National Grid 2005 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2005 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

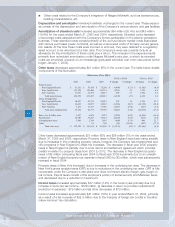

of any pending or potential deregulation legislation. If future recovery of costs becomes no longer

probable, the assets and liabilities would be recognized as current-period revenue or expense.

Amortization of regulatory assets is provided over the recovery period as allowed by the related

regulatory agreement. Amortization of the stranded cost regulatory asset is shown separately

(as it is the largest component of regulatory assets). Amortization of other regulatory assets are

included in depreciation and amortization, purchased electricity and gas and other operation

and maintenance expense captions on the income statement (depending on the origin of the

regulatory asset).

Derivatives

The Company accounts for derivative financial instruments under SFAS No. 133, “Accounting for

Derivatives and Hedging Activities” (FAS 133), and SFAS No. 149, “Amendment of SFAS No. 133

on Derivative Instruments and Hedging Activities,” as amended. Under the provisions of FAS 133,

all derivatives except those qualifying for the normal purchase/normal sale exception are recognized

on the balance sheet at their fair value. Fair value is determined using current quoted market prices.

If a contract is designated as a cash flow hedge, the change in its market value is generally deferred

as a component of other comprehensive income until the transaction it is hedging is completed.

Conversely, the change in the market value of a derivative not designated as a cash flow hedge is

deferred as a regulatory asset or liability. A cash flow hedge is a hedge of a forecasted transaction or

the variability of cash flows to be received or paid related to a recognized asset or liability. To qualify as

a cash flow hedge, the fair value changes in the derivative must be expected to offset 80% to 120%

of the changes in fair value or cash flows of the hedged item.

Niagara Mohawk has received approval from the New York State Public Service Commission

(PSC) to establish a regulatory asset or liability for derivative instruments that did not qualify for

hedge accounting and were the result of regulatory rulings.

Revenue Recognition

Revenues from the sale of electricity and gas to customers are generally recorded when electricity

and gas are delivered to those customers. The quantity of those sales is measured by customers’

meters. Meters are read on a systematic basis throughout the month based on established meter-

reading schedules. Consequently, at the end of any month, there exists a quantity of electricity

and gas that has been delivered to customers but has not been captured by the meter readings.

As a result, management must estimate revenue related to electricity and gas delivered to cus-

tomers between their meter read dates and the end of the period.

Goodwill

The company applies the provisions of SFAS No. 142, “Goodwill and Other Intangible Assets”

(FAS 142). In accordance with FAS 142, goodwill must be reviewed for impairment at least annual-

ly and when events indicate the asset may be impaired. The Company utilizes a discounted cash

flow approach incorporating its most recent business plan forecasts in the performance of the

annual goodwill impairment test. The result of the annual analysis determined that no adjustment

to the goodwill carrying value was required.

Tax Provision

The Company’s tax provisions, including both current and deferred components, are based on

estimates, assumptions, calculations and interpretation of tax statutes for the current and future

years in accordance with SFAS No. 109, “Accounting for Income Taxes”. Federal income tax

returns have been examined and all appeals and issues have been agreed upon by the Internal

Revenue Service and the Company through March 22, 2000.

Management regularly makes assessments of tax return outcomes relative to financial statement

tax provisions and adjusts the tax provisions in the period when facts become final.

Pensions

The Company has recognized a net additional minimum pension liability of $290 million on its bal-

ance sheet reflecting an underfunded pension obligation. The Company’s subsidiaries, NEP and

Niagara Mohawk, due to the nature of their respective rate plans, recorded a regulatory asset.

(See Note G – “Employee Benefits.”)

8

National Grid USA / Annual Report