National Grid 2015 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2015 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200

|

|

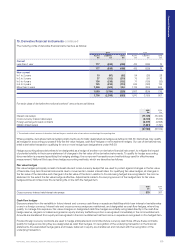

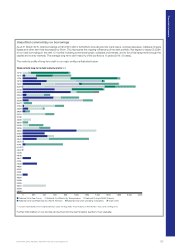

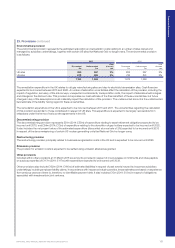

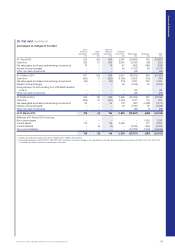

Unaudited commentary on borrowings

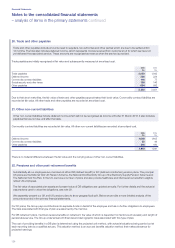

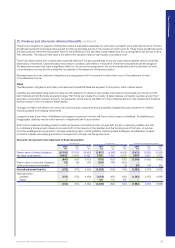

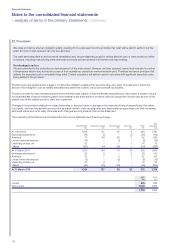

As at 31 March 2015, total borrowings of £25,910m (2014: £25,950m) including bonds, bank loans, commercial paper, collateral, finance

leases and other debt had decreased by £40m. This represents the ongoing refinancing of the debt portfolio. We expect to repay £3,028m

of our total borrowings in the next 12 months including commercial paper, collateral and interest, and to fund this repayment through the

capital and money markets. The average long-term debt maturity of the portfolio is 13 years (2014: 12 years).

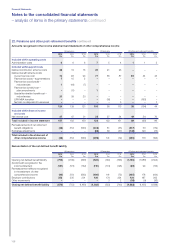

The maturity profile of long-term debt in our major entities is illustrated below:

National Grid long-term debt maturity profile £m

15/16

16/17

17/18

18/19

19/20

20/211

21/22

22/23

23/24

24/25

25/261

26/27

27/28

28/29

29/30

30/31

31/32

32/33

33/34

34/35

35/36

36/37

37/38

38/39

39/40

40/41

41/42

42/43

43/44

44/45

45/46

46/47

47/48

48/49

49/50

50/51

51/52

52/53

53/54

54/55

55/56

56/57

57/58

58/59

200

0400 600 800 1,000 1,200 1,400 1,600 1,800 2,000 2,200

National Grid Gas Group

National Grid USA/National Grid North America

National Grid Electricity Transmission National Grid plc/NGG Finance

National Grid USA operating companies Grain LNG

1. Includes hybrid bonds at first callable date (euro: 2020; sterling: 2025). Actual maturity of these bonds is euro: 2076; sterling: 2073.

Further information on our bonds can be found in the debt investor section of our website.

Financial Statements

NATIONAL GRID ANNUAL REPORT AND ACCOUNTS 2014/15 125