset lives. This return does not form part

ofregulatory profit.

Fast/slow money adjustment: The regulatory remuneration

ofcosts incurred is split between in year revenue allowances

andthecreation of additional RAV. This does not align with the

classification of costs as operating costs and fixed asset additions

under IFRS accounting principles.

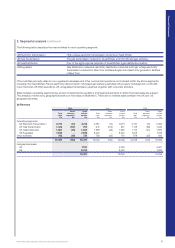

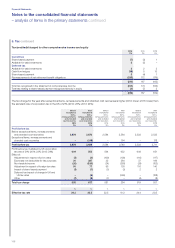

UK Electricity Transmission

Regulated financial performance for UK Electricity Transmission

increased to £1,232m from £1,066m, up 16%. The year on year

movement reflected the higher opening regulated asset value

andthe higher achieved operational return on equity. There

wasalso a one-off benefit of £56m from legal settlements.

Thesewerepartially offset by a reduced price control ‘tracker’

cost ofdebt allowance.

Reconciliation of regulated financial

performance to operating profit

2015

£m

2014

£m

%

change

Reported operating profit 1,237 1,087 14

Movement in regulatory ‘IOUs’ (130) (19)

Deferred taxation adjustment 88 53

RAV indexation (average 3%

long-runinflation) 326 301

Regulatory vs IFRS depreciation

difference (352) (337)

Fast/slow money adjustment 34 (2)

Pensions (48) (47)

Performance RAV created 77 30

Regulated financial performance 1,232 1,066 16

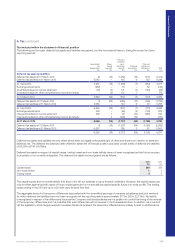

UK Gas Transmission

Regulated financial performance for UK Gas Transmission

increased to £648m from £552m, up 17%. This reflected improved

operational return on equity, mainly as a result of incentive

performance, and the increase in underlying revenues associated

with increased regulated asset value. This was partly offset by

lower allowed cost of debt (2.72% real compared with 2.92% real

in2013/14).

Reconciliation of regulated financial

performance to operating profit

2015

£m

2014

£m

%

change

Reported operating profit 437 417 5

Movement in regulatory ‘IOUs’ (16) (28)

Deferred taxation adjustment 85 12

RAV indexation (average 3%

long-runinflation) 166 162

Regulatory vs IFRS depreciation

difference (22) (2)

Fast/slow money adjustment 54 44

Pensions (49) (46)

Performance RAV created (7) (7)

Regulated financial performance 648 552 17

UK Gas Distribution

Regulated financial performance for UK Gas Distribution

decreased to £819m from £855m. The year on year movement in

regulated financial performance reflected an increase in underlying

revenues associated with increased regulated asset value, more

than offset by lower allowed cost of debt and a slightly reduced

achieved return on equity.

Reconciliation of regulated financial

performance to operating profit

2015

£m

2014

£m

%

change

Reported operating profit 826 904 (9)

Movement in regulatory ‘IOUs’ (28) (59)

Deferred taxation adjustment 60 85

RAV indexation (average 3%

long-runinflation) 255 252

Regulatory vs IFRS depreciation

difference (148) (149)

Fast/slow money adjustment (182) (197)

Pensions (5) (9)

Performance RAV created 41 28

Regulated financial performance 819 855 (4)

100