National Grid 2015 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2015 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Corporate Governance

Directors’ Remuneration Report

Annual statement from the

Remuneration Committee chairman

Overview

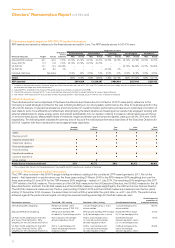

Last year, over 96% of shareholders voted to approve a new

remuneration policy for National Grid. Although the policy is not

subject to shareholder vote again this year, we have reprinted it

onpages 62 to 68 for ease of reference. The new policy followed

anextensive review by the Remuneration Committee to assess

how the remuneration framework needed to change to reflect

developments in National Grid’s business – the introduction of

a new eight year regulatory framework in the UK (RIIO), and the

continued evolution of our US business.

National Grid’s shareholder returns are earned progressively

through two main contributing factors. First, through careful

management of long-term assets and their financing; and second,

by building for future returns through a substantial, continuing and

well-executed programme of long-term capital investment in

regulated and non-regulated operations. Our aim was to make sure

that shareholders’ and executives’ longer-term interests are clearly

aligned through properly focused incentive plans and by requiring

executives to have a significant shareholding in the Company. In

summary, we concluded that:

• there should be a significant weighting towards longer-term

incentives and longer-term shareholding exposure for senior

management through a reduction in the potential maximum

Annual Performance Plan (APP) level, and an increase in the

potential maximum Long Term Performance Plan (LTPP) level;

• the bulk of remuneration should be paid in National Grid shares;

• senior executives should be required to have a significant

mandatory shareholding (500% of pre-tax salary for the CEO

and 400% for other Executive Directors) and that no shares

could be sold (except for meeting the tax on vesting) until the

mandatory shareholding level was attained;

• shares that vested under the LTPP, following the three year

performance measurement period, had to be retained for

afurther two years, irrespective of whether the mandatory

shareholding level had been attained; and

• the metrics for LTPP performance should change to Return on

Equity (RoE) and value growth. RoE provides a measurement

of management’s performance in generating profit from the

business, and value growth captures management’s longer-term

performance in creating shareholder value.

We were clear that the new arrangements must only deliver higher

rewards when executives had achieved a commensurately stronger

performance. We believe that we have set threshold, target and

stretch levels of performance accordingly. We also wanted to make

sure that our commitment to increasing the annual dividend by at

least RPI for the foreseeable future – an important element in

shareholders’ total return – was linked to executive remuneration.

The Committee, therefore, made it explicit that it had the power to

reduce LTPP vesting if the Company failed to honour the dividend

commitment, irrespective of the level of vesting resulting from the

performance against the LTPP targets set by the Committee.

The Remuneration Committee believes that the policy endorsed

last year by shareholders is fully aligned with the Company’s

strategy and with the experience of shareholders in general.

Italsobelieves that, based on our appraisal of performance

againstour demanding targets to date, the policy is not inflationary

compared with previous arrangements. We will, however, continue

to reassess remuneration policy and targets for future awards so

that we can remain confident they are still meeting the objectives

set by the Committee.

Performance for the year

APP

National Grid has achieved another year of strong financial

performance in the UK and solid performance in the US with

record investment levels. The financial measures for the APP were

adjusted EPS and either Group RoE, UK or US RoE depending

onrole. At 60.6 pence, the adjusted EPS figure for APP was up

6.3pence (12%) on 2013/14. The EPS figure used for the APP

calculation differs slightly to the reported EPS figure of 58.1 pence

as it is adjusted for the impact of timing and actuarial assumptions

on pensions and other post-employment benefits (OPEB). Group

RoE was 11.8%, ahead of last year’s 11.4% result. Our UK RoE was

14.3%, including the benefit of a legal settlement referred to in the

report of the Audit Committee on page 52. In the US, our RoE was

8.4%, which was slightly down on last year. As a result, in respect

offinancial metrics for the APP (representing 70% of the value of

the award), we have made awards of between 50% and 100% of

the maximum potential to the Executive Directors. The balance of

the APP award is represented by performance against personal

objectives set by the Remuneration Committee. As a result, we

have made APP awards to the Executive Directors of between 64%

and 119% of salary. Details of each Executive Director’s APP award

are set out on page70. This is the first year ofthe new policy for

maximum APP payments, with the maximum being reduced from

150% of salary (for the 2013/14 awards) to125%.

LTPP

2014 was the first year in which the maximum potential for the

LTPP awarded during the year was increased in line with the new

remuneration policy from 225% to 350% of salary for the Chief

Executive and 200% to 300% of salary for the other Executive

Directors. This is a three year plan and the performance

outcomeswill only be determined in July 2017. In 2014/15, Group

RoE and value growth were both on target in relation to the 2014

LTPP parameters, with UK RoE around stretch, and US RoE

belowthreshold.

The LTPP that vested during 2014/15 was that awarded in 2011.

This included three performance measures: adjusted EPS;

relativetotal shareholder return (TSR); and UK and US returns.

TheEPS measure vested at 31%, reflecting EPS growth just above

the threshold target for this measure. The TSR measure vested at

98.3%, which reflects an annualised return to shareholders of

18.9% over the period. The UK and US returns measures are

expected to vest at 100% and 25.9% respectively, reflecting strong

operational performance in the UK, including the first two years of

RIIO, and the impact of rate base growth and higher winter related

costs in the US. As a result, the 2011 LTPP vested at between

46%and 66% for the Executive Directors. Details of each Executive

Director’s vested LTPP are setout on pages 70 and 71.

Future targets

Details of future targets and historical performance are disclosed

each year in respect of the LTPP. Details of historical performance

against targets are disclosed each year in respect of the APP.

Weprovide these details on pages 70 to 72 and page 74. Taking

account of this year’s performance, as well as the challenges

Jonathan Dawson

Committee chairman

60